Nick Goold

Market analysis

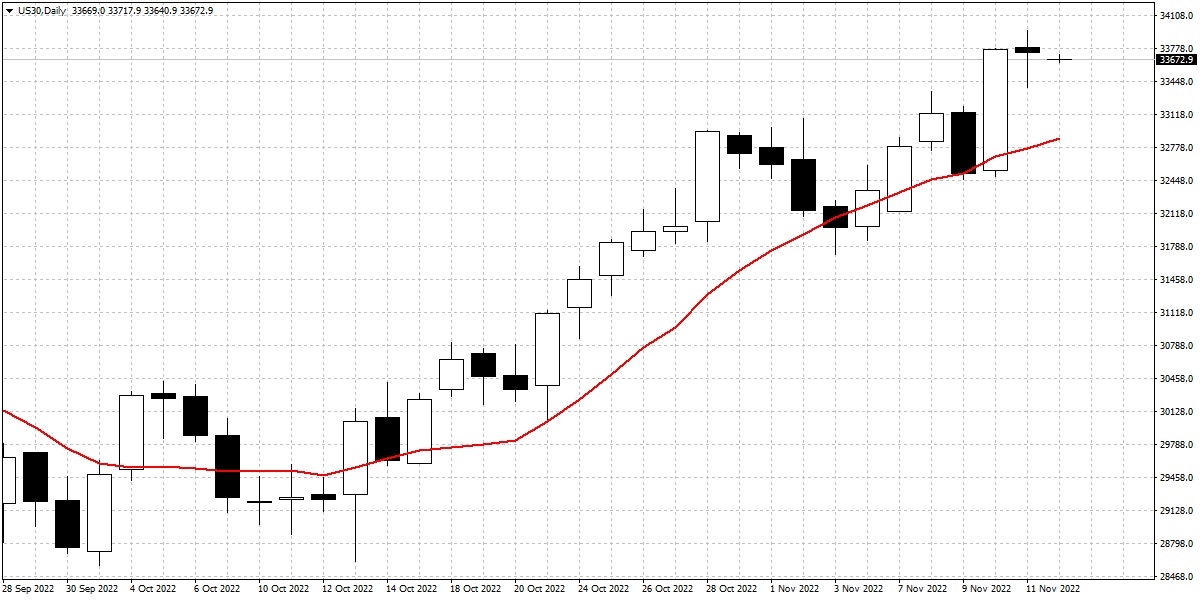

The Dow Jones Index moved sideways for the first half of the week, with prices returning to the 10-day moving average. On Thursday, US CPI showed lower-than-expected inflation, seeing the market surge higher towards resistance at 34,000. The CPI figure saw the closely watched US 10-year interest fall 0.25% back below 4%.

The medium-term outlook for the Dow is strong if inflation continues to show signs of slowing. In the short-term, resistance at 34,000 could see the market push lower this week, resulting in good buying opportunities close to the 10-day moving average. The market trends remain strong, and the economic indicators can change the market trend, so traders need to watch the news.

Daily NY Dow with 10 day moving average

Resistance:34000, 34300, 35000

Support:33000, 32000, 31000, 30000

The three main trading styles for trading the Dow Jones Index

There are three main trading strategies when trading the Dow Jones index; scalping, day trading and swing trading. Each trading style has different advantages and disadvantages.

Scalping

This the most short-term trading style where trades are held for minutes to make quick profits. Scalping can be profitable when trading the Dow as volatility is very high. Scalpers must be disciplined and follow their stop loss orders.

Day trading

This is the most common strategy where traders exit all their positions by the end of the day. Day traders hold trades from minutes to hours and look to take advantage of short-term trends. Having a clear strategy and avoiding over-trading is a skill successful day traders possess.

Swing trading

A trader who holds a position for more than one day is considered a swing trader. Swing trading is much less stressful than the other trading strategies and popular for beginners. The danger is when swing trading is a news event and can result in unexpected losses which are difficult to forecast.

It is helpful to try all three trading strategies when learning to trade. Compare your performance and pick the trading strategy which showed the best performance and the one you are most comfortable with. Mixing trading styles can be dangerous for most traders, so using one trading strategy is recommended.