Aayush Jindal

Key Highlights

- Gold price started a fresh increase above the $1,850 resistance.

- It broke a major bearish trend line with resistance near $1,842 on the 4-hours chart.

- EUR/USD spiked higher and surpassed the 1.0700 resistance.

- GBP/USD struggled to clear the 1.2640 and 1.2650 resistance levels.

Gold Price Technical Analysis

Gold price formed a base above the $1,780 level against the US Dollar. The price started a fresh increase above the $1,800 resistance and moved into a positive zone.

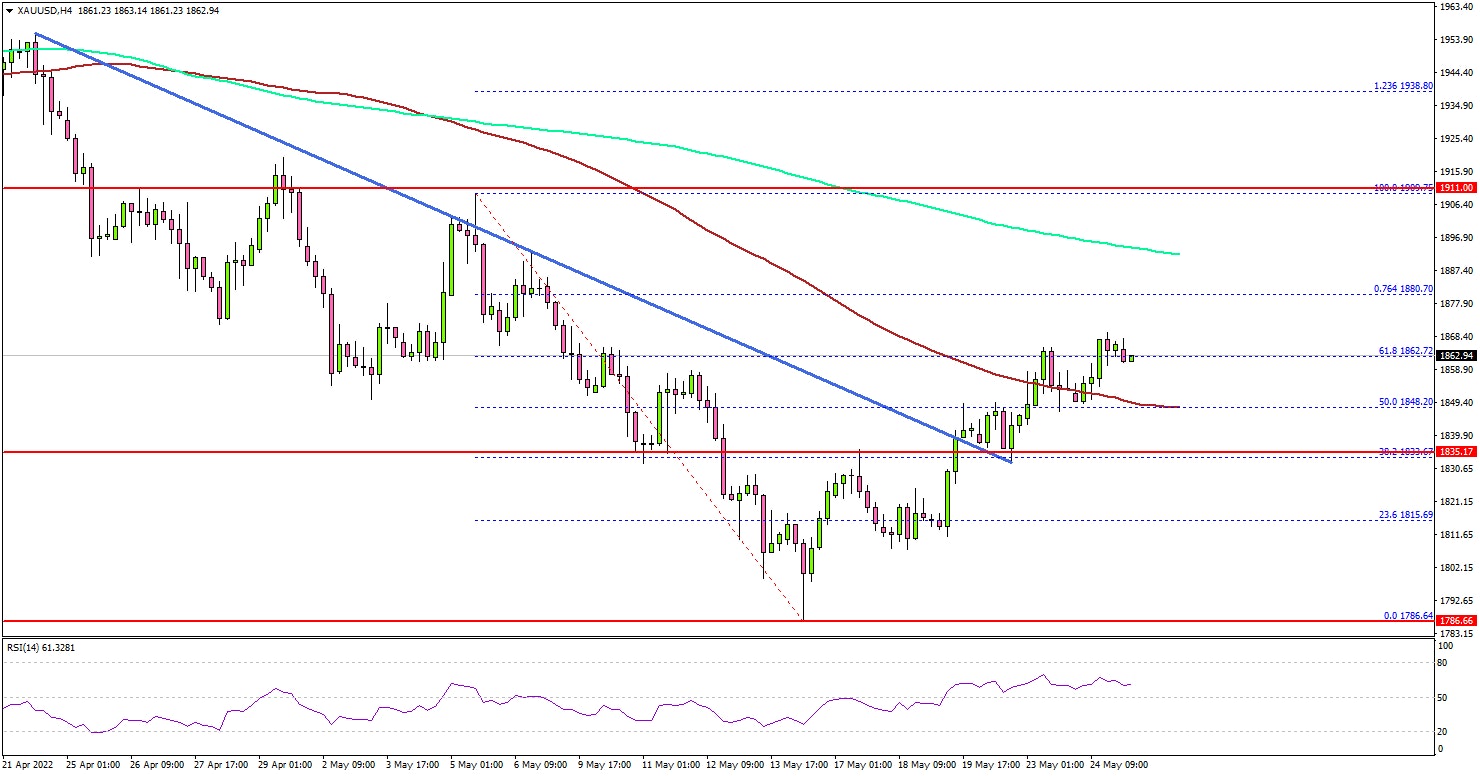

The 4-hours chart of XAU/USD indicates that the price was able to clear a few key hurdles near the $1,835 level. There was also a move above a major bearish trend line with resistance near $1,842.

The price cleared the 50% Fib retracement level of the downward move from the $1,909 swing high to $1,786 low. Finally, it climbed above the $1,850 resistance and the 100 simple moving average (red, 4-hours).

On the upside, the price might face resistance near $1,880 or the 200 simple moving average (green, 4-hours). It is close to the 76.4% Fib retracement level of the downward move from the $1,909 swing high to $1,786 low.

The next key resistance could be $1,900. A clear move above $1,900 might send the price towards the $1,920 resistance.

If there is no upside break move, the price could trim gains and test the $1,835 support. The next major support is near the $1,820 level, below which it could even test $1,800.

Looking at EUR/USD, the pair was able to gain strength for a move above the 1.0650 resistance zone. Conversely, GBP/USD struggled near 1.2650.

Economic Releases to Watch Today

- German Gross Domestic Product for Q1 2022 (YoY) (Preliminary) – Forecast 3.7%, versus 3.7% previous.

- German Gross Domestic Product for Q1 2022 (QoQ) (Preliminary) – Forecast 0.2%, versus 0.2% previous.

- US Durable Goods Orders for Sep 2022 – Forecast +0.6% versus +1.1% previous.