Nick Goold

Due to lower liquidity and volatility compared to the European and US sessions trading forex during the Asian timezone can be challenging. The best forex pairs to trade during the Asian session are USDJPY and AUDJPY, as they have narrow spreads and high volatility. GBPJPY and EURJPY occasionally present trading opportunities but only some days.

While news releases are rare during the Asian session, it is essential to be aware of the economic calendar and monitor any scheduled news releases that could affect your positions. Recently the most important news events have been monetary policy announcements from the central banks of Japan and Australia. Regarding economic data releases, Chinese data is the most important as China is the second largest economy in the world.

Below is a list of potential strategies you can use during the Asian session to trade forex.

Tokyo open trend following

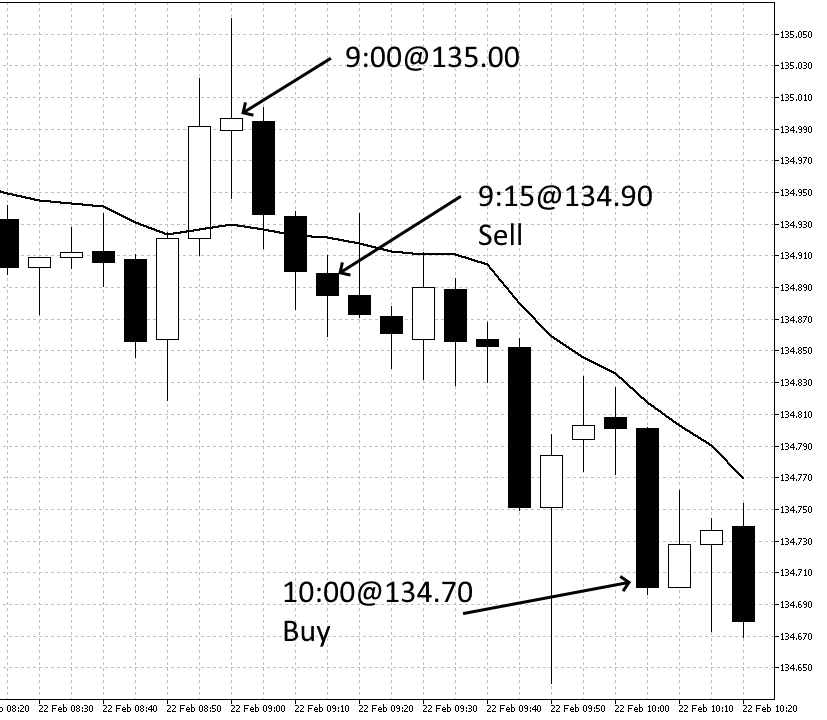

Between 9 am and 10 am, Tokyo time is usually the most volatile time for the USDJPY and other forex pairs during the Asian session. Short-term traders can succeed in following the trend in the first 15 minutes, which can last until 10 am or longer.

Analyzing the overnight move

Traders' views in the Asian session can differ from those in different time zones. Therefore, analyzing how moves after the close of the Asian session impact the Asian session open profitable trading patterns can be found.

For instance, Asian-based traders might be favorable to buying the USDJPY. Should the USDJPY be lower today compared to yesterday's Asian close, the USDJPY is more likely to rise during the Asian session.

Reversal over Japanese lunchtime

Should the USDJPY enjoy a significant move in the morning, there will likely be a reversal between 12:00 and 12:30 when the Japanese stock market is closed. The reversal move happens as some traders look to take profits on trades from the morning and reduce their risk.

This strategy can have a high win rate, but it is difficult to make large profits on each trade due to the low volatility over this time period. It won't be easy to achieve more than 5 to 10 pips profits in normal trading conditions, so it is best to use a stop loss of fewer than 5 pips.

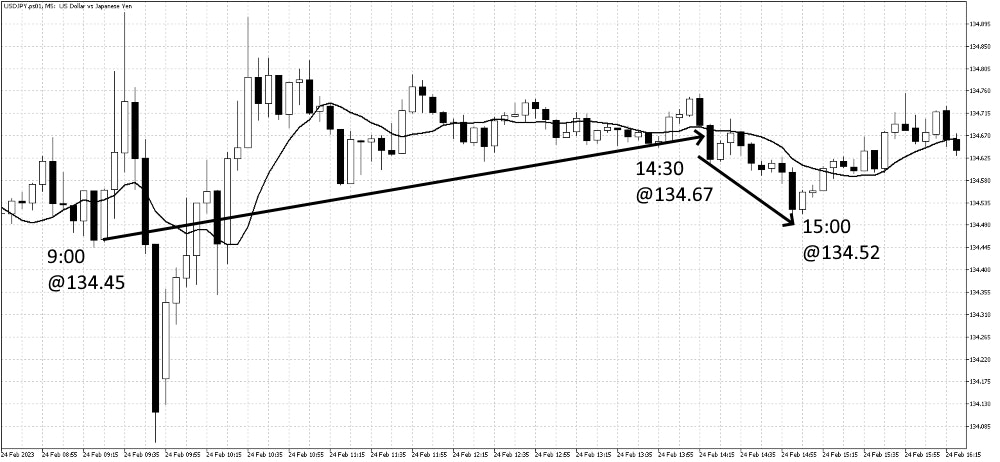

Reversal on Japanese equity close

Similar to the lunchtime reversal pattern, the USDJPY can reverse the day's move into the close of the Japanese stock market around 3 pm. This move happens due to profit-taking and early European and UK-based traders taking early positions before their market opens.

Stop hunting

Due to the low liquidity in the Asian session, large traders will look to trigger stops through push above resistance or below support. Stops are more likely to be activated before 9 am Tokyo when the market is quiet and on market holidays when the forex market is still open.

There are two ways to trade a stop-hunting strategy.

Look for stops

This strategy involves buying before resistance or selling before support in the hope that stop-loss orders are triggered, resulting in a quick trend move. Important support or resistance levels are more likely to lead to a large move. Popular places for traders to place their stop loss levels are above yesterday's high or below yesterday's low.

Look for reversal follow stops

Most of the time, once the stop orders are filled, the market will reverse in the other direction presenting a trading opportunity. This strategy has a high win percentage. When the strategy makes losses, they can be large, so traders need to have a high level of discipline and not chase their losses.

Swing traders

While swing traders will find few trading opportunities during the Asian session, they can be very profitable compared to the rest of the day. This is because the Asian session can sometimes reverse the overall trend and allow traders the opportunity to enter at favorable entry points. Also, news from the Bank of Japan can start a long-term trend, so swing traders should be ready to trade during the Asian session.

Trading during the Asian timezone requires a different approach than other trading sessions. Most of the better trading opportunities are range trading. However, it is vital to control your losses when the market enters a strong trend, as the market can move more than expected.