Aayush Jindal

Key Highlights

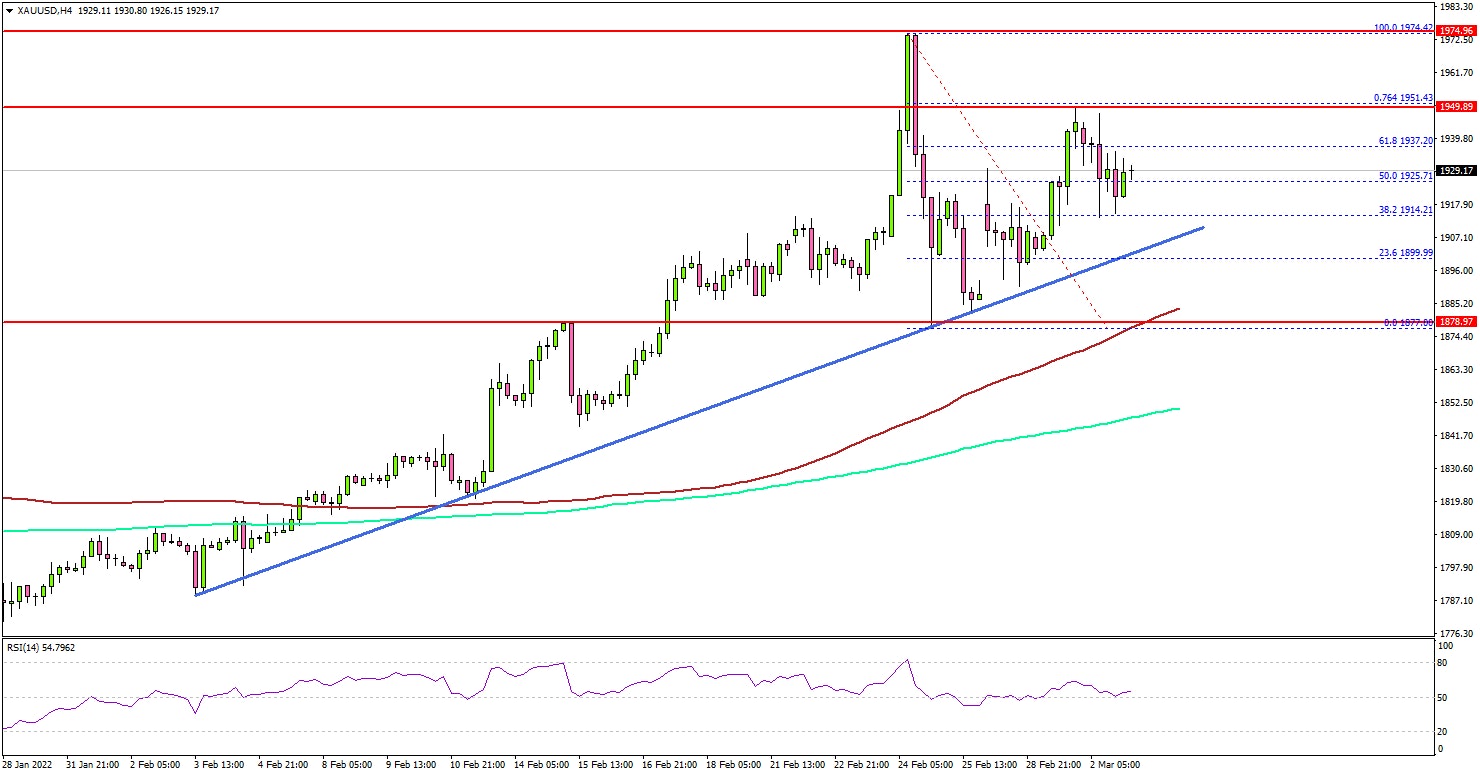

- Gold price rallied above the $1,920 and $1,950 resistance levels.

- A major bullish trend line is forming with support near $1,905 on the 4-hours chart.

- EUR/USD extended decline below 1.1120, and GBP/USD retested 1.3280.

- The US ISM Services Index could increase from 59.9 to 61.0 in Feb 2022.

Gold Price Technical Analysis

Gold price started a major increase after it broke the $1,900 resistance against the US Dollar. The price even cleared the $1,920 level to move into a positive zone.

The 4-hours chart of XAU/USD indicates that the price surpassed the $1,950 level. It traded as high as $1,974, and settled above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

Recently, there was a downside correction, but the price was stable above $1,880. It is now back above $1,900 and consolidating.

On the upside, the $1,950 zone is a key breakout zone. A close above $1,950 might set the pace for a move to $1,975. The next major stop for the bulls might be $2,000.

If not, the price might correct lower and trade below the $1,905 level. There is also a major bullish trend line forming with support near $1,905 on the same chart. The next major support is near $1,880, below which the price might decline to $1,865.

Fundamentally, the US ADP Employment Change was released yesterday by the Automatic Data Processing, Inc. The market was looking for an increase of 388K.

The actual result was better than the forecast, as the US ADP Employment increased 475K. The last reading was also revised to 509K.

Looking at EUR/USD, the pair is facing an increase in selling pressure and recently there was a move below 1.1120. Similarly, GBP/USD retested the key 1.3280 support zone.

Economic Releases to Watch Today

- Germany’s Services PMI for Feb 2022 - Forecast 56.6, versus 56.6 previous.

- Euro Zone Services PMI for Feb 2022 – Forecast 55.8, versus 55.8 previous.

- UK Services PMI for Feb 2022 – Forecast 60.8, versus 60.8 previous.

- US Services PMI for Feb 2022 – Forecast 57.5, versus 56.7 previous.

- US ISM Services Index for Feb 2022 – Forecast 61.0, versus 59.9 previous.