Aayush Jindal

Key Highlights

- NZD/USD started an upside correction from 0.6530.

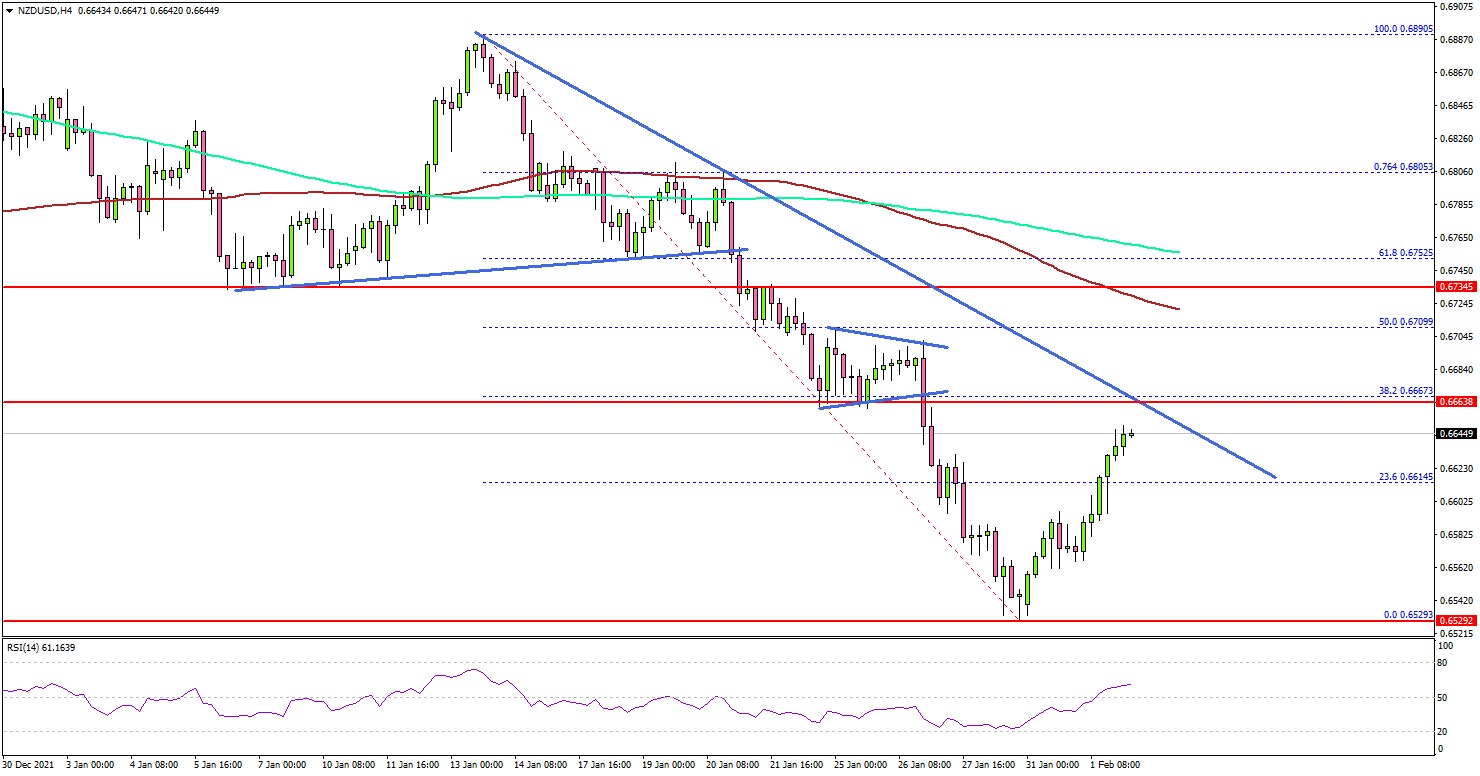

- A major bearish trend line is forming with resistance near 0.6670 on the 4-hours chart.

- EUR/USD and GBP/USD recovered above 1.1250 and 1.3500 respectively.

- The US ISM Manufacturing Index declined from 58.8 (revised) 57.6 in Jan 2022.

NZD/USD Technical Analysis

The New Zealand Dollar declined heavily from well above 0.6850 against the US Dollar. NZD/USD even traded below the 0.6700 support level before the bulls appeared.

Looking at the 4-hours chart, the pair traded as low as 0.6529. There was a close below the 0.6700 pivot level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It is now correcting losses and trading above 0.6580. It even moved above the 23.6% Fib retracement level of the downward move from the 0.6890 swing high to 0.6529 low.

An immediate resistance is near the 0.6640 level. The first major resistance is near the 0.6670 zone. There is also a major bearish trend line forming with resistance near 0.6670 on the same chart. Any more gains could send the pair towards the 50% Fib retracement level of the downward move from the 0.6890 swing high to 0.6529 low at 0.6700.

If there is no upside break above 0.6670, the pair could start another decline. An immediate support is near the 0.6580 level. The next major support is near the 0.6550 level, below which it could test 0.6500.

Fundamentally, the US ISM Manufacturing Index for Jan 2022 was released yesterday by the Institute for Supply Management (ISM). The market was looking for a decline from 58.7 to 57.5 in Jan 2022.

The actual result was mixed, as there was a drop in the US ISM Manufacturing Index to 57.6. The last reading was revised up from 58.7 to 58.8.

Looking at EUR/USD, the pair started a recovery wave above 1.1200 and 1.1250. Similarly, GBP/USD recovered above the 1.3500 resistance zone.

Economic Releases

- Euro Zone CPI for Jan 2022 (YoY) (Prelim) - Forecast +4.4%, versus +5.0% previous.

- Euro Zone Core CPI for Jan 2022 (YoY) (Prelim) - Forecast +1.9%, versus +2.6% previous.