Nick Goold

If you can make an entry using support and resistance, you can find more trades with a high-risk reward (profit greater than loss). This article explains how to find entry points using support and resistance.

There are four main strategies when using support and resistance. Although there are four strategies, it is not necessary to use all of them. Some traders prefer trend trading, while others are more comfortable with range trading. Your trading performance will be better if you specialize in a limited number of strategies.

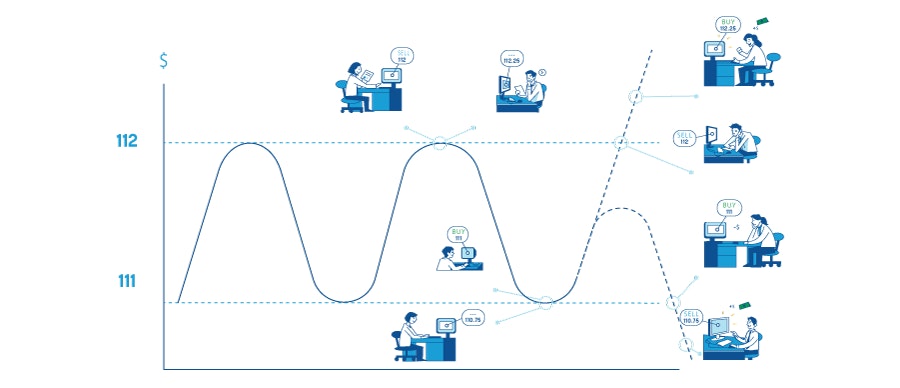

Strategy 1: Buy at support/Sell at resistance

The most common use of support resistance is to buy near support and sell near resistance. This strategy is effective in a range markets, and there is no news to disrupt the market. For traders who can cut their losses, this entry strategy allows for a high winning rate and consistent profits.

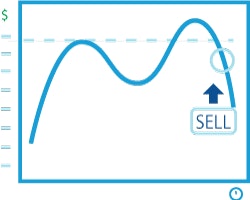

Strategy 2: Buy above resistance/Sell below support

A trading strategy trend followers. While the win percentage for this strategy can be below 50%, profits can be much larger than losses. This strategy is for high-volatility markets, as the probability of the market trending is higher. Following a news event, there is a higher chance of this strategy being profitable.

A popular trend trading strategy. Although the win rate can be less than 50%, it can yield profits much bigger than losses. This strategy works best in high volatility conditions when the market is likely to trend. Following a news release, this strategy also offers a higher probability of success.

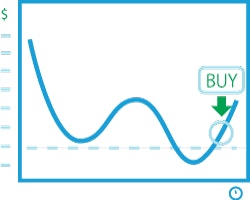

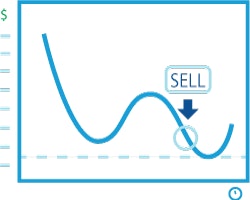

Strategy 3: Buy false support break/Sell false resistance break

Many professional traders use this strategy. When the market breaks below support, many traders enter the market with a sell entry. However, if the market moves back above support, the trader who sold will have an unrealized loss and will have to buy back to minimize the loss. The move back above support signals range traders to take a long position and drive the price higher.

A failed move above resistance is a good selling opportunity once the market moves back below resistance.

This strategy does not happen often, but it is the most consistently profitable way to trade support and resistance.

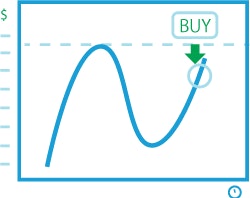

Strategy 4: Sell ahead of support/Buy ahead of resistance

A strong trending market will likely continue to move in one direction until reaching support or resistance. Professional traders look for other traders' stop orders (stop losses) by selling before the support level and buying before the resistance level. This strategy provides trading opportunities with a high-risk reward (more profit than loss).

When selling, set the target below support. If the trend is strong, the market will break below support to extend profits. Conversely, if the market stops falling once support is touched, you can exit with a smaller profit.

In this article, we have presented four entry points using support resistance. The first step in deciding which strategy to use is to analyse whether the market is in a range or a trend. Once you know the market conditions, you can choose the best entry point for the current market.