Nick Goold

Are you able to trade in line with price movements?

Failure to do this correctly can be one of the major causes of trading losses.

Let's take a closer look at what it means to adapt to price movements.

Differences between novice and professional traders

Many novice traders enter trades as soon as they see an opportunity, without a trading plan. Professional traders, on the other hand, plan carefully, taking advantage of such novice behaviour and checking the situation before entering.

Professional traders patiently time their entries, but it can still be difficult to time it perfectly. If the timing isn't right, a good trader will decide it's not the right time to trade and wait for the next opportunity. Never rush into the next trade.

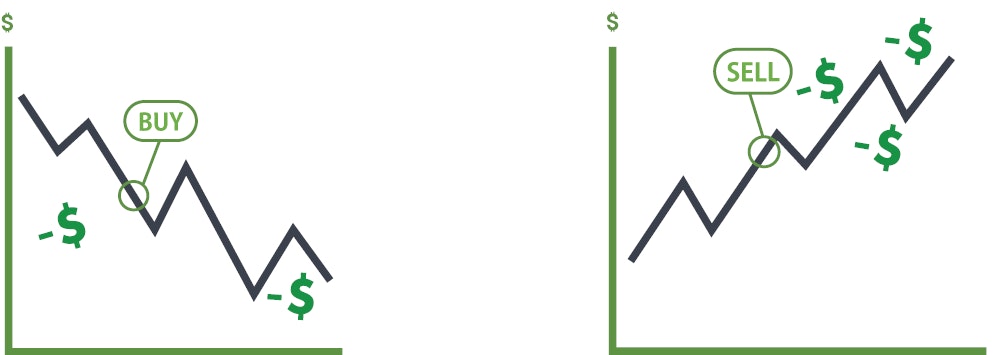

Example 1: Reversal trade

Novice traders buy on the downside when the market is falling and sell on the upside when the market is rising.

Professional traders buy on the downside only after seeing the price reverse to the upside, and sell on the upside after watching it fall back.

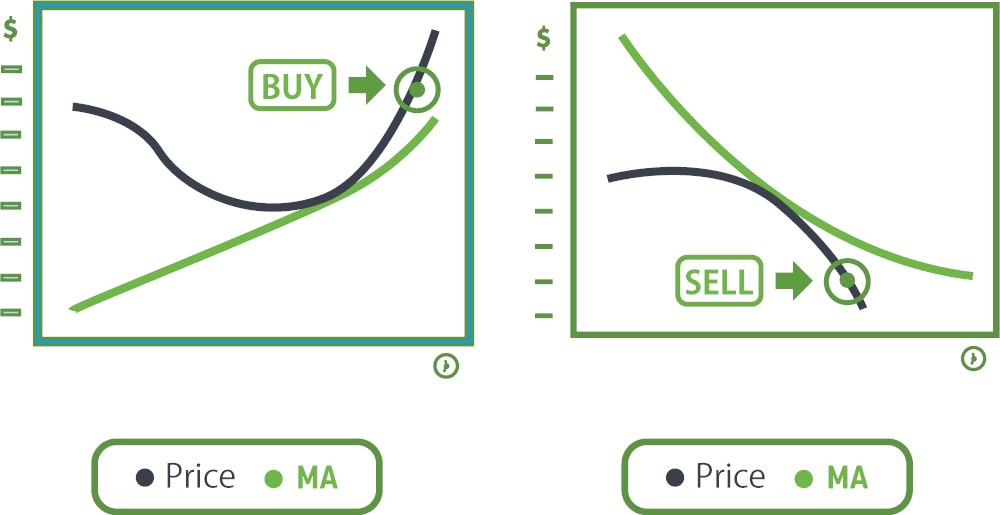

Example 2: Trend trade

Novice traders

Notice traders tend to buy when the market rises significant and sell when the market falls significantly.

Professional traders

They wait for the price to return to the moving average on a rising trend, and then buy on a further rise.

On the downside, it's better to wait for the price to retrace up to the moving average and sell when it turns back negative.

Example 3: Planning

Another big difference between professional and novice traders is planning.

Novice traders

When they see a market move and feel there's an opportunity, they trade on emotion without a plan. As their behaviour is 100% controlled by the market, they suffer heavy losses if the market moves against their position.

Professional traders

They always have a trading plan and wait for the best time to execute that plan. If the market moves against them, they can adjust their strategy and control their actions without panic.

Trade in line with price movements

When trading, it is always tempting to seek maximum profits. However, buying at low prices and selling at high prices is difficult and often dangerous as it can easily continue to move in the same direction. It's almost impossible to guess precisely how far the market will rise or fall.

Instead, it is better to go with the flow of the market and follow the current price action. When entering the market, buy when the price is moving up, and sell when the price is moving down. When entering the market, always check the direction shown by the colour of the candlestick.

A positive candlestick means that buying power is increasing, while a negative candlestick means that selling power is increasing. Stick to buying when the candle is positive and selling when it is negative.

Short-term price movements

Short-term price movements are most important. Even if you have a solid plan and strategy, the market may not always move in the direction you need. Therefore, you shouldn't force a trade if the timing is not good looking at short-term price changes. Avoid unnecessary losses and be ready to take advantage of the next trading opportunity.

Short-term price movements are quicker than long-term ones and require immediate trading decisions. If you think too long and hard, you will often delay your entry, resulting in a bad entry point and a loss.

Be prepared to accept that the market is always right. Going against the market direction can lead to big losses and be dangerous. Always trade with the short-term market momentum in mind.