Nick Goold

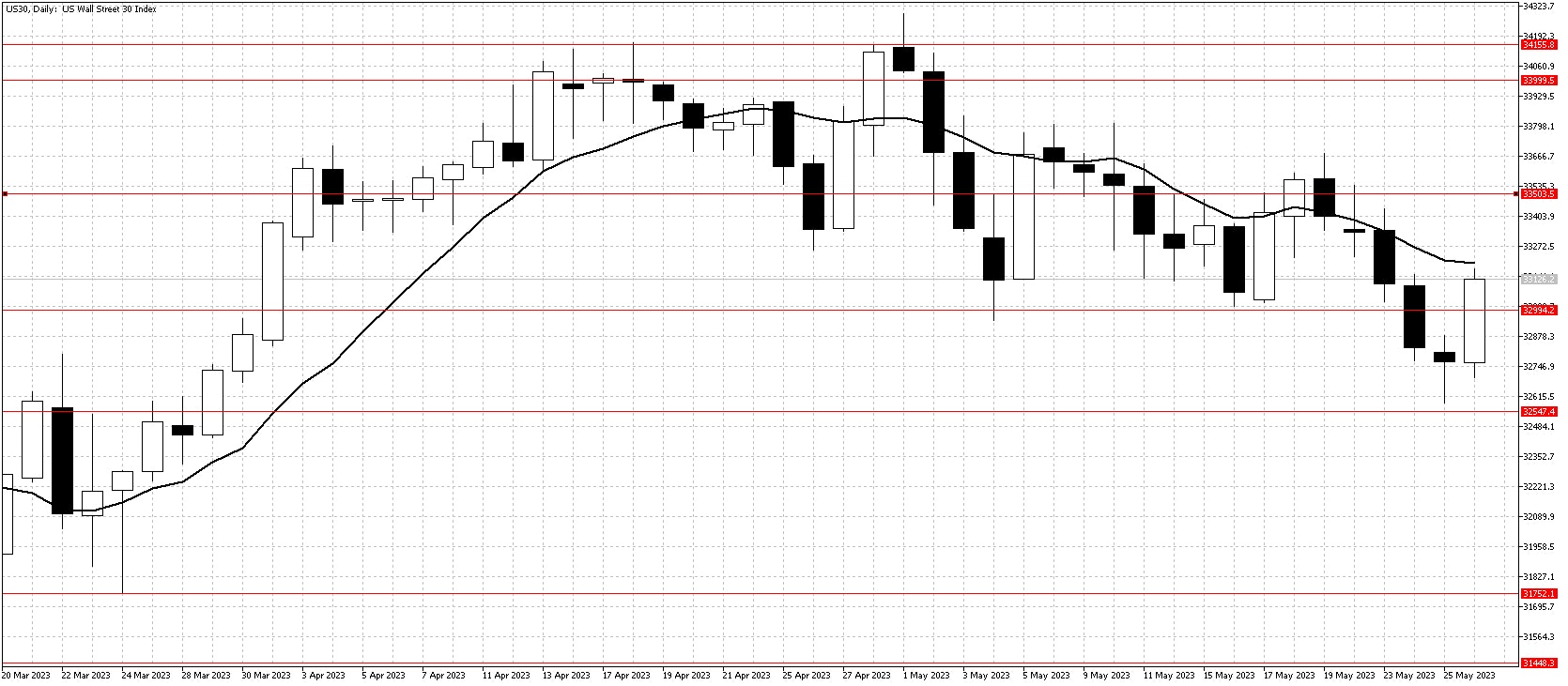

Dow Jones Index

The Dow continued the recent downturn last week, breaking below important support at 33,000 as worries about the US debt ceiling persisted. Progress on negotiations lifted the index back above 33,000 to end the week but failed to break the downtrend as the 10-day moving average points lower. Technology stocks have been rising significantly on AI interest, but few technology stocks are in the Dow index.

Stronger-than-expected inflation and Durable Goods data Friday increased the chance of a US interest rate rise in June to 70%, but debt negotiations remain the market`s focus for now. Monday is a US holiday, and no economic data is released until Friday`s US employment data, so expect a subdued start to the week. In addition, Treasury Secretary Janet Yellen has extended the US debt deadline to June 5, so it will be another week of wait-and-see for the markets.

The recovery back above 33,000 is positive, so there is a potential for a push higher at the start of the week. However, any rise should be limited until the US debt problem is resolved, so looking for short-term selling opportunities remains the best strategy.

Resistance: 33500,34000, 34155, 34500, 35000

Support: 33000, 32550, 31750

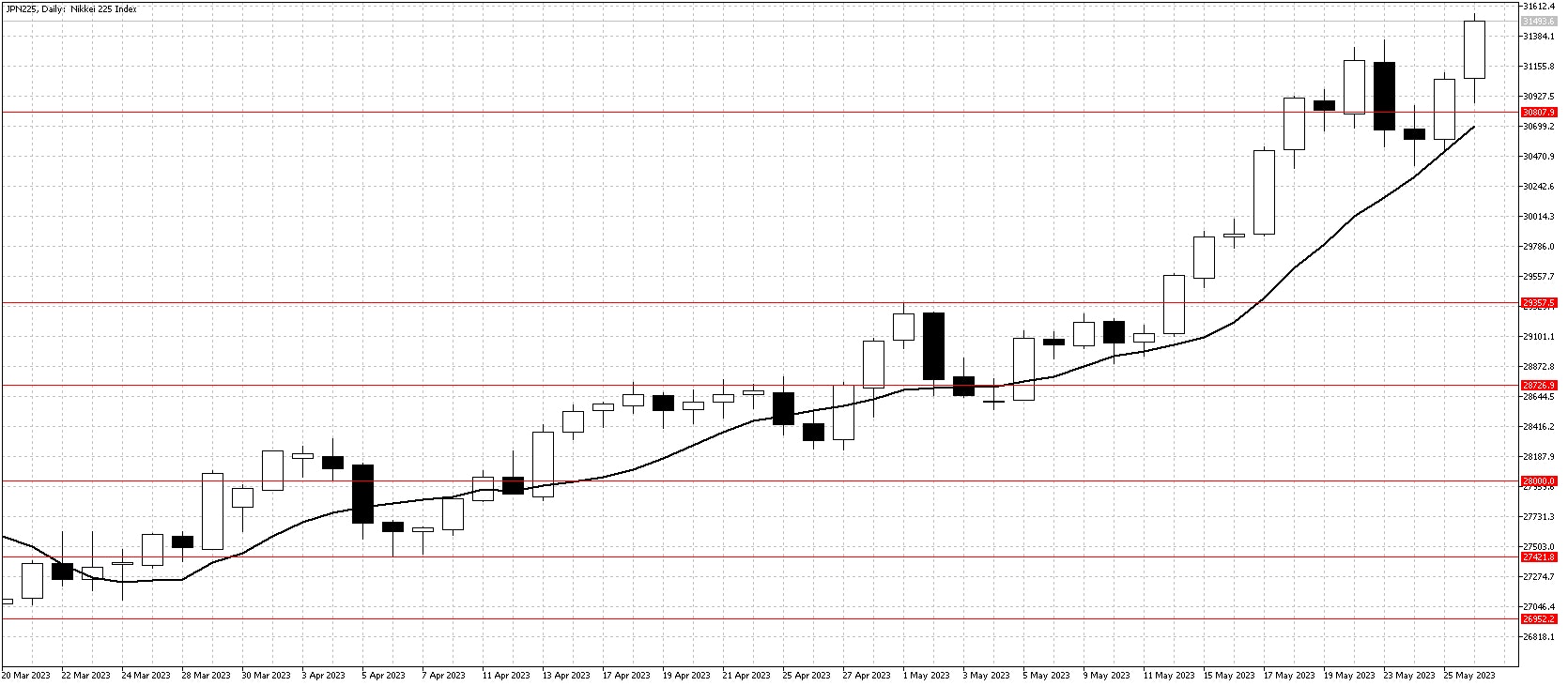

Nikkei 225 Index

The Nikkei index`s textbook upward continued last week. However, expected profit-taking at the start of the week weakened the index as the Dow Jones fell. The higher Nikkei volatility lately presents many more trading opportunities, and numerous traders were waiting for a buying opportunity.

The uptrend quickly resumed as support at the 10-day moving average, and the USDJPY surging above 140.00 saw the index close the week exceptionally strongly. While the Dow Jones index is moving sideways, continued gains on the Nasdaq index are also helping Japanese technology stocks in the Nikkei move higher.

Similar to last week, the Nikkei index will start the week overbought and could attract profit-taking from Japanese investors again. The USDJPY is now looking stronger above 140.00, and as 10-year US interest rates continue to rise toward 4.00% export related Japanese company profits will continue to grow.

Resistance: 32000, 33000

Support: 31000, 30800, 30500, 30000, 29360