Aayush Jindal

Key Highlights

- Gold price started a fresh decline from the $1,729 resistance zone.

- It traded below a key bullish trend line at $1,692 on the 4-hours chart.

- USD/JPY rallied to a new multi-year high and surpassed 145.00.

- The US Consumer Price Index (CPI) could increase 8.1% in Sep 2022 (YoY).

Gold Price Technical Analysis

Gold price struggled to gain pace above the $1,725 level against the US Dollar. The price formed a top near $1,729 and started a downside correction.

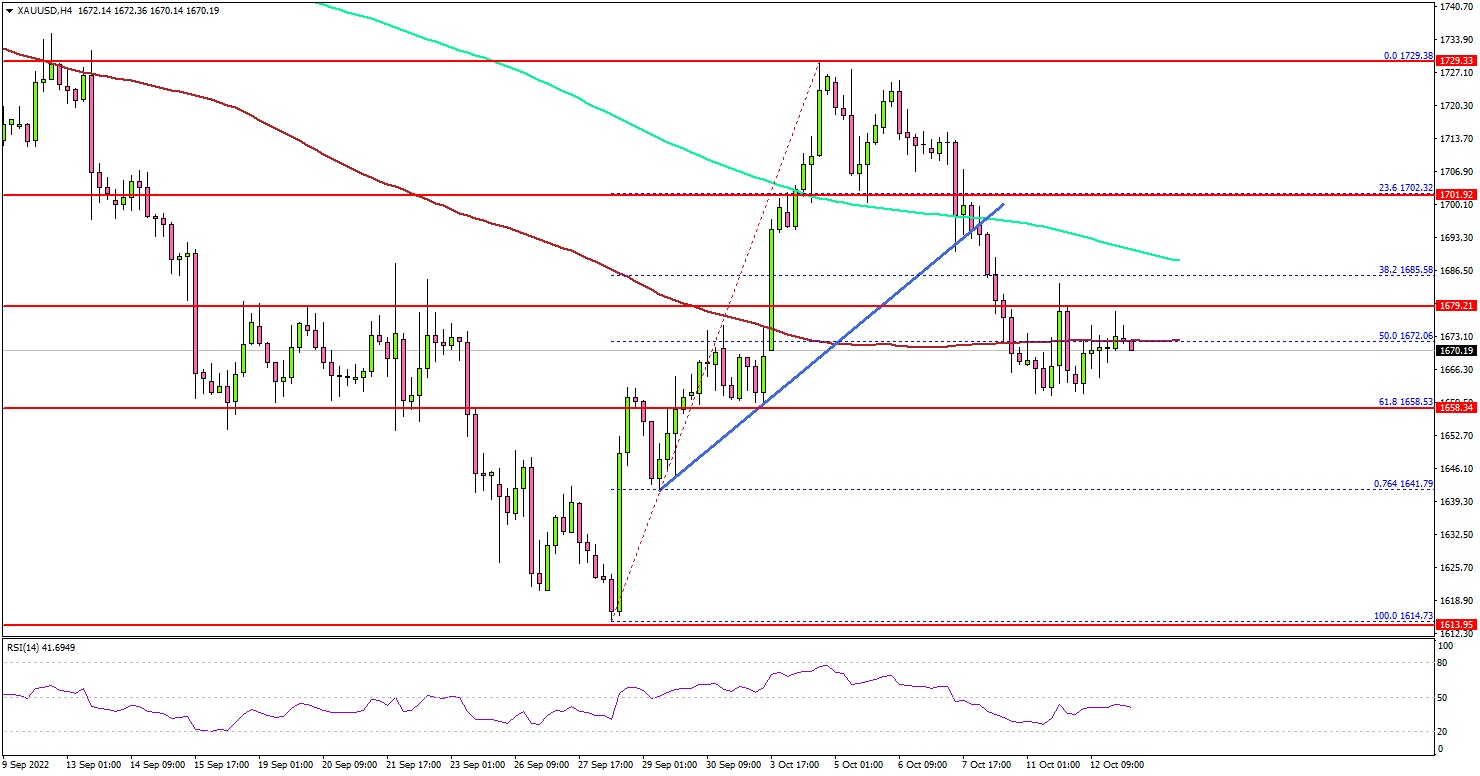

The 4-hours chart of XAU/USD indicates that the price declined below the $1,700 support zone, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

There was a clear move below a key bullish trend line at $1,692 on the same chart. The price declined below the 50% Fib retracement level of the key upward move from the $1,614 swing low to $1,729 high.

On the downside, an initial support is near the $1,658 level. It is near the 50% Fib retracement level of the key upward move from the $1,614 swing low to $1,729 high. The next major support is near the $1,650 level, below which the price could accelerate lower.

In the stated case, the price may perhaps decline towards the $1,620 level. On the upside, the price might face sellers near the $1,680 level.

The next major resistance is near the $1,690 level. Any more gains might send the price towards the $1,700 resistance level, above which gold price might revisit the $1,730 resistance.

Looking at USD/JPY, there was a strong increase above the 145.00 resistance zone and the pair traded to a new multi-year high.

Economic Releases to Watch Today

- German Consumer Price Index for Sep 2022 (YoY) – Forecast +10%, versus +10% previous.

- German Consumer Price Index for Sep 2022 (MoM) – Forecast +1.9%, versus +1.9% previous.

- US Consumer Price Index for Sep 2022 (MoM) – Forecast +0.2%, versus +0.1% previous.

- US Consumer Price Index for Sep 2022 (YoY) – Forecast +8.1%, versus +8.3% previous.

- US Consumer Price Index Ex Food & Energy for Sep 2022 (YoY) – Forecast +6.5%, versus +6.3% previous.