Nick Goold

Mastering Stop-Loss Timing: How to Cut Losses and Protect Your Capital

In Forex and CFD trading, the timing of your stop-loss can make the difference between long-term success and repeated losses. Many beginner traders focus only on achieving a high win rate, but professional traders understand that controlling losses is more important than maximizing wins. Cutting losing positions quickly allows you to preserve capital and be ready for the next profitable opportunity.

The goal of a stop-loss is simple: exit a trade that is no longer likely to be profitable. Regardless of whether you trade in the morning, afternoon, or evening, the rules are the same—define your stop-loss before entering the trade. Waiting until you are already in a position can lead to emotional decision-making and poor risk management.

Where to Place Stop-Loss Orders

As a rule of thumb, stop-losses should be placed below support for long (buy) trades and above resistance for short (sell) trades. Below are four proven strategies with stop-loss placement techniques.

Strategy 1: Range Trading

Range trading involves buying at support and selling at resistance. While this strategy has a high win rate, it only works if losses are cut quickly. When buying at support, always place your stop-loss just below the support zone. When selling at resistance, place it just above the resistance level. This ensures you exit quickly if the market breaks out of the range.

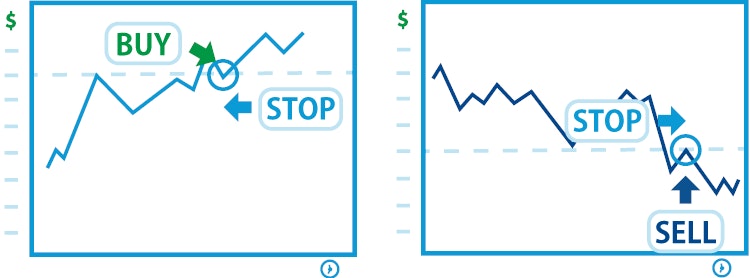

Strategy 2: Breakout Trading

Breakout trading means entering when price breaks above resistance or below support. Breakouts can produce large profits, but the win rate is usually low. The advantage is that stop-losses are small. For buy trades, place your stop-loss just below the broken resistance—if the breakout fails, exit quickly. For sell trades, place it just above broken support.

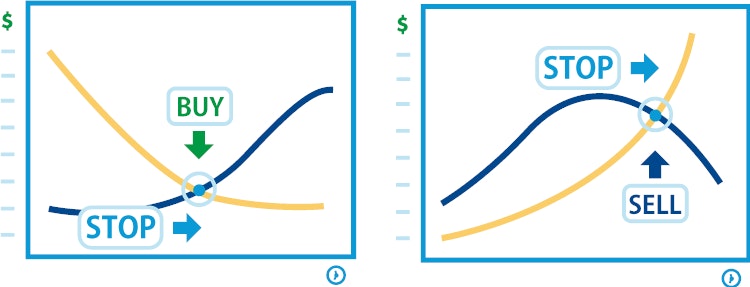

Strategy 3: Trend Trading

Trend trading means following the direction of moving averages or trend lines. In an uptrend, the moving average acts as support. Place your stop-loss below the moving average. In a downtrend, the moving average acts as resistance, so place your stop-loss above the moving average. The same rule applies to trend lines—buy ahead of an uptrend line with a stop just below, or sell in a downtrend with a stop just above the line.

Strategy 4: Reversal Trading

Reversal trading involves spotting when the market breaks away from the trend. For example, if price in an uptrend falls below the moving average, it signals weakness—set your stop-loss above the moving average. If price in a downtrend rises above the moving average, it may signal a reversal upward—set your stop-loss below the moving average.

Why Stop-Loss Discipline Matters

These stop-loss strategies can be applied to scalping, day trading, or swing trading. No matter your style, always trade with a stop-loss order. Unexpected news or volatility can move markets quickly, and without a plan, losses can spiral out of control.

Cutting losses is not failure—it is part of trading. By defining your stop-loss levels before every trade, you protect your capital, stay calm under pressure, and improve your long-term profitability. The most successful traders are not those who win every trade, but those who manage losses effectively.