Nick Goold

Williams %R Indicator: How to Use Williams Percent Range in Forex and Stock Trading

The Williams %R indicator (Williams Percent Range), developed by legendary trader Larry Williams, is a powerful momentum oscillator widely used in forex, stock, and commodity trading. It helps traders identify overbought and oversold conditions, anticipate trend reversals, and gauge the strength of market momentum. Understanding and applying Williams %R effectively can significantly improve your trading strategies and risk management.

What is the Williams %R Indicator?

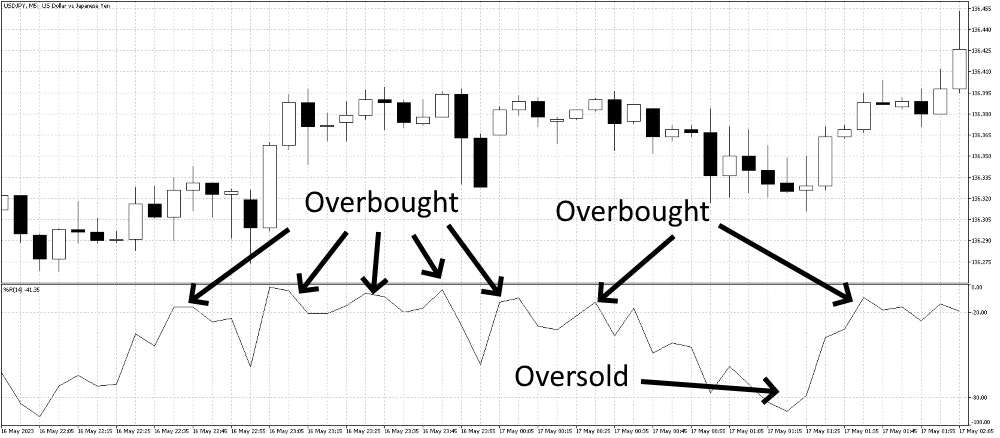

The Williams Percent Range is a technical analysis oscillator that compares the current closing price to the high-low range over a specific period, usually 14 bars. Its values range from -100 to 0:

- Above -20 = Overbought conditions (potential sell signal)

- Below -80 = Oversold conditions (potential buy signal)

Williams %R Formula: (Highest High - Close) / (Highest High - Lowest Low) * -100

The indicator is plotted as a line oscillating between -100 and 0. The standard setting is 14 periods, but traders often adjust it for shorter or longer timeframes depending on their style.

How to Interpret Williams %R

The Williams %R is most commonly used to identify overbought and oversold levels, but it also reveals momentum strength and possible divergences:

- Overbought: Above -20, signaling prices may correct lower.

- Oversold: Below -80, signaling prices may bounce higher.

- Divergences: If price makes new highs while Williams %R fails to, it suggests weakening momentum (bearish divergence). If price makes new lows while Williams %R rises, it signals bullish divergence.

These signals become even stronger when combined with other technical indicators or chart patterns.

Williams %R Trading Strategies

Here are several proven ways traders integrate Williams %R into their strategies:

1. Overbought and Oversold Entries

Use the -20 and -80 thresholds to find reversal zones. For example:

- If price hits the top of a Bollinger Band and Williams %R is above -20, it may be a good sell opportunity.

- If price tests a strong support level and Williams %R falls below -80, it may signal a buying opportunity.

2. Divergence Trading

Look for mismatches between price and Williams %R. For instance:

- Bearish Divergence: Price makes higher highs, Williams %R makes lower highs → possible downtrend.

- Bullish Divergence: Price makes lower lows, Williams %R makes higher lows → possible uptrend reversal.

3. Trend Confirmation

If Williams %R stays in the overbought zone during an uptrend or oversold zone during a downtrend, it confirms the strength of the trend. In such cases, traders may continue trading in the direction of the trend instead of anticipating reversals.

4. Multiple Timeframe Analysis

Combine Williams %R across different timeframes to avoid false signals. For example, if the daily chart shows overbought conditions but the weekly chart is oversold, this conflict signals caution. Aligning signals across multiple charts increases accuracy.

5. Support and Resistance Confirmation

Extreme Williams %R readings near key support or resistance levels add weight to reversal signals. For example, if Williams %R touches -100 near a strong support zone, it suggests a high-probability bounce.

6. Combining with Other Indicators

The Williams %R works best when paired with other tools. For example:

- Williams %R shows overbought conditions while a bearish candlestick pattern forms.

- Williams %R confirms a sell signal during a moving average crossover.

These confirmations reduce false signals and strengthen trade setups.

Limitations of the Williams %R

Like all technical indicators, Williams %R has limitations:

- False Signals: In sideways markets, it may flash frequent but unreliable signals.

- Whipsaws: In high-volatility periods, rapid oscillations can trigger multiple signals too quickly.

- Market Context: It should always be used alongside fundamental analysis, news events, and broader trend analysis.

For example, during major news events, prices may remain overbought or oversold for extended periods, making Williams %R signals misleading.

How to Trade with Williams %R

The Williams %R indicator is a versatile tool that helps traders identify reversal points, momentum shifts, and trend strength. Used correctly, it can improve timing and refine entries and exits. However, it should never be used in isolation. The best results come from combining Williams %R with support/resistance, candlestick patterns, moving averages, and fundamental analysis.

By practicing with Williams %R on demo accounts and testing it across multiple markets and timeframes, traders can build confidence and incorporate it into a profitable trading strategy.