Aayush Jindal

Key Highlights

- Gold price started an upside correction from the $1,740 region.

- A major bearish trend line is forming with resistance near $1,786 on the 4-hours chart.

- EUR/USD declined below 1.1700, and GBP/USD is trading well below 1.3700.

- The US Manufacturing PMI could increase from 61.1 to 62.5 in Sep 2021 (Preliminary).

Gold Price Technical Analysis

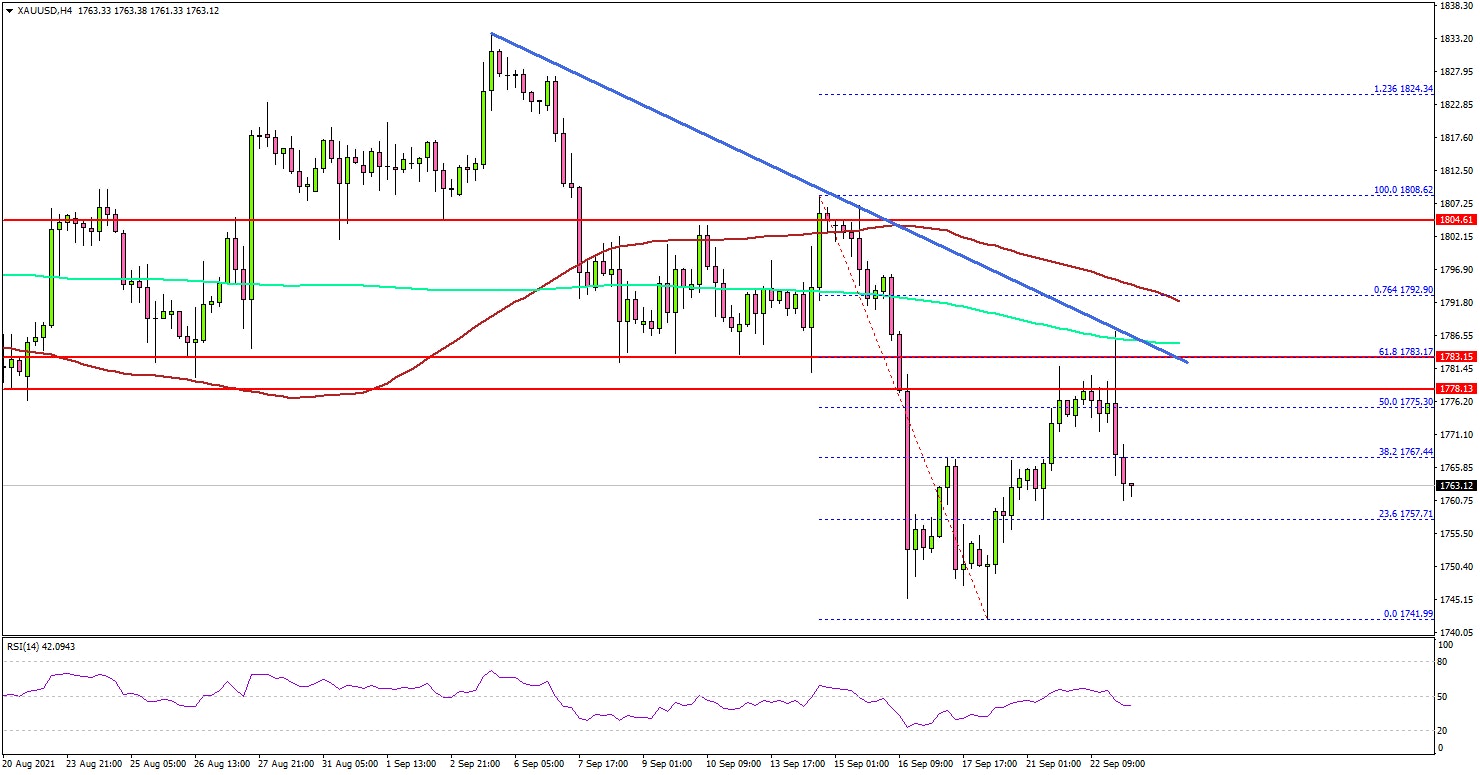

This past week, gold saw a bearish reaction below the $1,800 support against the US Dollar. The price broke the $1,780 support to move into a negative zone.

The 4-hours chart of XAU/USD indicates that the price even broke the $1,760 and $1,750 support levels. There was a daily close below $1,800, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The price traded as low $1,741 and recently started an upside correction. The price corrected above the $1,765 and $1,770 levels.

There was a break above the 50% Fib retracement level of the key decline from the $1,808 swing high to $1,741 low. However, the price is facing an uphill task near the $1,785 and $1,790 levels.

There is also a major bearish trend line forming with resistance near $1,786 on the same chart. The next major resistance is near the $1,792 level and the 100 simple moving average (red, 4-hours). It is close to the 76.4% Fib retracement level of the key decline from the $1,808 swing high to $1,741 low.

The main hurdle sits at $1,800, above which the price could rise towards $1,825. Any more gains could lead the price towards the $1,850 level.

Looking at EUR/USD, the pair could start a decent recovery if there is a break above 1.1750. Conversely, GBP/USD is struggling to recover above 1.3700.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for Sep 2021 (Preliminary) - Forecast 65.0, versus 62.5 previous.

- Germany’s Services PMI for Sep 2021 (Preliminary) - Forecast 61.4, versus 60.8 previous.

- Euro Zone Manufacturing PMI for Sep 2021 (Preliminary) – Forecast 62.0, versus 61.4 previous.

- Euro Zone Services PMI for Sep 2021 (Preliminary) – Forecast 59.8, versus 59.0 previous.

- UK Manufacturing PMI for Sep 2021 (Preliminary) – Forecast 61.4, versus 60.3 previous.

- UK Services PMI for Sep 2021 (Preliminary) – Forecast 56.5, versus 55.0 previous.

- US Manufacturing PMI for Sep 2021 (Preliminary) – Forecast 62.5, versus 61.1 previous.

- US Services PMI for Sep 2021 (Preliminary) – Forecast 59.5, versus 55.1 previous.