Aayush Jindal

Key Highlights

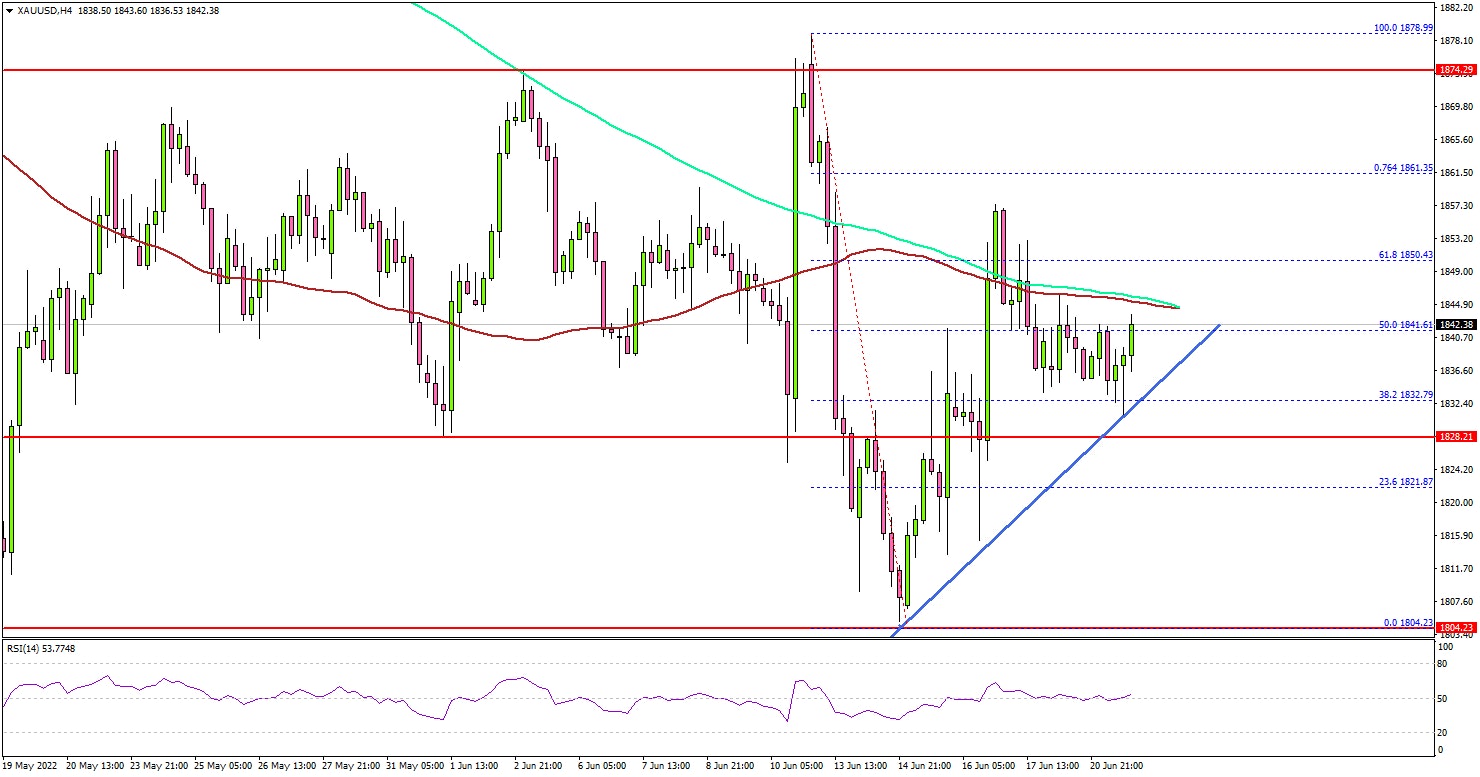

- Gold price is facing resistance near $1,850 and $1,860.

- A connecting bullish trend line is forming with support near $1,835 on the 4-hours chart.

- USD/JPY rallied further and traded to a new multi-year high above 136.00.

- The UK CPI could increase 9.1% in May 2022 (YoY), up from 9.0%.

Gold Price Technical Analysis

Gold price declined sharply from the $1,875 resistance zone against the US Dollar. The price traded below the $1,850 support zone and even traded close to $1,800.

The 4-hours chart of XAU/USD indicates that the price settled below the $1,850 level, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

The price traded as low as $1,804 and recently started an upside correction. There was a move above the $1,825 and $1,830 resistance levels. There was a spike above the 1,845 level and the 100 simple moving average (red, 4-hours).

However, the price is facing a strong resistance near the $1,850 level. A clear move above the $1,850 resistance might send the price towards the $1,860 resistance. The next major resistance sits near $1,875.

If there is no upside break move, the price could trim gains and test the $1,825 support. The next major support is near the $1,820 level, below which it could even test $1,800.

Looking at USD/JPY, there was a fresh increase and the bulls pumped the pair to a new multi-year high above 136.00.

Economic Releases to Watch Today

- UK Consumer Price Index for May 2022 (YoY) – Forecast +9.1%, versus +9.0% previous.

- UK Core Consumer Price Index for May 2022 (YoY) – Forecast +6.0%, versus +6.2% previous.

- Canadian Consumer Price Index for May 2022 (MoM) – Forecast +1.0%, versus +0.6% previous.

- Canadian Consumer Price Index for May 2022 (YoY) – Forecast +7.4%, versus +6.8% previous.