Nick Goold

The triple top bearish pattern is rarely seen but potentially highly profitable price action all traders should know. The triple top pattern is formed when the market hits the same high three times and then falls below the lows set between the highs.

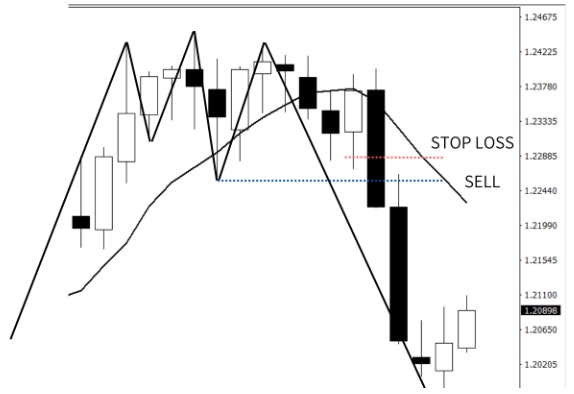

Below is a triple top pattern in the GBPUSD. As you can see the three highs are close but not exactly the same level. Chart analysis is not a perfect science and judgement is required by the trader to whether they see a chart pattern. In this situation a strong US employment number was the catalyst for the break of support and large fall.

The triple top pattern can be found on all chart lengths from 1 minute to monthly charts. As a general rule the longer the chart period the stronger the trade signal as it is more likely other traders are using the same chart pattern.

Triple top risk management advice

Profit target setting

There are a couple of different methods to set a target with the triple top bottom.

Method 1: Calculated recent range

Some traders calculate the difference between the recent triple highs and lows to calculate a target. For example if the USDJPY range between the triple top and recent lows was 1.50 yen, if you sell at 130.00, your target would be 128.50 (130.00 - 1.50).

Method 2: Retracement of uptrend

Another method is to calculate a retracement of the uptrend to calculate a profit target. Popular retracement percentages are 38.2%, 50% and 61.8%. For example if the USDJPY has risen from 120.00 to 130.00 a 50% retracement target would be 125.00. Some traders exit their profits partially at each different retracement level to reduce their risk.

Method 3: Exit at support

Following the end of an uptrend the market can return to the next support level which is usually a previous resistance. For example if previous resistance was 123.00 and the market is now 130.00, 123.00 could be a support level as traders who sold at 123.00 resistance could look to exit their short positions as well.

Stop loss setting

A triple top pattern will usually make a profit quickly so a large stop is not required. The textbook stop loss is above the last high and this is beneficial for long term traders.

For short term traders placing the stop a little above the recent low can be a better idea. By placing a small stop you can re enter again later should the market fall again or sell if the market returns to the recent highs.

Triple top mental control advice

Due to the rarity of the triple top pattern there is some natural excitement when the pattern forms. Trading when excited rarely produces positive outcomes so staying calm and rational is a must. Before entering the sell order make sure you analyzed the market and checked for any news events which might be released shortly. Only when well prepared should you enter a trader regardless of how potentially attractive the opportunity.

A triple top pattern is not a guarantee of a profitable trade. An unexpected loss can lead to gambling so accept any losses and take a break after a losing trade. On the other hand successfully trading a triple top pattern can be exciting and lead to overconfidence. Regardless of the trade`s remember your performance is measured over many trades not one.

The triple top pattern is a strategy that can lead to large trading profits in foreign exchange and used by many traders. While a rare strategy and easily forgotten strategy traders who are patient will be well rewarded.