Aayush Jindal

Key Highlights

- Gold price started a fresh decline from the $1,965 zone.

- A key bearish trend line is forming with resistance near $1,920 on the 4-hours chart.

- EUR/USD attempted a recovery wave from 1.0950, and GBP/USD is still above 1.3050.

- The US Gross Domestic Product could increase 7% in Q4 2021.

Gold Price Technical Analysis

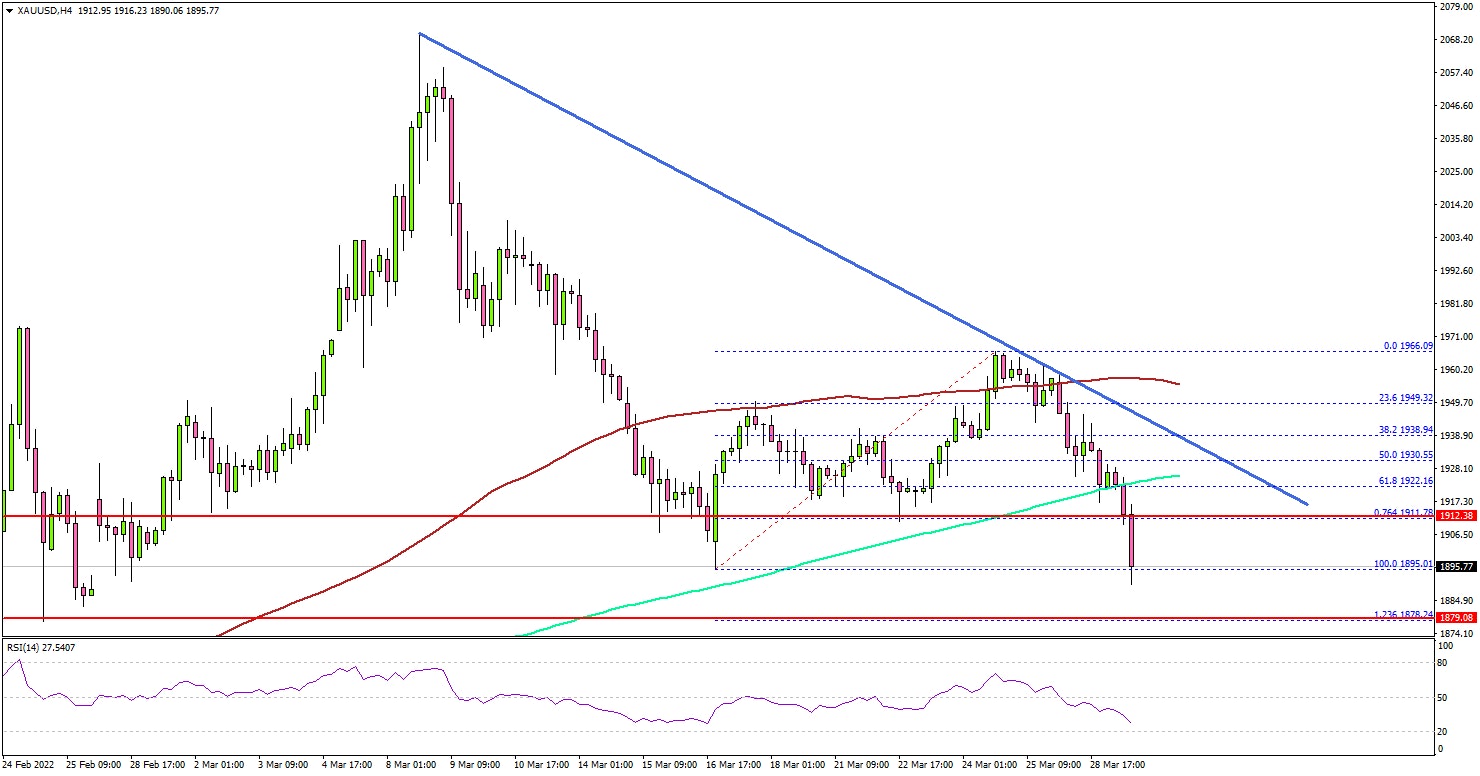

Gold price attempted a fresh increase above the $1,950 level against the US Dollar. However, the price failed to clear $1,965 and started another decline.

The 4-hours chart of XAU/USD indicates that the price declined steadily below the $1,950 support level. There was a close below the $1,920 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The price declined below the 76.4% Fib retracement level of the upward move from the $1,895 swing low to $1,966 high.

If the bears remain in action, the price may perhaps test the $1,880 support. The next major support is near the $1,850 level. It coincides with the 1.618 Fib extension level of the upward move from the $1,895 swing low to $1,966 high.

On the upside, the price might face resistance near $1,920. There is also a key bearish trend line forming with resistance near $1,920 on the same chart. The next key resistance could be $1,960, above which the bulls might aim a test of the $1,980 resistance zone or even $2,000.

Looking at EUR/USD, the pair found support near the 1.0950 level and attempted a recovery wave. Besides, GBP/USD remained well bid above the 1.3050 support zone.

Economic Releases to Watch Today

- German Consumer Price Index for March 2022 (YoY) (Prelim) – Forecast +6.3%, versus +5.1% previous.

- German Consumer Price Index for March 2022 (MoM) (Prelim) – Forecast +1.6%, versus +0.9% previous.

- US Gross Domestic Product Q4 2021 – Forecast 7% versus previous 7%.