Nick Goold

Successful trading in the forex market requires a comprehensive understanding of various strategies and techniques that can help maximize profits and manage risks effectively. One such strategy that experienced traders employs is the scaling-in and scaling-out strategy. This approach allows traders to gradually enter and exit positions, providing flexibility and adaptability to market conditions. This article will detail the scaling-in and scaling-out strategy, its benefits, and how to implement it in your forex trading endeavors.

Understanding the Scaling-In Strategy:

The scaling-in strategy, also known as pyramiding, involves gradually adding to an existing position as the trade moves in the desired direction. Instead of entering a full position all at once, traders initiate smaller positions initially and increase their exposure as the trade proves profitable. This strategy allows traders to capitalize on favorable price movements and build larger positions while managing risk effectively.

Advantages of the Scaling-In Strategy:

Risk Management: Scaling-in helps manage risk by reducing exposure during the initial stages of a trade. By entering smaller positions, traders limit their potential losses if the trade goes against them. If the trade moves favorably, further positions can be added to increase potential profits while keeping risk under control.

Confidence Building: The scaling-in strategy provides an opportunity for traders to build confidence in their trade analysis. By initiating a small position initially and confirming the trade's viability through favorable price movements, traders can gain conviction and increase their position size accordingly.

Optimizing Profit Potential: Scaling-in allows traders to maximize their profit potential by adding positions as the trade progresses. By gradually increasing exposure, traders can effectively capture more significant price movements and ride trends.

Understanding the Scaling-Out Strategy:

The scaling-out strategy systematically reduces the position size as the trade moves in the desired direction. Instead of closing the entire position at once, traders exit partial positions at predefined price levels or based on specific indicators. This strategy enables traders to secure profits while allowing a portion of the trade to run, aiming for further gains.

_dlkii.png?fm=pjpg&auto=format)

Advantages of the Scaling-Out Strategy:

Profit Protection: Scaling-out allows traders to secure profits by taking partial profits at predetermined levels. This strategy helps protect gains and reduces the risk of potential reversals or market volatility eroding profits. Traders can lock in profits while still maintaining exposure to the market.

Flexibility and Adaptability: Scaling-out provides flexibility to traders, allowing them to adjust their position size based on market conditions. By partially exiting positions, traders can respond to changing market dynamics and adjust their risk exposure accordingly.

Reduces Stress: Trying to pick the best exit point is stressful, so spreading your exit point reduces the chance of missed profits and can help produce more consistent profits.

Implementing the Scaling-In and Scaling-Out Strategy:

To effectively implement the scaling-in and scaling-out strategy in your forex trading, consider the following steps:

Trade Analysis: Identify potential support and resistance levels where prices could reverse, which would present good exit points.

Position Sizing: Determine an appropriate initial position size based on your risk management parameters. It should be small enough to limit potential losses if the trade moves against you.

Scaling-In: As the trade moves in the desired direction and validates your analysis, consider adding to your position gradually. Identify specific price levels or technical indicators that signal favorable conditions for scaling in. It is easier to add the same lot size as the initial position. For example, if you buy one lot initially, you could buy another lot twice as the market rises.

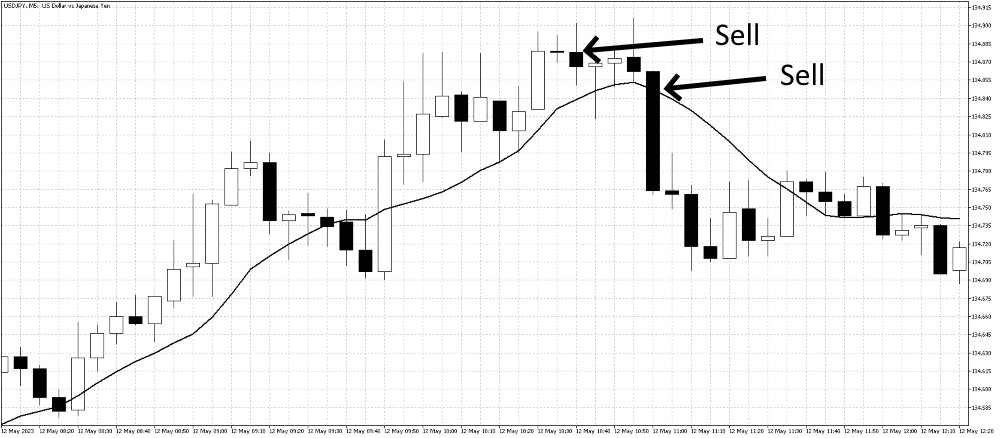

Scaling-Out: Once the trade starts generating profits, determine predefined price levels or indicators at which you will exit partial positions. Consider taking profits at key resistance levels, Fibonacci retracement levels, or when specific technical indicators suggest potential reversals.

Risk Management: Monitor and adjust your stop-loss orders as the trade progresses. Using a trailing stop to reduce your risk is beneficial for most positions.

Adaptation and Evaluation: Regularly review and evaluate your trades to assess the effectiveness of your scaling-in and scaling-out strategy. Analyze the outcome of each trade, including the timing and size of position additions and the levels at which you scaled out. This evaluation will help you refine your strategy and make any necessary adjustments for future trades.

Tips for Successful Scaling-In and Scaling-Out:

Patience and Discipline: Exercise patience and discipline when implementing the scaling-in and scaling-out strategy. Avoid the temptation to rush into large positions or exit prematurely. Stick to your predefined plan and let the trade develop according to your analysis.

Technical Analysis: Utilize technical analysis tools such as trend lines, moving averages, and oscillators to identify potential entry and exit points for scaling in and scaling out. Combine technical analysis with fundamental analysis to increase the probability of successful trades.

Risk-Reward Ratio: Maintain a favorable risk-reward ratio for each position you add or exit. Ensure that the potential reward justifies the risk taken at each stage of the trade. Your profit target should be at least double your stop loss.

Market Conditions: Consider the prevailing market conditions and volatility when implementing the scaling-in and scaling-out strategy. Adjust your position sizes and exit levels accordingly, as higher volatility may require more conservative position additions and partial exits.

Backtesting and Practice: Before implementing the scaling-in and scaling-out strategy in live trading, practice it using historical data and backtesting. This will help you gain familiarity with the strategy, identify potential pitfalls, and refine your approach.

Conclusion:

The scaling-in and scaling-out strategy gives traders a dynamic and adaptable approach to forex trading. By gradually entering and exiting positions, traders can effectively manage risk, optimize profit potential, and adapt to changing market conditions. However, successfully implementing this strategy requires careful analysis, disciplined execution, and continuous evaluation of trades. With practice and experience, traders can master the art of scaling in and scaling out, enhancing their chances of success in the forex market.