Aayush Jindal

Key Highlights

- Gold price gained bullish momentum and traded to a new multi-year high near $1,818.

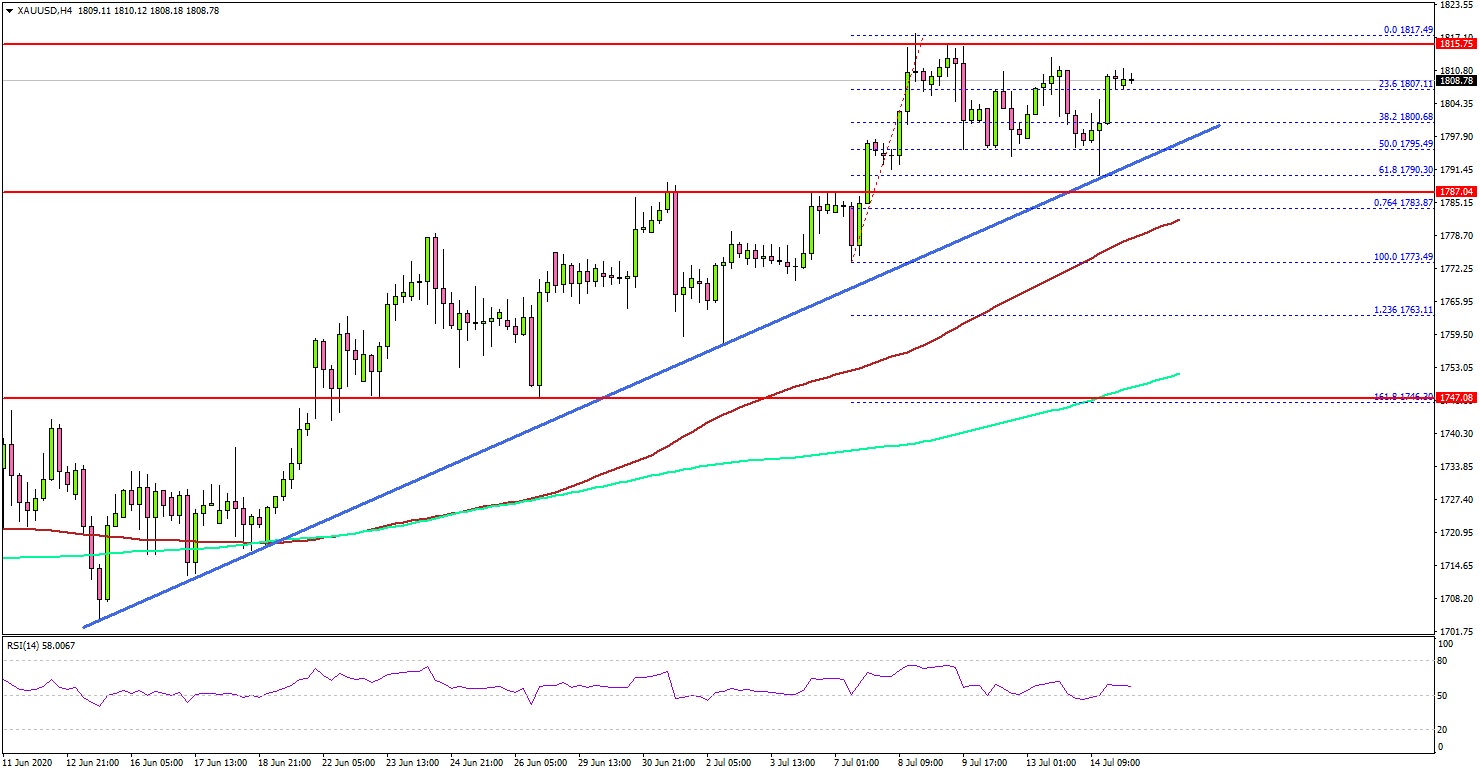

- A significant bullish trend line is forming with support at $1,795 on the 4-hours chart of XAU/USD.

- The UK GDP grew 1.8% in May 2020 (MoM), less than the +5% market forecast.

- The US CPI increased 0.6% in June 2020 (YoY), similar to the market forecast.

Gold Price Technical Analysis

Earlier this month, gold price extended its uptrend above the main $1,800 resistance against the US Dollar. The price traded to a new multi-year high near $1,818 before starting a minor downside correction.

The 4-hours chart of XAU/USD indicates that the price made a couple of attempts to clear $1,818, but it failed. As a result, there was a downside correction below the $1,805 and $1,800 levels.

The price even broke the 50% Fib retracement level of the upward move from the $1,773 low to $1,818 high. However, the price found support near the $1,790 level and it remained well above the 100 simple moving average (red, 4-hours).

Moreover, there is a significant bullish trend line forming with support at $1,795 on the same chart. It seems like there are important supports forming near $1,795 and $1,788. If there is a downside break below $1,788 and the 100 SMA, there is a risk of an extended decline towards $1,750.

On the upside, an initial resistance is near the $1,818 level, above which the price might resume its uptrend and rise towards $1,825 or even $1,840 in the coming days.

Fundamentally, the US Consumer Price Index for June 2020 was released by the US Bureau of Labor Statistics. The market was looking for a 0.6% rise in the CPI compared with the same month a year ago.

The actual result was a similar to the forecast, as the US CPI increased 0.6%. The monthly change was 0.6%, which was more than the 0.5% forecast.

Overall, gold price might continue to climb higher unless there is a clear break below $1,780. Looking at EUR/USD, there were positive signs above the 1.1350 level, while GBP/USD extended its decline below 1.2550 before recovering higher.

Economic Releases to Watch Today

- UK Consumer Price Index June 2020 (YoY) – Forecast +0.4%, versus +0.5% previous.

- UK Core Consumer Price Index June 2020 (YoY) – Forecast +1.2%, versus +1.2% previous.

- US Industrial Production June 2020 (MoM) – Forecast +4.3%, versus +1.4% previous.

- BoC Interest Rate Decision – Forecast 0.25%, versus 0.25% previous.