Nick Goold

Dow Jones index

A week of bad news for the US equities saw the Dow Jones index close below the lows from December 2022. The market started the week positively as investors hoped to build on gains from the previous week. However, the positivity was short-lived. The first bearish news was the speech by Fed chairman Powell indicating high-interest rates will be required to control inflation. The following bad news was liquidity problems at the Silicon Valley Bank, which the Government will now take over. Finally, the US job report was better than expected but had little impact on the market.

This week there are many important economic releases in the US, with inflation and retail sales data the highlights. However, the US banking sector will be the focus as the market looks for further problems at other banks. While most analysts do not expect similar problems like 2008, there is always a risk of further issues if confidence falls.

Technically the Dow Jones index looks bearish in the medium term now. The rise in the index from Oct 2022 to Nov 2022 could easily be reversed in the coming weeks. While the market is oversold, it has just broken its 32500/34500 range, so unless this week`s inflation figures are below expectation, we expect lower levels this week.

Resistance: 32500, 33000, 33500, 34000, 34500, 35000, 35500, 36000

Support: 31725, 31000, 30500, 30000

Nikkei 225 index

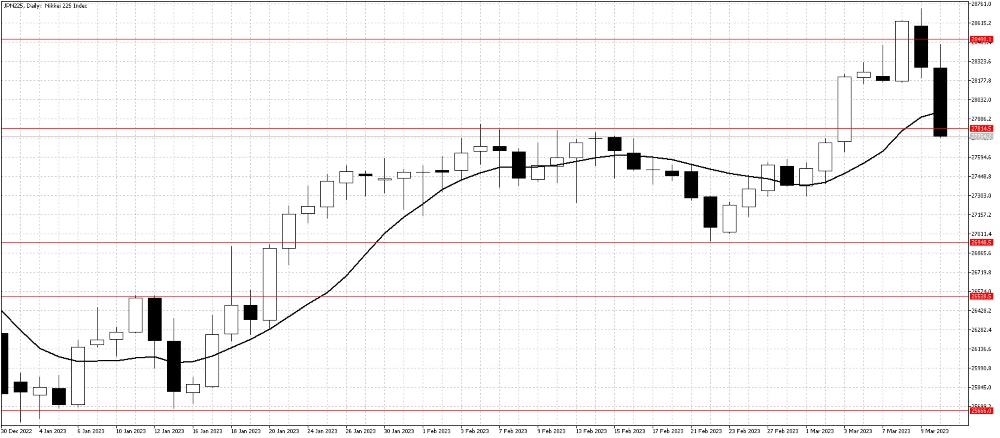

The Nikkei 225 index surged to a six-month high at the start of the week, helped by continued supportive monetary policy from the Bank of Japan. In addition, confidence in the Japanese economy continues to rise as tourism flourishes. As a result, many analysts are increasing their forecasts for the Nikkei index in 2023.

Problems with the US banking sector saw the USDJPY fall significantly Friday, and US equity values saw the Nikkei fall back considerably to end the week. It is difficult to know whether last week`s problems in the US are short-term or will last longer, but the Nikkei index outlook remains positive. Expect range trading conditions this week as the market closely watches US economic data and developments in the US banking system.

Resistance: 28500, 29000, 29250

Support: 27500, 27000, 26250, 25500, 25000, 24500