Paula Rodriguez

When facing trading failure, highlight the mistake and focus on the opportunity to reevaluate and optimize

Reevaluating trading failure is an indispensable practice for career growth. In any kind of business, everyone aims to succeed and concentrate on profit. But to thrive as a forex trader, the best strategy for success is to not just focus on the wins but also recognize and reevaluate the losses.“Failure is a compass for intelligent planning and decision-making that can sharpen the skills of managers, policymakers and everyone involved in the daily challenge of getting from point A to point B.” -The Logic Of Failure: Recognizing And Avoiding Error In Complex Situations by Dietrich DornerNot all forex traders perform without failure. During the first few months or years of trading, statistics show that there is a high percentage of losses for both fulltime and part time traders. The success rate of a forex trader will depend on overall trading strategy, forex education and level of performance. Depending on your current trading strategy, the risk reward ratio for profit varies with each execution. What remains the same is the chances of trading failure.

To better understand the logic of reevaluating failure, try to analyze the mindset of becoming an honor student. For some students, passing an exam is enough. With this attitude of avoiding failure, the immediate goal in mind is to answer 60 percent of a test correctly in order to get a passing mark. This kind of thinking will only get you 60 percent ahead. For a grade A student, the path to becoming successful in class is different. With a goal for high achievement, the process does not involve shortcuts or simply studying enough to pass. The objective is to get all answers correctly instead of simply avoiding a failing mark.To consistently earn from forex trading, you should not ignore your losses but learn from it instead. Like an honor student, traders should not just perform well enough to avoid trading failure. For more profit and better performance, aim for success and educate yourself from both wins and failures.

To better understand the logic of reevaluating failure, try to analyze the mindset of becoming an honor student. For some students, passing an exam is enough. With this attitude of avoiding failure, the immediate goal in mind is to answer 60 percent of a test correctly in order to get a passing mark. This kind of thinking will only get you 60 percent ahead. For a grade A student, the path to becoming successful in class is different. With a goal for high achievement, the process does not involve shortcuts or simply studying enough to pass. The objective is to get all answers correctly instead of simply avoiding a failing mark.To consistently earn from forex trading, you should not ignore your losses but learn from it instead. Like an honor student, traders should not just perform well enough to avoid trading failure. For more profit and better performance, aim for success and educate yourself from both wins and failures.Why recurring trading failure happens

Insufficient practice and experience

Trading failure can simply come from lack of experience. This happens when you get right into trading while still lacking confidence or a reliable strategy. Without having the right timeframe for learning or practicing, any forex trader can become susceptible to monetary losses. Before starting your new career in trading or executing a new strategy, practice and master your skills beforehand.No solid troubleshooting scheme

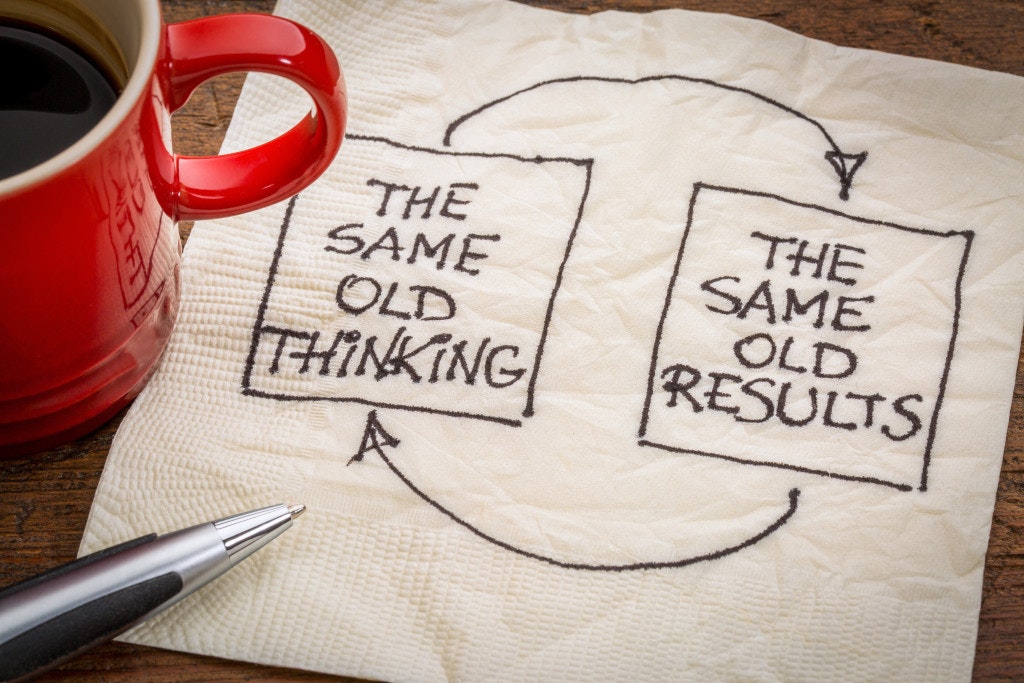

The challenges of forex trading is inevitable and can come unexpectedly. During sudden market changes, successful traders are not only disciplined but are also very much prepared. Even when following a strict trading scheme, there will be situations where you will need to improve your strategy after losses. With a troubleshooting scheme, you can overcome any unforeseen challenges and minimize trading failure.Unchallenged mental habit

Overgeneralizing, narrow mindedness or complacency may provoke an unchallenged mindset. Common to business executives or owners, constant failure is caused by habits that “go unpunished”. Sometimes the decisions made in a trading career come from ingrained habits that lead to recurring losses. Make sure you keep evolving by working harder and smarter. Before choosing the familiar decision, test out better ways to approach a challenge.Lack of revisions and reviews

Recurring failure happens when you experience losses and avoid analysing what got you there. Some traders might resort to blaming market conditions and other problems beyond their control. But despite any disagreeable scenario, it is important to be open minded and thorough in inspecting your current approach. The lack of modifying and reevaluating failure will eventually lead to having an inefficient strategy. Because of this, it is vital to trace your steps and review your thought process during that losing trade.Compartmentalizing of losses

The natural reaction to accepting losses is similar to the instinct of escaping danger. When dealing with any kind of trading failure, most will want to quickly address the loss and try to do better next time. When a forex trader avoids failure, this leads to compartmentalizing emotions and taking failure personally. The emotional investment from forex trading comes from managing mental wellness in regards to losing personal capital. Without moving on, you pass up the chance to learn. This can lead to making the same mistake again.Best reasons to reexamine trading failures

To minimize cost

There are hidden costs behind every loss. Because of this, one of the best reasons for reevaluating trading failure is the monetary setbacks. The substantial damage of trading failure is seen in the hidden costs which can continue to increase without any action plan. If you do not address the reasons behind any losses, you will continue to repeat the mistake as well as increase the costs.What to do: Acknowledge the weak points of your trading scheme. If you want to eliminate the costs of trading failure, reevaluate and optimize your current strategy. This will prevent further setbacks and increase profit instead of losses.To develop better emotional intelligence

Emotional intelligence is the capability to understand and manage emotions while going through several kinds of circumstances. Though everyone has different personalities, all forex traders have the similar goal to succeed in the industry. High emotional intelligence has statistically shown better coping skills and stronger mental wellbeing. In forex trading, developing emotional intelligence assists in dealing with conflict, frustration and decision making.What to do: Practice facing failure and ensure you learn from it. Master the way you deal with your emotions especially during difficult situations. To learn more on how to enhance emotional intelligence, check out Norman Rosenthal’s 10 ways to enhance emotional intelligence.To optimize trading and personal habits

If you find yourself consistently experiencing trading failure, take a look at your trading habits as well as personal behaviour.According to American psychologist Daniel Goleman, the self-defeating work habits come from emotional patterns and the habitual reactions that were triggered in a negative situation. Although traders strive to earn profit from every execution, sometimes a destructive habit can lead to trading failure.What to do: Recognize your personal deficiencies when trading. After doing this, analyze the triggers. Trading failure has its undesirable outcomes. But the lessons learned are valuable for optimized trading performance and better personal habits.Most effective way to face trading failure

The natural response to defeat is avoidance and quick recovery. With monetary risks involved, the instinct to stay away from misfortune and trading failure is typical for forex traders within all skill levels. The most effective way to deal with trading failure is to build stronger mental wellbeing. Mental wellbeing contributes to the way a trader deals with challenges and failures. Approaching extreme losses require proper management of emotions especially in a forex trading career.To start, here are top 5 ways to build stronger mental wellbeing to avoid trading failure:- Take notice of your emotions and current mental health

- Actively challenge your thought process and practice controlling your emotions

- Implement a more active lifestyle as well as better nutrition

- Connect and share your thoughts with fellow forex traders

- Make time for rest and relaxation to lower stress levels