Nick Goold

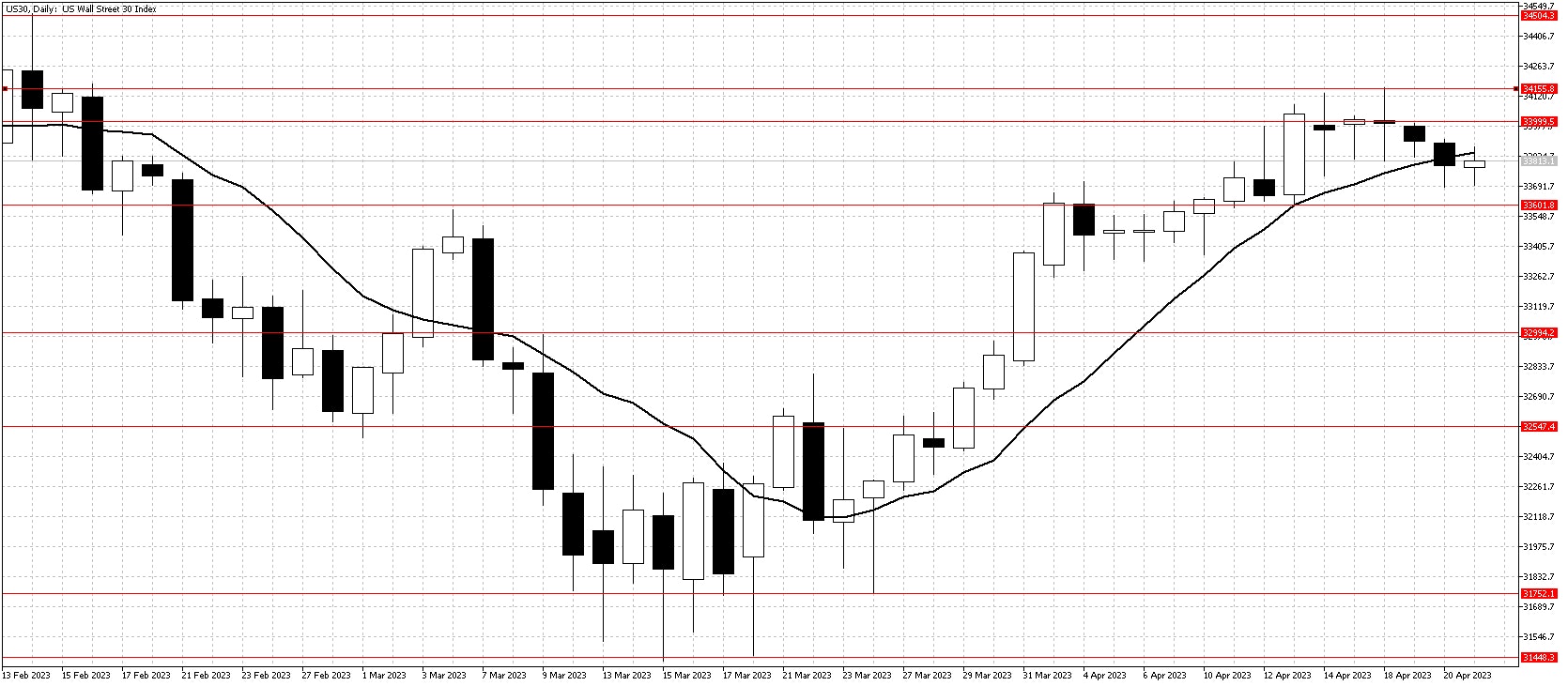

Dow Jones index

A subdued week in US equities as the Dow Jones failed at 34,000 resistance closing the week below the 10-day moving average. Investors are worried about the potential of a US recession, but Friday`s US manufacturing data was much better than expected.

With mixed signals regarding the economy, investors focus on company earnings, with Tesla falling 10% on the week after reporting a 20% drop in net income. Next week, many major technology firms like Alphabet, Microsoft, Meta, and Amazon report earnings. The only other major news expected is the USD GDP release on Thursday.

The failure to hold above 34,000 and double top at 34,150 will encourage technical traders to look for lower in the coming week. Lower levels seem more likely, with a move below 33,600 signaling the end of the up trend from mid-March. In the medium term, sideways price action should continue, so short-term trend trading is the easier way to trade in the coming week.

Resistance: 34000, 34155, 34500, 35000

Support: 33600, 33000, 32550, 31750, 31450, 31000

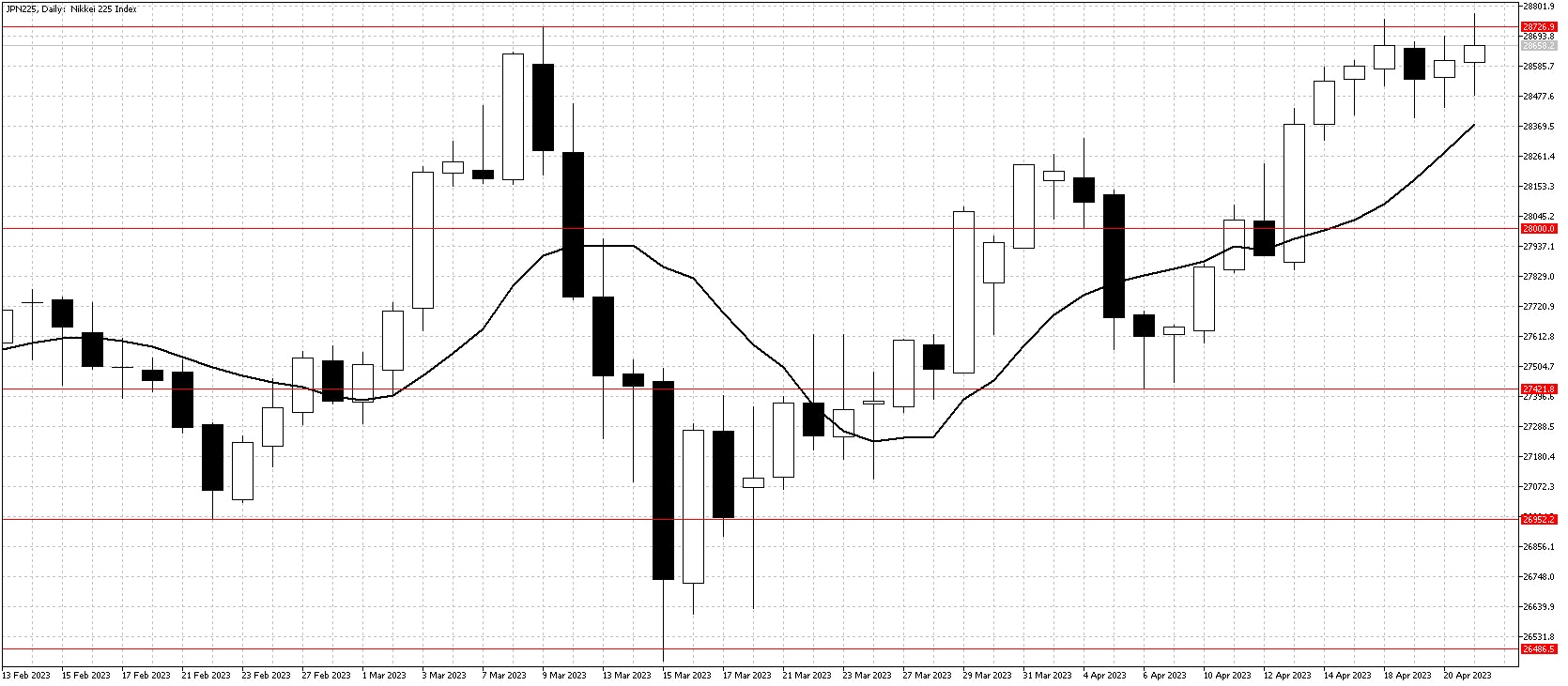

Nikkei index

A positive week for the Japanese stock market as overseas investors continued to look for undervalued Japanese companies following Warren Buffett`s lead. Also, the USDJPY continued to push higher on higher long-term US interest rates.

The highlight of the upcoming week is Friday`s Bank of Japan monetary policy announcement. The meeting will be the first for the new central bank governor Kazuo Ueda. Ueda is unlikely to change current policy significantly, but the meeting will increase volatility and create trading opportunities.

The outlook for the Nikkei remains positive, and the index briefly hit new highs for 2023 last week. In addition, the 10-day moving average points the market higher, so expect another test higher this week as the market targets 29,000 and higher.

Resistance: 28725, 29000, 29250

Support: 28000, 27425, 26950, 26500, 26250, 25500, 25000