Nick Goold

Candlestick charts visually represent price movements, and traders use them to analyze market trends and make predictions about future price movements.

Origin

Candlesticks and their patterns are some of the oldest trading indicators, originating in Japan in the 1700s. A rice trader called Munehisa Homma proposed in his writings that the rice price was driven by emotional cycles linked to supply and demand in what we now refer to as 'bull' and 'bear' market cycles. This became represented by different colored bars for periods when the price rose or fell.

Formation

Candlestick charts display price movements over time, and each candlestick represents a specific period. The candlestick's body shows the currency pair's opening and closing price, while the wicks or shadows represent the high and low prices during that time.

An upward candlestick is usually represented by the colors blue or green, filling a solid thick bar between the open and closing price for the period. A thinner line extends this bar for the high and low prices for the period.

A downward candlestick is the same, except it is usually colored red or yellow.

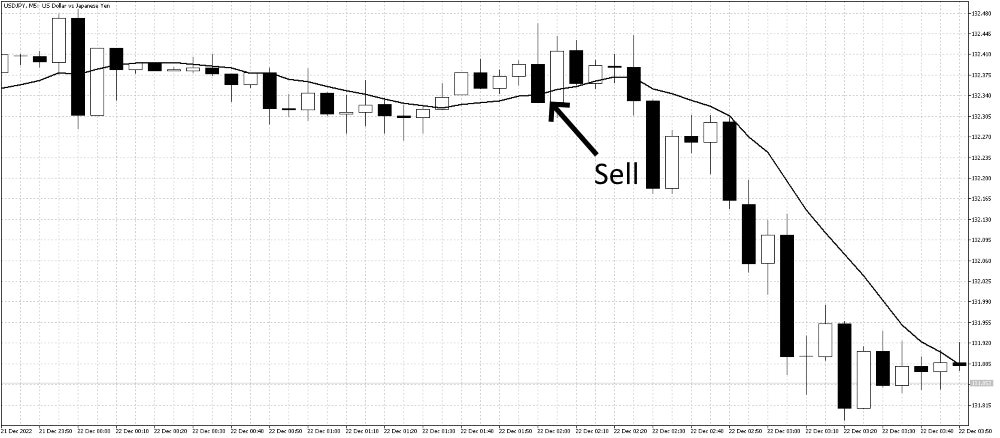

Since the bullish or blue candle represents market strength, traders should only look to buy when the current candle is blue. Similarly, they should only sell short if the current candle is red, representing a downward trend. It is a simple visualization of the current trend that's very easy to monitor and control entry timing. Basically, you only buy into strength and sell into weakness.

Candlestick patterns

Candlestick charts can also be watched for signs of a trend reversal, where a previous bull or bear cycle ends. The human mind is particularly good at recognizing these patterns; many common ones can signal an upcoming trend reversal or confirm one just after it happened.

Simple reversal patterns

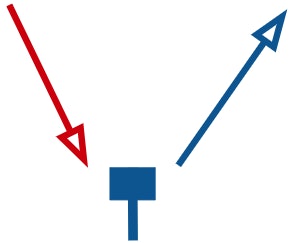

The Hammer

The Hammer forms at the end of a bearish period of multiple downward candlesticks and shows the point where there has been a bullish reversal. At some point, this candlestick has changed from downward to upward, with the price initially moving lower from the open price to record a new low for the cycle but then reversing strongly to close at its high. The typical price action seen after a Hammer is a period of further strength with multiple upward candlesticks. Watching for a Hammer to form and then buying into the strength of the following candle is a common trading strategy.

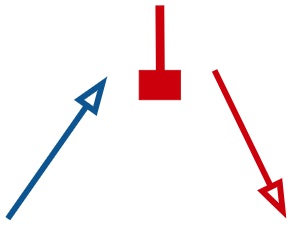

The Shooting Star

The opposite pattern is called the Shooting Star. A period of strength suddenly reverses after making a new high. It's typically followed by a period of weakness represented by further downward candlesticks.

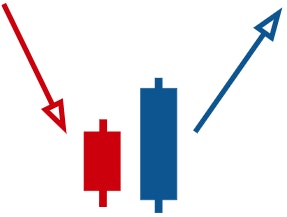

The Bullish Engulfing

These patterns combine two candlesticks to represent a trend reversal taking place. In the bullish version, a period of weakness ends when fresh buyers enter the market near the new low price, and the current candlestick changes upward. When this candlestick closes above the previous close and it has lower lows and higher highs..

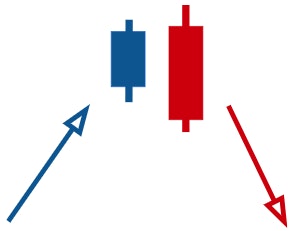

The Bearish Engulfing

The reverse case is the bearish engulfing pattern where a new market top is quickly rejected, and sellers reverse the price to close below the open of the previous candlestick.