Nick Goold

Recap

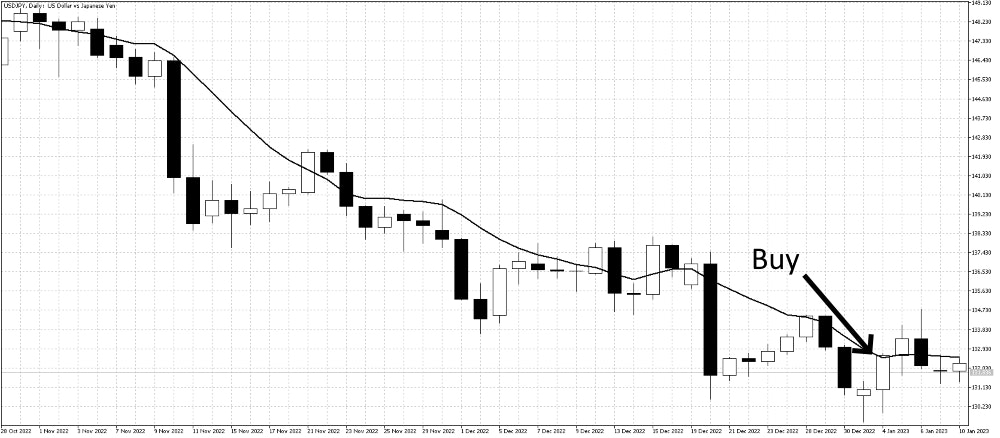

As explained in our first article, candlestick charts are one of the most popular ways to visualize price action. Each candle shows the open, high, low, and close of a market over a given time frame, giving traders a fast way to spot trends, reversals, and trading opportunities.

These charts originated in Japan centuries ago during the rice trade and have since become a global standard in technical analysis. Over time, traders have identified hundreds of candlestick patterns—each linked to potential changes in market direction. While not foolproof, these patterns remain widely used because of their simplicity, versatility, and ability to work across all financial markets, from Forex and stocks to commodities and cryptocurrencies.

More candlestick patterns

Candlestick charts are especially useful for spotting reversal patterns—signals that the market may be ending its current trend and starting to move in the opposite direction. Below are several well-known reversal candlestick patterns that traders watch closely.

Simple reversal patterns

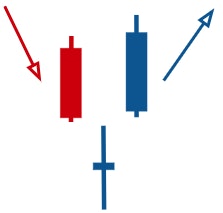

Morning Star

The Morning Star is a bullish reversal pattern that often appears after a strong downtrend. It typically begins with a long red (bearish) candle, followed by a small-bodied candle that gaps down—representing hesitation in the selling pressure. The third candle is a strong green (bullish) candle that pushes the price back above the midpoint of the first candle. This signals that sellers are exhausted and buyers are regaining control, marking the beginning of a potential uptrend.

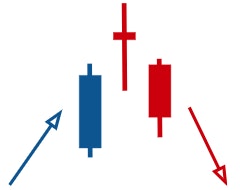

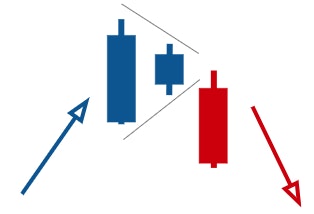

Evening Star

The Evening Star is the opposite of the Morning Star. It appears after a strong uptrend and signals bearish reversal. It begins with a long green (bullish) candle, followed by a small-bodied candle that gaps higher but shows hesitation. The third candle is a long red (bearish) candle that closes deep into the body of the first candle. This shows that buying momentum has failed, and sellers are starting to take over.

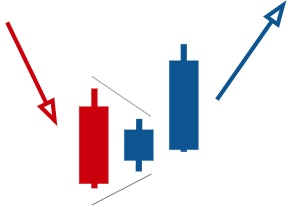

Three Inside Up

The Three Inside Up is another bullish reversal pattern. It starts with a long red candle, followed by a smaller green candle that is completely contained within the body of the first candle. The third candle is another strong green candle that closes above the first candle’s high. This sequence confirms that sellers have lost control and that a new uptrend may be starting.

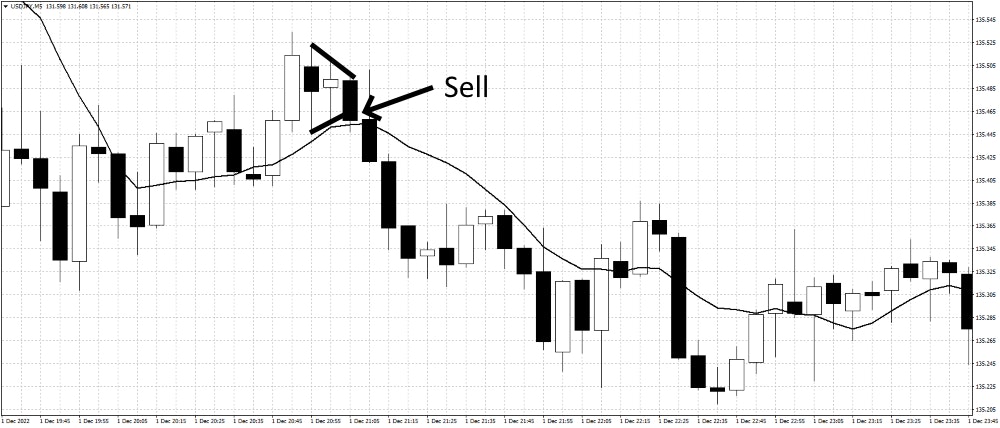

Three Inside Down

The Three Inside Down is the bearish counterpart to the Three Inside Up. It begins with a strong green candle, followed by a smaller red candle inside its body. The third candle is another red candle that closes below the first candle’s low. This formation shows that bullish momentum has stalled and a bearish trend may be forming.

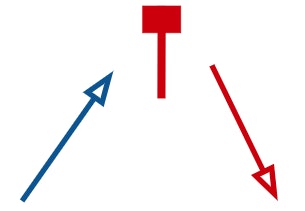

Hanging Man

The Hanging Man is a single-candle bearish reversal signal that often appears near the top of an uptrend. It has a small body and a long lower shadow, showing that sellers pushed prices down during the session, but buyers managed to bring it back up before the close. Despite this recovery, the long wick signals weakness, suggesting that buyers may be running out of steam and a reversal could follow in the next session.

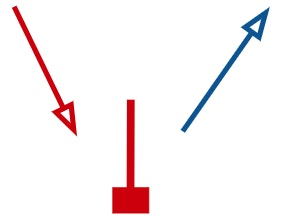

Inverted Hammer

The Inverted Hammer is the bullish counterpart to the Hanging Man and often appears at the end of a downtrend. It has a small body with a long upper wick, showing that buyers attempted to push prices higher but couldn’t maintain control. However, the attempt signals that selling pressure is weakening. If followed by a strong bullish candle, the Inverted Hammer can mark the start of a rebound and new uptrend.

Conclusion

These candlestick reversal patterns—Morning Star, Evening Star, Three Inside Up, Three Inside Down, Hanging Man, and Inverted Hammer—are among the most widely used in trading. They help traders spot potential turning points in the market and time their entries or exits more effectively. While no single pattern guarantees success, combining candlestick analysis with other technical tools such as moving averages, support and resistance, and volume analysis can greatly improve trading decisions.