Nick Goold

Weekend Gap Trading Strategy in Forex

The forex market operates 24 hours a day, five days a week. But when the market closes on Friday and reopens on Sunday, price discrepancies can occur. This difference between the Friday close and the Sunday open is known as the weekend gap. Many traders use a weekend gap trading strategy to take advantage of these unique opportunities. Below, we explore how weekend gaps work, how to trade them, and the risks involved.

What Is a Weekend Gap in Forex?

Forex runs on the schedules of the world’s major financial centers. When the New York session closes on Friday, trading halts until the Sydney open on Monday. During the weekend pause, important events — such as geopolitical developments, economic data releases, or breaking news — can move currency valuations. When the market reopens, if the price is significantly different from the Friday close, a weekend gap is formed.

The Logic Behind Weekend Gap Trading

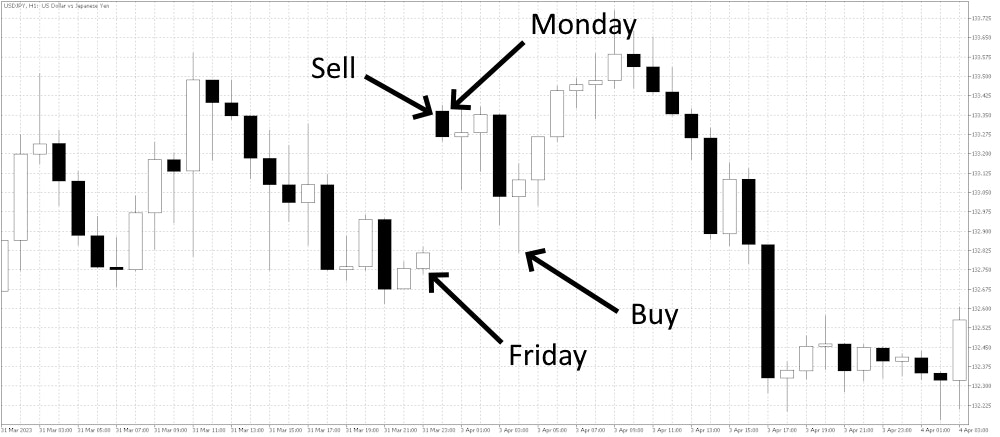

The core idea of the weekend gap strategy is that the market often attempts to “fill” the gap — meaning prices tend to move back toward the previous Friday close. Traders who use this strategy typically open positions shortly after Sunday’s market open, betting on this reversion. However, not all gaps close, which makes timing and risk management critical.

How to Trade Weekend Gaps

1. Identify the Gap

At Sunday’s open, determine if a significant gap exists between Friday’s closing price and Sunday’s opening price.

2. Choose the Direction

If Sunday opens higher than Friday’s close, this is an upward gap. In many cases, traders will short the pair, anticipating a move back down toward Friday’s close. Conversely, if Sunday opens lower, traders often go long, expecting a rebound upward.

3. Time Your Entry

Entering immediately at the open can be risky. Many traders who held losing positions on Friday exit at the Sunday open, creating initial volatility. A better entry often comes once the first wave of stop-loss orders is absorbed and the price begins reversing.

4. Set Stop Loss and Take Profit Levels

A common method is to place the stop loss just beyond the opening price and set the profit target at Friday’s close. More advanced traders may use trailing stops to capture additional profits if momentum extends beyond the gap close.

5. Monitor the Trade

Weekend gaps can close quickly or take several sessions. In some cases, gaps remain unfilled, which can trap traders in losing positions. Active monitoring is essential.

Risks of Weekend Gap Trading

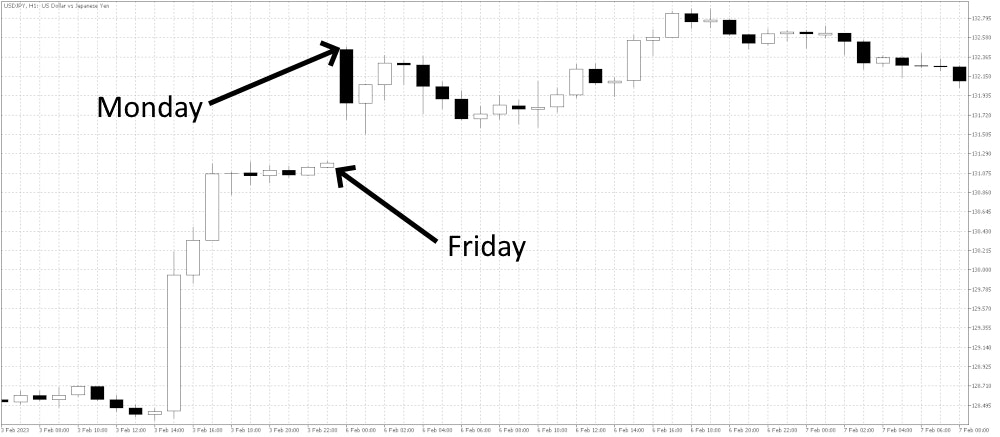

Non-Closing Gaps

Not every gap closes. Some gaps mark the beginning of new long-term trends. Assuming every gap will fill is a common mistake that can lead to prolonged losses.

Slippage

At the Sunday open, volatility is often extreme, and orders may execute at different prices than expected. This slippage can increase risk significantly.

Wide Gaps

Major weekend news events — such as elections, central bank interventions, or geopolitical shocks — can cause unusually wide gaps. These moves may exceed your risk tolerance and create dangerous conditions for trading.

Risk Management in Gap Trading

Proper risk management is essential for trading gaps. Consider these key rules:

- Risk Per Trade: Limit each trade to 1–2% of your capital.

- Correlation Risk: Avoid trading gaps across multiple correlated pairs at the same time.

- News Awareness: Stay informed about scheduled and unscheduled events over the weekend that could trigger large moves.

Testing the Strategy

Before committing real money, traders should always backtest weekend gap strategies on historical data. Practicing in a demo account helps you understand how gaps behave under live market conditions and refine entry/exit rules without risking capital.

Psychology of Gap Trading

Gap trading requires patience and emotional control. Waiting all weekend for the market to reopen can build anticipation, and once a trade is entered, the price may initially move against you before reversing. Fear and greed often push traders to exit too early or ignore stop losses. Sticking to your plan is crucial.

Weekend gap trading can be a profitable forex strategy when used with discipline, patience, and proper risk management. While many gaps do close, some become the start of powerful new trends. By combining technical analysis, risk controls, and strong trading psychology, you can approach weekend gaps with confidence and improve your chances of success.