Aayush Jindal

Key Highlights

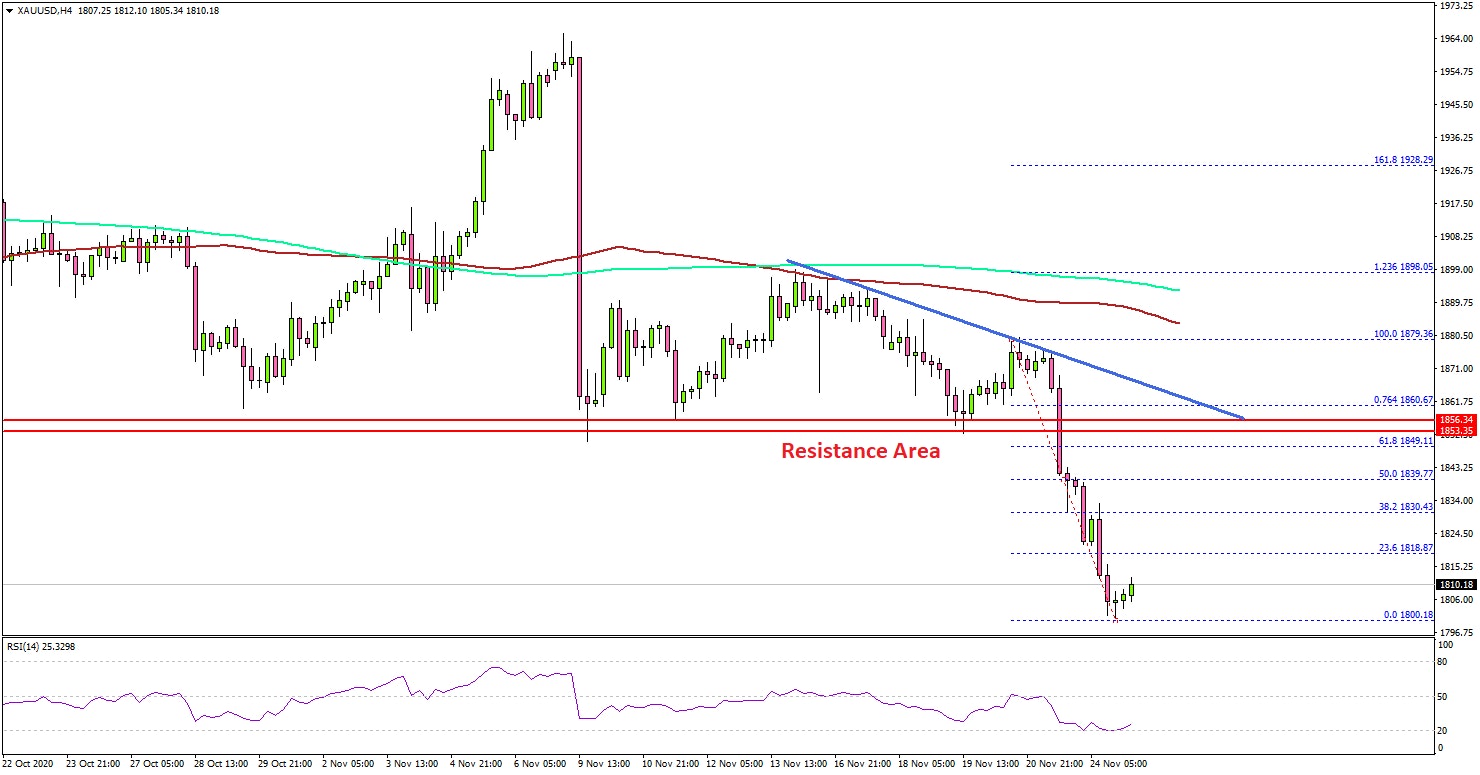

- Gold price broke the key $1,850 support and declined sharply.

- A key bearish trend line is forming with resistance near $1,855 on the 4-hours chart of XAU/USD.

- Crude oil price climbed further higher above $43.00.

- The US Gross Domestic Product (to be released today) could expand 33.1% in Q3 2020 (Preliminary).

Gold Price Technical Analysis

In the last technical analysis, we discussed the importance of the $1,900 resistance for gold price against the US Dollar. The price failed to climb above $1,900 and declined heavily.

The 4-hours chart of XAU/USD indicates that the price decline heavily below the $1,850 support level. There was a sharp decline below the $1,820 level, and the price settled well below the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

The price even traded close to the $1,800 level and it remains at a risk of more losses. If there is a clear close below $1,800 and $1,795, the price might continue to move down towards the $1,765 level.

On the upside, the previous support near the $1,850 level is a major barrier. There is also a key bearish trend line forming with resistance near $1,855 on the same chart. To move into a positive zone, the price must settle above $1,850 and $1,855.

Overall, gold price broke a major support zone and it is likely to extend its decline below $1,800. Looking at EUR/USD, the pair remained well bid above 1.1820. Similarly, GBP/USD stayed above 1.3300 and 1.3280, and mostly consolidated gains.

Economic Releases to Watch Today

- US Initial Jobless Claims - Forecast 730K, versus 742K previous.

- US New Home Sales for Oct 2020 (MoM) – Forecast +1.9% versus -3.5% previous.

- US Gross Domestic Product Q3 2020 (Preliminary) – Forecast 33.1% versus previous 33.1%.