Aayush Jindal

Key Highlights

- Gold price started an upside correction above $1,780 and $1,800.

- A major bearish trend line is in place with resistance near $1,840 on the 4-hours chart of XAU/USD.

- EUR/USD remained stable above 1.2050, while GBP/USD declined sharply from 1.3440.

- The US ISM Services PMI (to be released today) could decline from 56.6 to 56.0 in Nov 2020.

Gold Price Technical Analysis

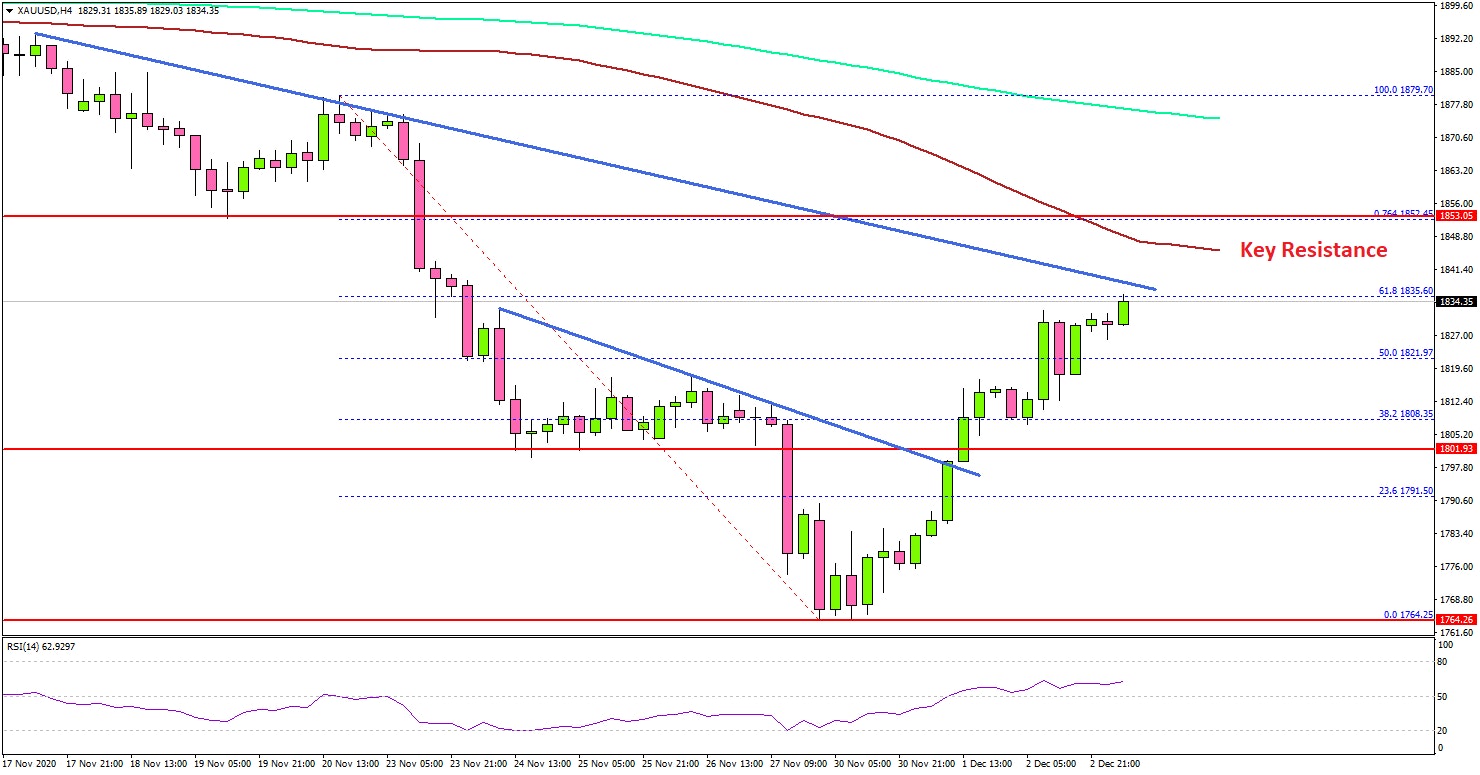

This month, gold price saw a steady decline below the $1,850 support against the US Dollar. The price even broke the $1,800 support level to move into a bearish zone.

The 4-hours chart of XAU/USD indicates that the price traded below the $1,780 level, and settled well below the 200 simple moving average (green, 4-hours) and the 100 simple moving average (red, 4-hours).

Finally, it found support near the $1,765 level and recently started an upside correction. There was a break above the $1,780 and $1,800 resistance levels.

The price even recovered above the 50% Fib retracement level of the last key decline from the $1,879 high to $1,764 swing low. However, the price is facing a couple of major hurdles near the $1,840 and $1,850 levels.

There is also a major bearish trend line forming with resistance near $1,840 on the same chart. The trend line coincides with the 61.8% Fib retracement level of the last key decline from the $1,879 high to $1,764 swing low.

To move into a positive zone, gold price must surpass $1,840, $1,850, and the 100 simple moving average (red, 4-hours).

Fundamentally, the US ADP Employment Change report for Nov 2020 was released by the Automatic Data Processing, Inc. The market was looking for a change of 410K in jobs, up from the last 365K.

The actual result was below the market forecast, as the US ADP Employment increased by 307K jobs from October to November 2020.

Looking at EUR/USD, the pair remained stable above 1.2050 and it could continue to rise. Conversely, there was a sharp bearish wave in GBP/USD from the 1.3440 zone.

Economic Releases to Watch Today

- Germany’s Services PMI for Nov 2020 - Forecast 46.2, versus 46.2 previous.

- Euro Zone Services PMI for Nov 2020 – Forecast 41.3, versus 41.3 previous.

- UK Services PMI for Nov 2020 – Forecast 45.8, versus 45.8 previous.

- US ISM Services PMI for Nov 2020 – Forecast 56.0, versus 56.6 previous.

- US Initial Jobless Claims - Forecast 775K, versus 778K previous.