Nick Goold

The Parabolic SAR (Stop and Reverse), developed by J. Welles Wilder Jr., is a versatile tool for identifying potential trend reversals and providing valuable entry and exit signals. In this article, we will delve into the intricacies of the Parabolic SAR indicator, understand its calculations, explore its interpretation, and discuss its practical application in trading.

Understanding the Parabolic SAR Indicator

The Parabolic SAR is a trend-following indicator highlighting potential price movement reversal points. It consists of dots plotted above or below the price chart, representing possible stop-and-reverse points. The Parabolic SAR dynamically adjusts its position based on price action, making it particularly useful in trending markets.

Calculation of the Parabolic SAR:

The Parabolic SAR calculation involves two main factors: the acceleration factor (AF) and the extreme point (EP).

Initial Calculation: The first Parabolic SAR value is the closest point to the price prior to the start of the trend. This initial value is used as the baseline for subsequent calculations.

Acceleration Factor (AF): The AF determines the rate at which the Parabolic SAR dots converge toward the price. It starts at a predetermined value (often 0.02) and increases incrementally (typically 0.02) each time a new extreme point is established, with a maximum cap (usually 0.20). The AF amplifies as the trend persists, making the Parabolic SAR more sensitive to price changes.

Extreme Point (EP): The EP is the highest or lowest price observed during the current trend, depending on whether the trend is bullish or bearish. The EP is updated as new price highs or lows occur.

Interpreting the Parabolic SAR:

The Parabolic SAR provides traders with key insights into trend direction, potential reversal points, and entry and exit signals. Here are the primary considerations when interpreting the Parabolic SAR:

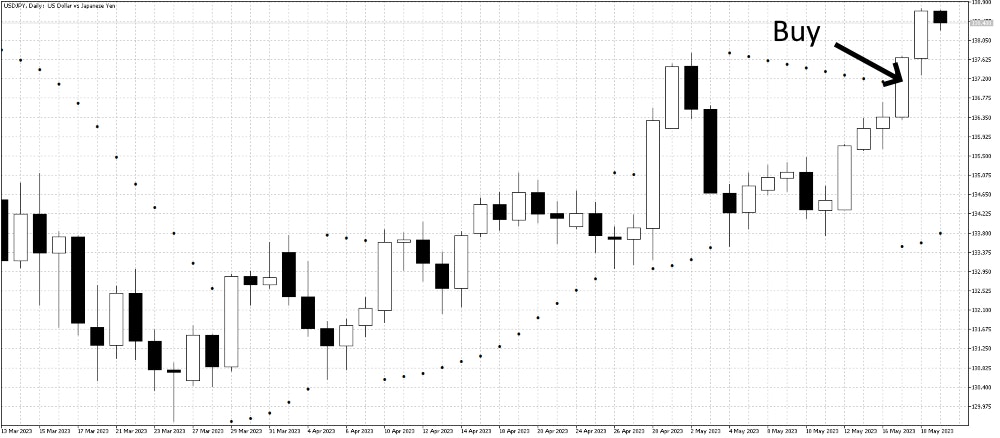

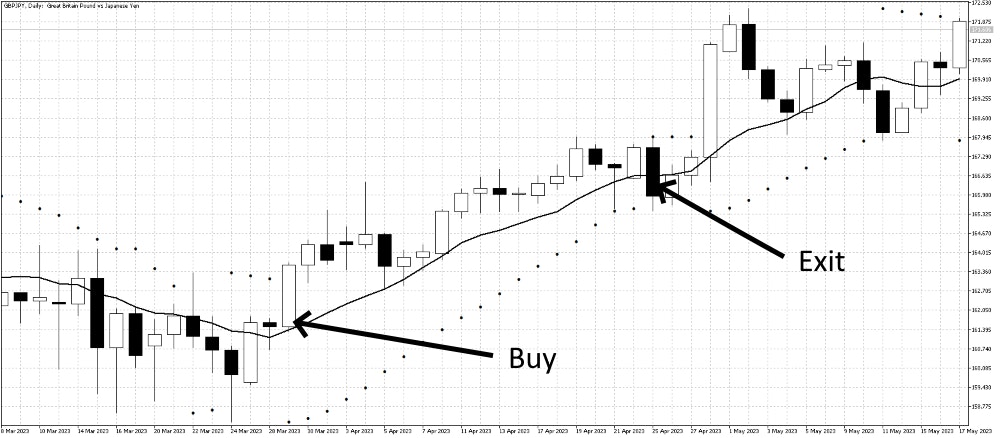

Trend Identification: The Parabolic SAR dots plotted above the price indicate a downtrend, while dots below the price suggest an uptrend. The proximity of the dots to the price reflects the trend's strength. Wide gaps between the dots and price indicate a strong trend, whereas closer proximity implies a weakening trend.

Reversal Signals: The Parabolic SAR dots flipping from one side of the price to the other signal a potential trend reversal. When the dots shift from below to above the price, it suggests a bullish reversal. Conversely, a shift from above to below the price indicates a bearish reversal. These reversal signals can be used to exit existing positions or initiate new trades in the opposite direction.

Entry and Exit Points: Traders can utilize the Parabolic SAR dots as potential entry and exit points. In an uptrend, traders may consider entering long positions when the price exceeds the Parabolic SAR dots. Similarly, traders may consider entering short positions in a downtrend when the price crosses below the Parabolic SAR dots. For exit signals, traders can use the Parabolic SAR dots as trailing stop levels, moving their stop-loss orders to the most recent dot position as the trend progresses.

Practical Application in Trading:

The Parabolic SAR is used in various trading strategies and timeframes. Here are some practical applications:

Trend-Following Strategies: Traders can employ the Parabolic SAR to identify and trade with the prevailing trend. When the dots are consistently below the price, indicating an uptrend, traders can focus on long positions. Conversely, traders can focus on short positions when the dots are consistently above the price, indicating a downtrend. This approach allows traders to align themselves with the market momentum and capture substantial gains during extended trends.

Reversal Strategies: The Parabolic SAR also effectively identifies potential trend reversals. Traders can use the reversal signals generated by the dots flipping from one side of the price to the other as an indication to exit existing positions or initiate counter-trend trades. This strategy can be particularly valuable in capturing early reversals and benefiting from price corrections or trend reversals.

Trailing Stop Loss: The Parabolic SAR can serve as a dynamic trailing stop-loss mechanism. As the dots adjust their position based on price action, traders can move their stop-loss orders to the most recent dot position. This technique allows traders to lock in profits as the trend progresses, giving the trade room to breathe and potentially capturing additional gains.

Confirmation with Other Indicators: To increase the accuracy of trade signals, traders often combine the Parabolic SAR with other technical indicators. For example, traders may use the Parabolic SAR with trend-following indicators like moving averages or oscillators like the Relative Strength Index (RSI) to validate trade entries or exits. The confluence of signals from multiple indicators can provide a stronger basis for decision-making.

Multiple Timeframe Analysis: The Parabolic SAR can be applied across different timeframes to gain a broader perspective on trend direction and potential trade opportunities. Traders can use a higher timeframe to identify the primary trend and a lower timeframe to fine-tune their entries and exits. This approach allows for a comprehensive analysis of the market dynamics and improves overall trading performance.

Conclusion

The Parabolic SAR indicator is a powerful tool for trend identification and trade management. Its ability to adjust its position based on price action dynamically makes it particularly useful in trending markets. By effectively interpreting the Parabolic SAR dots and integrating them into trading strategies, traders can benefit from trend-following trades, identify potential reversals, and implement effective risk management techniques.

However, like any technical indicator, the Parabolic SAR is not infallible and should not be used in isolation. Therefore, it is crucial to consider other market factors, perform a thorough analysis, and use the Parabolic SAR with other indicators or trading tools for confirmation. Additionally, traders should always practice risk management and adhere to their trading plans to achieve consistent and profitable results.

As with any trading tool, testing and familiarizing oneself with the Parabolic SAR through backtesting and demo trading before applying it to live trading is recommended. Testing allows traders to gain confidence in its usage, understand its strengths and limitations, and optimize its parameters for their specific trading style.

In conclusion, the Parabolic SAR indicator is valuable for traders seeking to identify trends and manage trades effectively. By harnessing its power and integrating it into a well-rounded trading strategy, traders can make more informed decisions and potentially increase their chances of achieving consistent profits trading forex.