Nick Goold

All forex traders understand that following the trend is one of the best ways to profit from trading forex. Following the trend when trading forex involves identifying the market's current direction and making trades in the same direction.

Here are some tips to help you follow the trend when trading forex:

Identify the trend

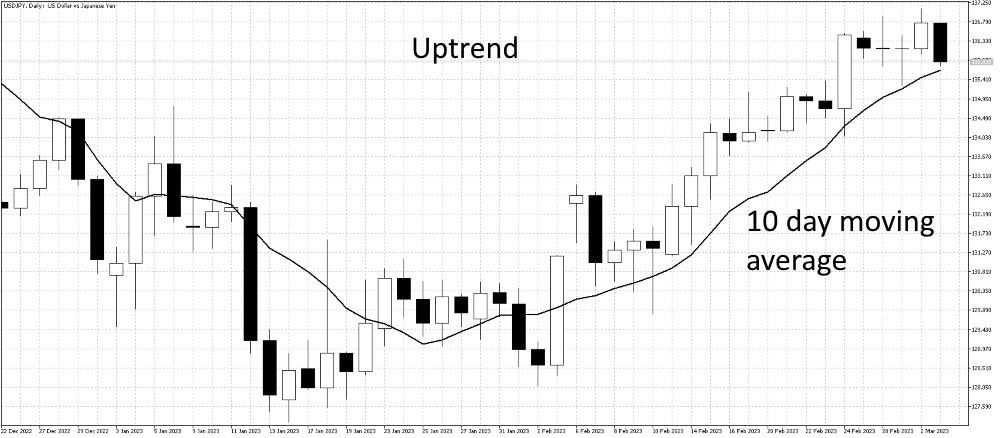

Look at the price chart of the currency pair you want to trade and try to identify the current trend. A moving average is one of the easiest ways to identify the trend. An upward-sloping moving average indicates an uptrend, and downward pointing moving average indicates a downtrend. Should the moving average point sideways, this means a sideways trend. The length of the moving average will determine whether the trend is short or long-term. For instance, a 10 to 30-bar moving average for short-term trends, a 50 to 100-bar moving average for medium-term trends, and over 100 bars for long-term trends.

While trendlines are also helpful, deciding which highs or lows to connect to draw a trendline can be difficult. A moving average is more objective in determining the trend than a trendline.

Determine the strength of the trend

Once you have identified the trend, assess its strength. A strong trend is characterized by a sharply higher or lower moving average. Another measure is a series of higher highs and higher lows in an uptrend or lower lows and lower highs in a downtrend.

The longer the trend has been continuing will also indicate a strong trend.

Check multiple timeframes

It can also be beneficial to confirm the trend on a longer-term timeframe. For example, if you are day trading on a 5-minute chart, following the daily chart trend in the same direction can increase your chances of making a profit. However, be careful to check only a few timeframes as it can confuse and negatively impact your decision-making.

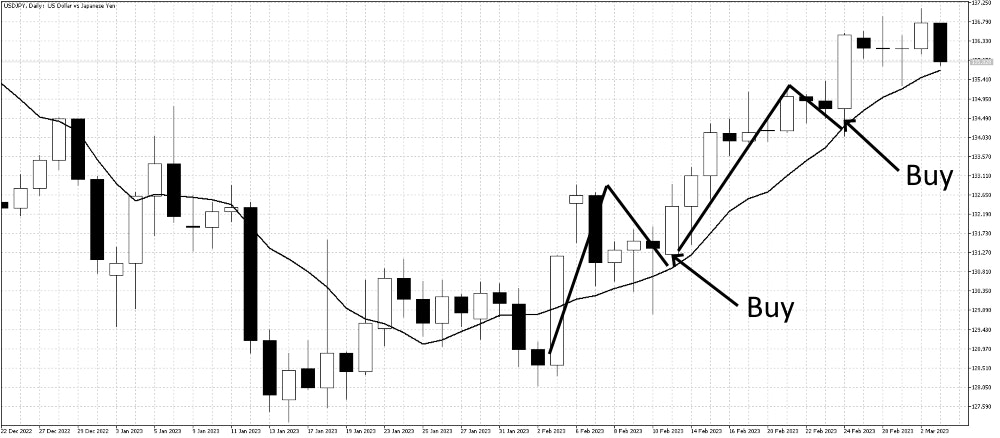

Wait for a pullback

After identifying the trend and its strength, wait for a pullback or a correction in the price. A pullback will give you a better entry point to enter the market in the same direction as the trend. An example of a pullback is when the market has risen 50 pips, and the trader then waits for the market to fall to return closer to the moving average or trend line to buy the market.

Too many traders panic when the market quickly rises and buy when the market is overbought, which increases the chance of making a loss. Developing patience to wait for prices to return to the moving average or trendline will help you find high-risk reward trading opportunities. No market moves in a straight line, so be confident to wait for the right opportunity to join the trend.

Understand the news

Strong trends usually are formed due to news events. Understanding what news is moving the market will help you follow the trend. Reading analyst reports can help you understand why the market is moving and the current trend. Accept that an economic announcement can quickly change the market's direction, so be willing to exit your trade should the news trend change.

Use a trailing stop

An important skill when following a trend is maximizing your profits. It can be challenging to forecast when a trend will end and set a profit target. Not placing a profit target and using a trailing stop can help follow a long-term trend. As your trade becomes more profitable, decrease the size of your stop loss, which allows you to hold the position while it remains profitable and exit when the trend ends.

Be patient

Trend trading requires a high level of patience to be successful. Over-trading and worrying about every price move will lead to losses. In addition, getting the timing precisely right when trend trading is difficult, so accept short-term losses and maintain confidence.

Remember that trends can change, and keeping an eye on the market is essential to avoid being caught in a trend reversal. Additionally, following the trend does not guarantee profits, and having a well-defined trading plan and risk management strategy is crucial.