Nick Goold

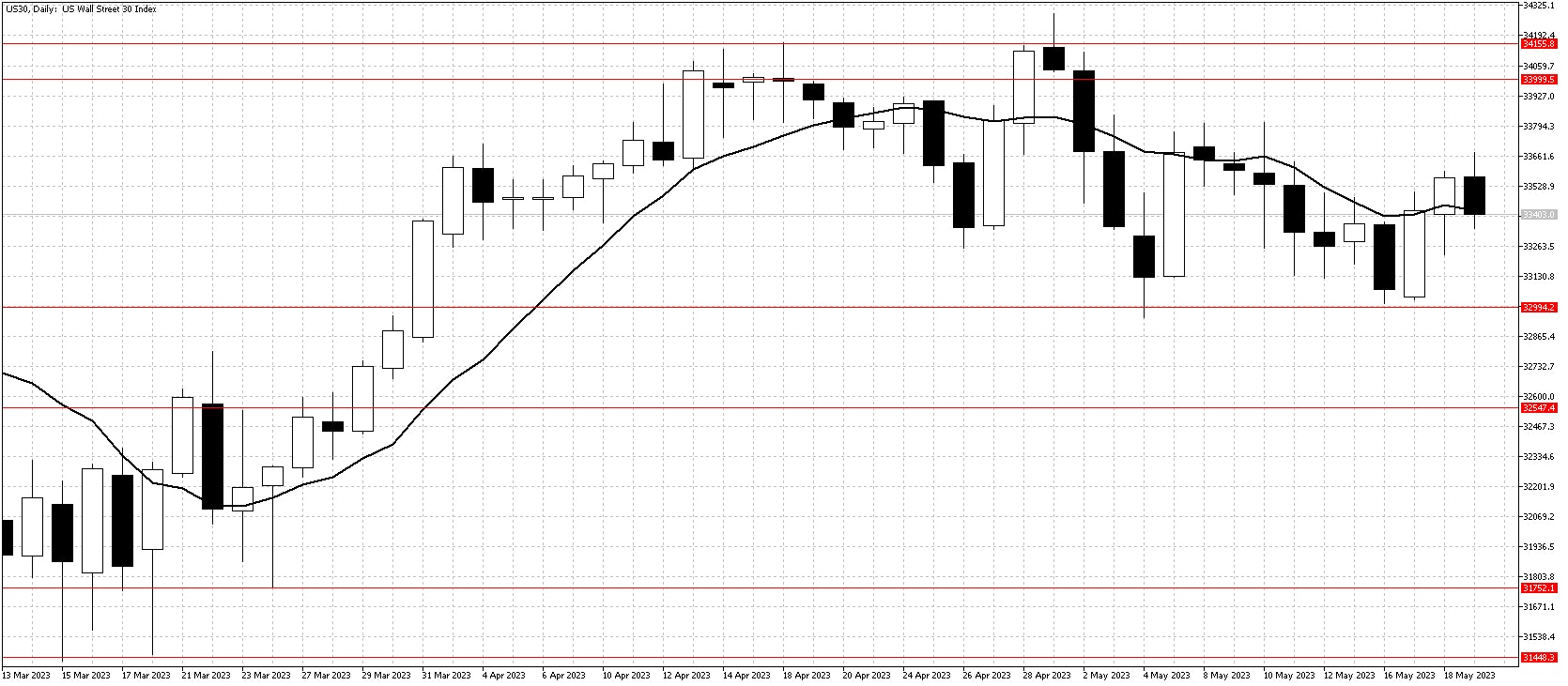

Dow Jones Index

The Dow Jones started the week under pressure as worries about the US debt situation continued. Also, US Retail Sales data was weaker than expected, which saw the market fall to the critical 33,000 support level. However, the market remained quiet, so buyers managed to turn momentum and support held.

Signs that a deal to end the US debt ceiling problem was getting closer saw the market rebound midweek, moving back above the 10-day moving average. In addition, the speech from Fed Chairman Powell was viewed positively for the stock as policy rates might not need to rise as high as the market expected.

The week ahead sees the range conditions likely to continue, with the news stories to watch being the Fed meeting minutes and US Durable Goods data at the end of the week. While support held at 33,000, the worries about the US debt situation remain, and without an agreement, there is more pressure on the stock market to fall. As a result, current conditions are attractive for range traders, and trend traders should wait for conditions to change rather than pick the next significant market move.

Resistance: 34000, 34155, 34500, 35000

Support: 33000, 32550, 31750

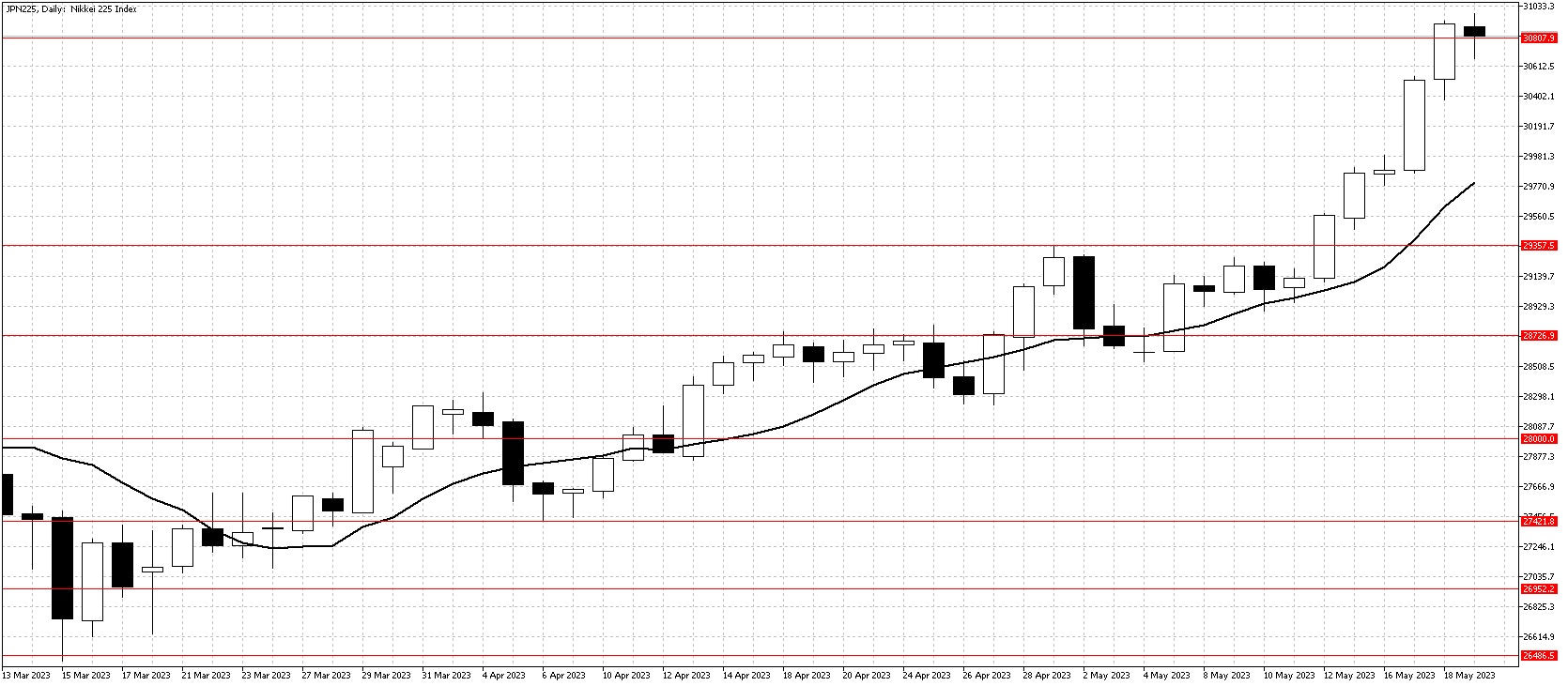

Nikkei 225 Index

The Nikkei index recorded its sixth straight week of gains surpassing the highs from 2021 to return to levels not seen in 33 years. Analysts pointed to corporate governance reforms and continued loose monetary policy encouraging large buying from overseas investors.

The USDJPY recorded large gains on the widening gap between US and Japanese interest rates, which equity investors closely watch. As a result, the USDJPY in the medium term looks likely to continue higher but in the short term is overbought.

While analysts are increasingly bullish, and the trend looks likely to continue in the medium term, the market is overbought in the short term. While going short is dangerous, a move below the 2021 highs could trigger profit-taking and a short-term opportunity to sell. For those looking to join the uptrend, it is better to wait for a return closer to 30,000 and look for buying opportunities.

Resistance: 31000, 32000

Support: 30800, 30000, 29360, 28725, 28000, 27425, 26950, 26500