Aayush Jindal

Key Highlights

- Gold price is struggling to gain momentum above $1,915 and $1,920.

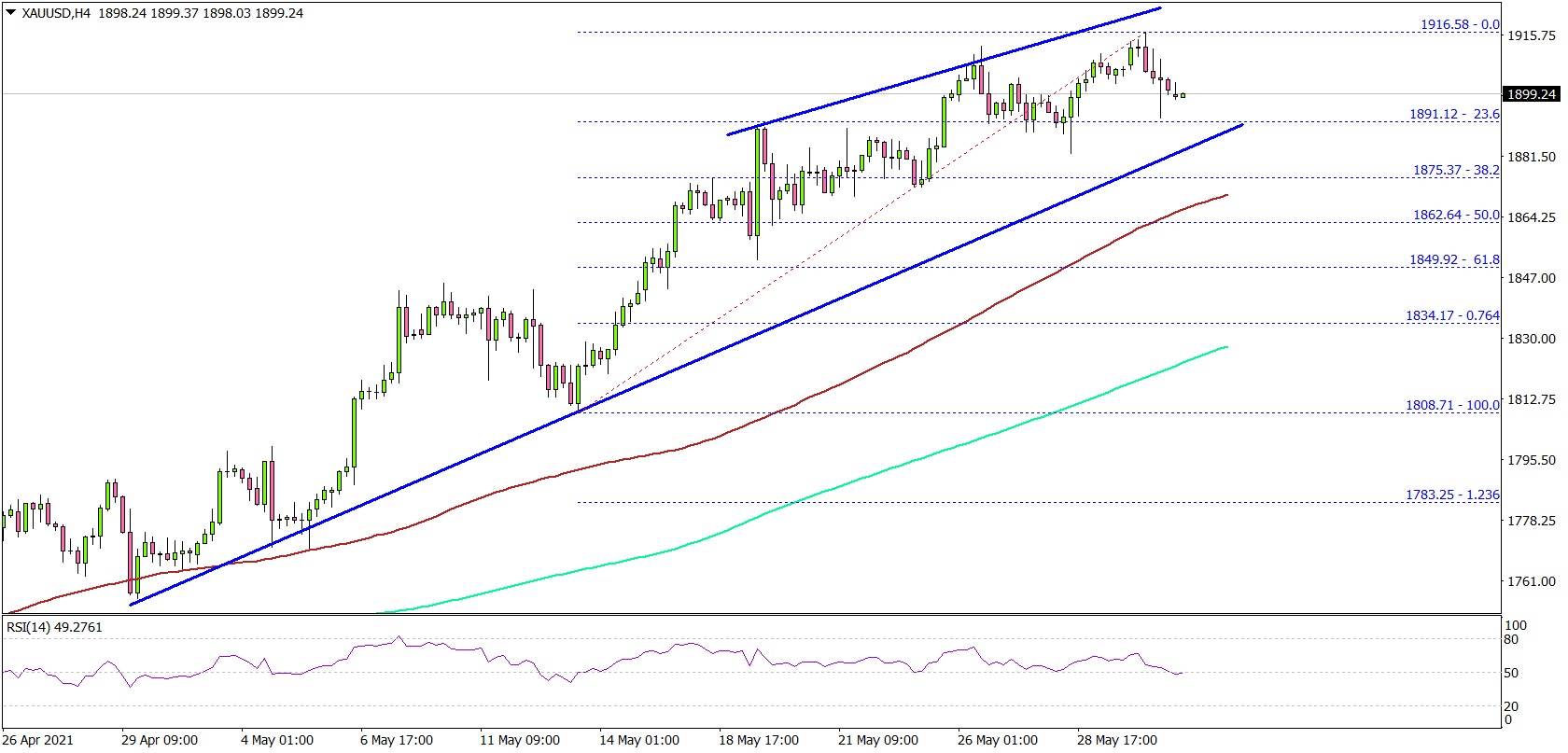

- A major bullish trend line is forming with support near $1,888 on the 4-hours chart.

- EUR/USD is trading nicely above 1.2200, oil price gained pace and it even broke $68.00.

- The US ISM Manufacturing PMI increased from 60.7 to 61.2 in May 2021.

Gold Price Technical Analysis

After forming a base above $1,850, gold price started another increase against the US Dollar. The price broke the key $1,880 resistance zone to move further into a positive zone.

The 4-hours chart of XAU/USD indicates that the price even broke the $1,900 resistance level. There was also a decent close above $1,880, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It traded as high as $1,916 and it recently started a downside correction. There was a break below the $1,900 level.

However, the price is well supported above the $1,880 support. There is also a major bullish trend line forming with support near $1,888 on the same chart. If there is a break below the trend line, the price could decline towards the $1,880 support.

The next key support is near the $1,870 level and the 100 simple moving average (red, 4-hours). Any more losses could lead the price towards the $1,850 support.

On the upside, the price is likely to face sellers near the $1,915 and $1,920 levels. A break above $1,920 could set the pace for a larger increase in the coming sessions.

Fundamentally, the US Institute for Supply Management (ISM) Manufacturing Index was released yesterday by the ISM. The market was looking for a stable reading at 60.7.

The actual result was better than the forecast, as the Institute for Supply Management (ISM) Manufacturing Index increased from 60.7 to 61.2.

Looking at EUR/USD, the pair is showing positive signs above 1.2200. Besides, GBP/USD corrected gains after trading to a new multi-month high at 1.4250.

Economic Releases to Watch Today

- German Retail Sales for April 2021 (MoM) – Forecast 10.1%, versus 11.0% previous.

- German Retail Sales for April 2021 (YoY) – Forecast -2.0%, versus 7.7% previous.