Nick Goold

Technical analysis

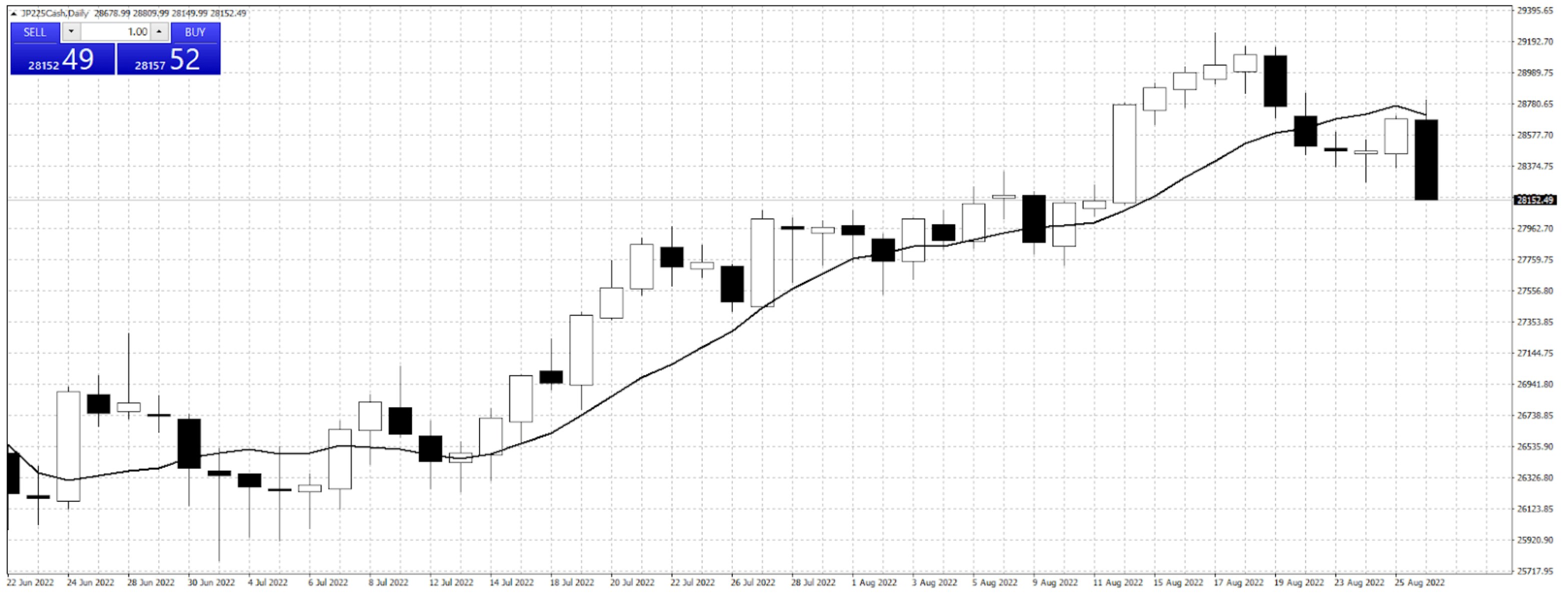

Titan’s JPN225 rebate offer ends Wednesday this week as a busy month of trading concludes. The Nikkei broke its recent uptrend last Monday after the market closed below the 10-day moving average. As discussed in last week's report the market had the potential for weakness as worries about higher US interest rates increased selling pressure.

The weaker yen limited the losses during the middle of the week as the market awaited an important speech by Fed chairman Powell. Powell’s indicated that the Fed will be aggressive in raising official interest rates to fight inflation which surprised the market. The Dow Jones dropped 1,000 points on the news and the Nikkei followed lower.

The Yen is still weak and this trend should continue which is positive for the Nikkei this week. In the medium term equities look likely to continue the downtrend which started last week. In the short term, the Nikkei has a large gap from the 10 moving average so expecting sideways to higher price action this week.

Daily Nikkei 225 with 10 day moving average

When the market moves a long way from a moving average there is a high likelihood the market will return close to the moving average. It is important to understand the news in the market and trade a range trading strategy only when there is no major news.

Resistance:28750, 29000, 29250, 29400, 30000

Support:27500, 27000, 26000, 25500, 25000

Nikkei 225: Fundamental verses technical analysis

Many traders are confused about whether to use fundamental or technical analysis when trading. Traders need a clear trading strategy to be successful.

To decide whether to use fundamental or technical analysis you need to decide whether you are a short-term or long-term trader. Technical analysis is more important when short-term trading where traders enter and exit trades during the same day. When long-term trading, fundamental analysis should be used more to make profits trading the Nikkei 225.

Regardless of which trading strategy you use it is important to use both fundamental and technical analysis. A short-term trader might use Bollinger bands to find range trading opportunities but the trader should understand the importance of economic announcements which might result in a strong trend. A longer-term trader can use technical analysis to improve their entry timing so they can make larger profits from their fundamental analysis.