Aayush Jindal

Key Highlights

- USD/CAD is attempting an upside break above the 1.2500 resistance region.

- Earlier, it traded below a major bullish trend line at 1.2450 on the 4-hours chart.

- EUR/USD failed to clear the 1.1600-1.1620 resistance zone, and GBP/USD also topped near 1.3600.

- The US CPI increased 6.2% in Oct 2021 (YoY), better than the last 5.4%.

USD/CAD Technical Analysis

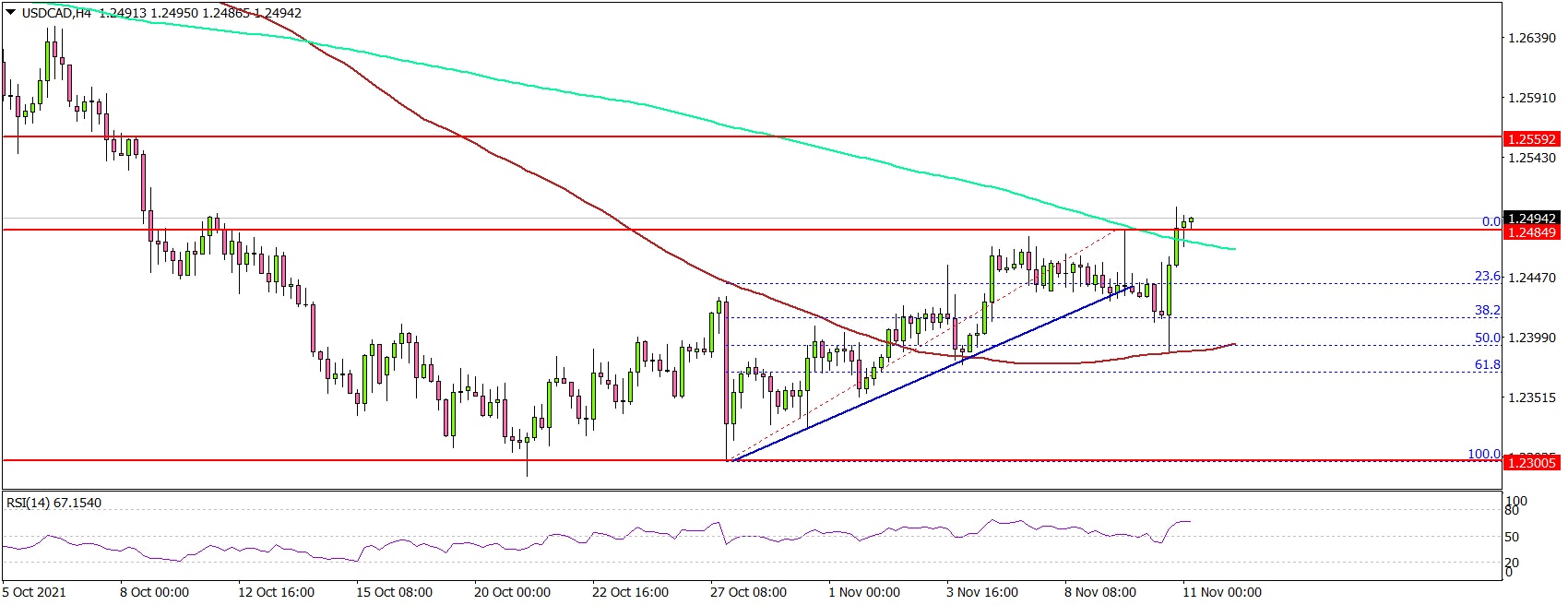

The US Dollar started a decent increase above 1.2450 against the Canadian Dollar. However, USD/CAD failed to clear the 1.2500 resistance zone.

Looking at the 4-hours chart, the pair topped near the 1.2490 level and the 200 simple moving average (green, 4-hours). It started a fresh decline and traded below 1.2450.

There was a break below a major bullish trend line with support at 1.2450 on the same chart. Besides, the pair declined below the 23.6% Fib retracement level of the upward move from the 1.2301 swing low to 1.2484 high.

An immediate support is near the 1.2400 level. It is near the 50% Fib retracement level of the upward move from the 1.2301 swing low to 1.2484 high.

A close below 1.2400 could open the doors for a move towards the 1.2320 level. The next major support is near the 1.2300 level. On the upside, an immediate resistance is near the 1.2490 level.

The next major resistance is near the 1.2500 level. A close above 1.2490 and 1.2500 could open the doors for a fresh increase. In the stated case, the pair could rise towards the 1.2620 level.

Fundamentally, the US Consumer Price Index for Oct 2021 was released yesterday by the US Bureau of Labor Statistics. The market was looking for a rise of 5.8% in Oct 2021, compared with the same month a year ago.

The actual result was better than the forecast, as the US CPI increased 6.2%. Besides, the Consumer Price Index (CPI) Ex Food & Energy increased 4.6%.

Looking at EUR/USD, the pair failed to clear the 1.1600 hurdle and it remains at a risk of a downside break. Similarly, GBP/USD failed to surpass 1.3600.

Economic Releases

- UK Industrial Production for Sep 2021 (MoM) - Forecast +0.2%, versus +0.8% previous.

- UK Manufacturing Production for Sep 2021 (MoM) - Forecast +0.2%, versus +0.5% previous.

- UK GDP for Q3 2021 (QoQ) (Prelim) - Forecast +1.5%, versus +5.5% previous.