Aayush Jindal

Key Highlights

- Gold price corrected lower, but it found support near $1,850.

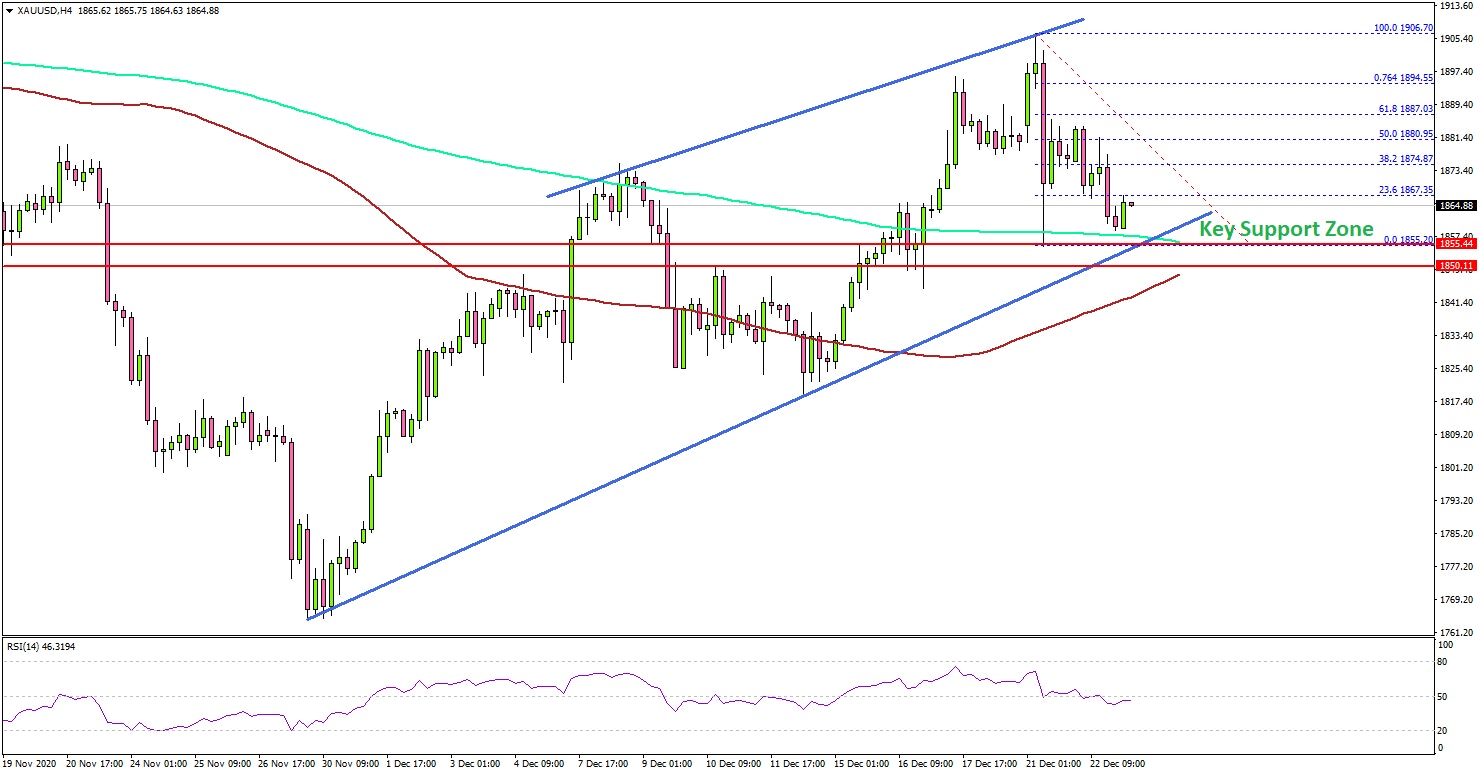

- A major bullish trend line is forming with support near $1,855 on the 4-hours chart of XAU/USD.

- EUR/USD is trading nicely above 1.2150, crude oil price corrects lower without testing $50.00.

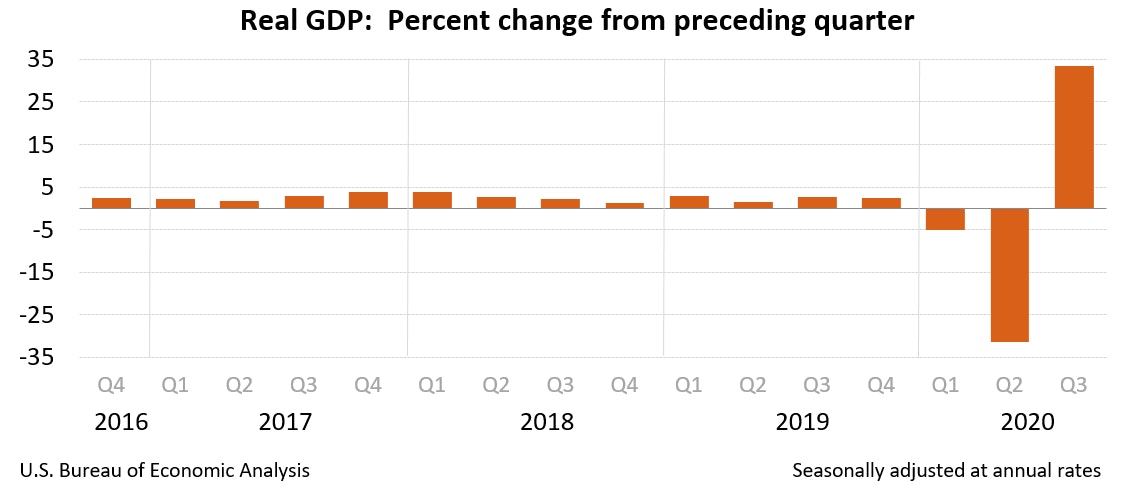

- The US Gross Domestic Product grew 33.4% in Q3 2020.

Gold Price Technical Analysis

In the past few days, there was a steady increase in gold price above $1,850 against the US Dollar. The price even spiked above $1,900 before it started a downside correction.

The 4-hours chart of XAU/USD indicates that the price traded as high as $1,906 and corrected sharply lower below $1,880 and $1,865. However, the price remained well bid above the $1,850 level and the 200 simple moving average (green, 4-hours).

There is also a major bullish trend line forming with support near $1,855 on the same chart. If there is a downside break below the trend line and $1,850, the price could test the $1,840 support. The 100 simple moving average (red, 4-hours) is also near the $1,840 zone.

If there is a fresh increase, the price is likely to struggle near $1,895 and $1,900. A close above $1,900 could open the doors for a larger increase towards $1,920 and $1,925.

Fundamentally, the US Gross Domestic Product for Q3 2020 was released yesterday by the US Bureau of Economic Analysis. The market was looking for a rise of 33.1% in Q3 2020.

The actual result was better than the forecast, as the US Gross Domestic Product grew 33.4% in Q3 2020 (according to the "third" estimate).

The report added:

The increase in third quarter GDP reflected continued efforts to reopen businesses and resume activities that were postponed or restricted due to COVID-19.

Looking at EUR/USD, the pair gained traction and it is trading nicely above the 1.2180 support. Similarly, GBP/USD traded in a positive zone above the 1.3300 level.

Economic Releases to Watch Today

- US Initial Jobless Claims - Forecast 885K, versus 885K previous.

- US New Home Sales for Nov 2020 (MoM) – Forecast -0.3% versus -0.3% previous.

- US Durable Goods Orders for Nov 2020 – Forecast +0.6% versus +1.3% previous.