Nick Goold

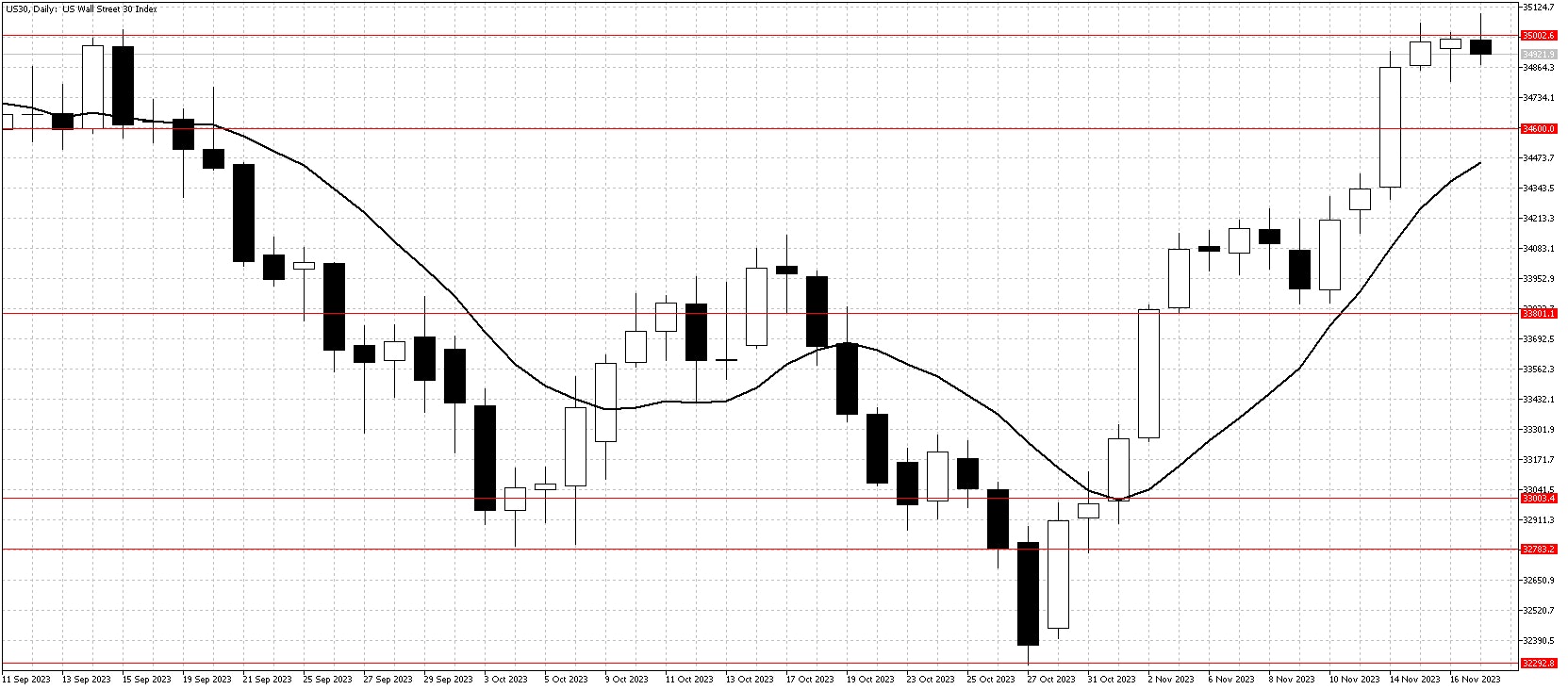

Dow Jones Index

The Dow Jones Industrial Average sustained its upward trajectory last.week, buoyed by encouraging economic indicators. The U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) inflation data, both coming in below expectations, played a pivotal role in this rise. This lower-than-anticipated inflation data decreased long-term interest rates, further fueling the market's optimism. Additionally, Wednesday's U.S. Retail Sales report exceeded expectations, injecting further confidence among stock buyers.

The softer inflation figures were interpreted as a positive sign that the Federal Reserve's monetary tightening policies are beginning to rein in inflation effectively. This perception eased concerns about the aggressive interest rate hikes that had previously rattled markets. Investors took comfort in the idea that the central bank's efforts were starting to pay off, leading to a more optimistic outlook on the economy.

The upcoming week is expected to be relatively calm, mainly due to the U.S. Thanksgiving holiday. This period typically sees reduced trading activity, with many investors and traders taking time off. The only significant economic event on the horizon is the release of the latest Federal Reserve meeting minutes. Given this, the market is anticipated to experience range-bound trading conditions. Traders are advised to follow the current uptrend, focusing on buying opportunities that may arise within this more subdued market environment.

Resistance: 35000, 36000

Support: 34600, 33800, 33000, 32785, 32300, 31750

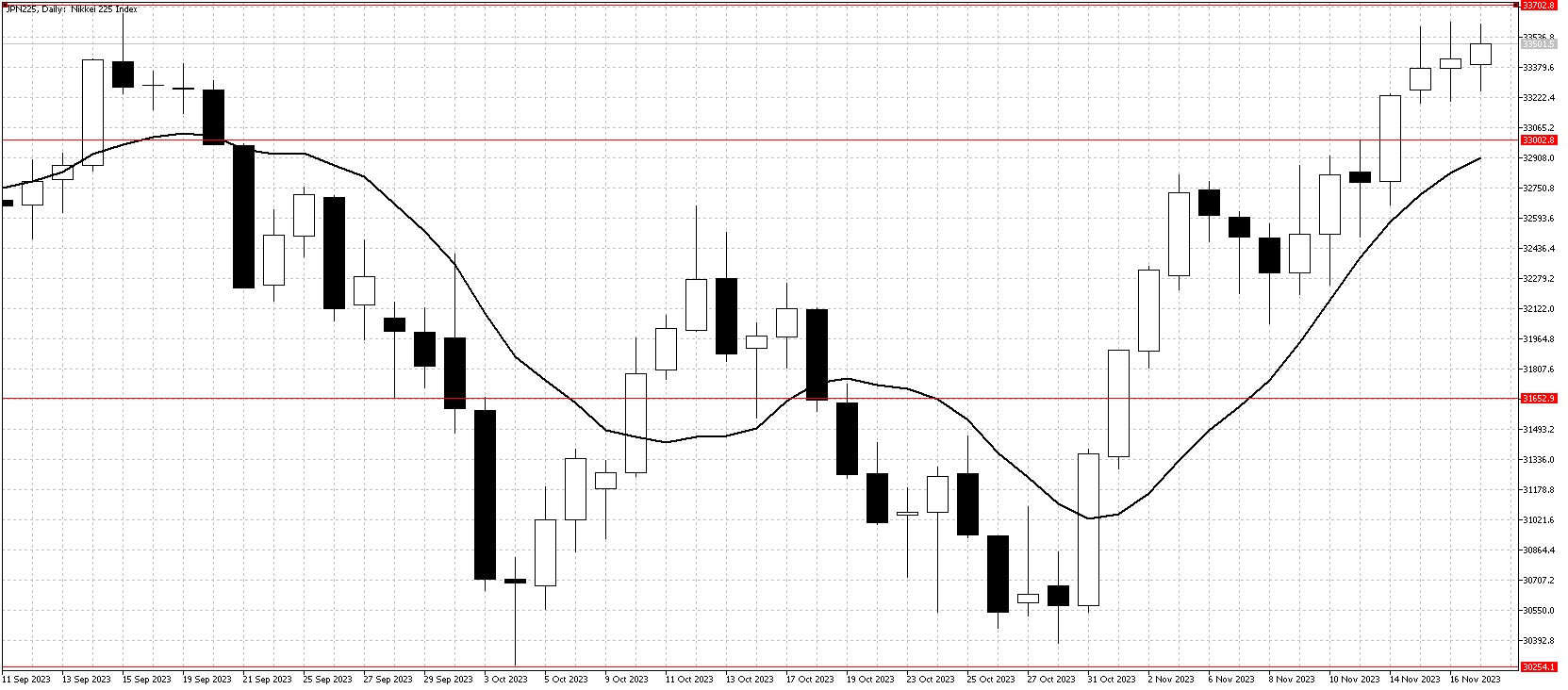

Nikkei 225 Index

Last week, the Nikkei Index experienced a significant boost, reaching a four-month high. This surge was primarily driven by solid earnings announcements from key Japanese companies, indicating a robust corporate sector. Additionally, the softening of U.S. inflation data played a vital role in this upward trend. Investors interpreted this data as a potential signal for the slowing or cessation of U.S. interest rate hikes, increasing the attractiveness of Japanese stocks.

Despite Japan's third-quarter Gross Domestic Product (GDP) data revealing a 0.5% contraction, exceeding initial pessimistic forecasts, this did not significantly dampen investor sentiment. Market participants appeared to focus more on the positive aspects, such as the potential for eased monetary policies from the U.S. Federal Reserve. Furthermore, the USD/JPY currency pair fell, following the trend of long-term U.S. interest rates.

With U.S. markets anticipated to experience a quieter period, particularly in light of the Thanksgiving holiday, short-term trading opportunities in the Nikkei might become more limited. However, the prevailing uptrend in the market suggests that periods of short-term weakness could present valuable buying opportunities for investors. The overall market sentiment remains positive, and the trend's strength implies that dips might be advantageous for market entry.

Resistance: 33700, 34000

Support: 33000, 31650, 30250, 30000