Aayush Jindal

Key Highlights

- USD/CAD faced resistance near 1.2740 and started a fresh decrease.

- A major bearish trend line is forming with resistance near 1.2700 on the 4-hours chart.

- USD/JPY is accelerating gains and it climbed to 107.00.

- The US Initial Jobless Claims in the week ending Feb 27, 2021 could increase from 730K to 750K.

USD/CAD Technical Analysis

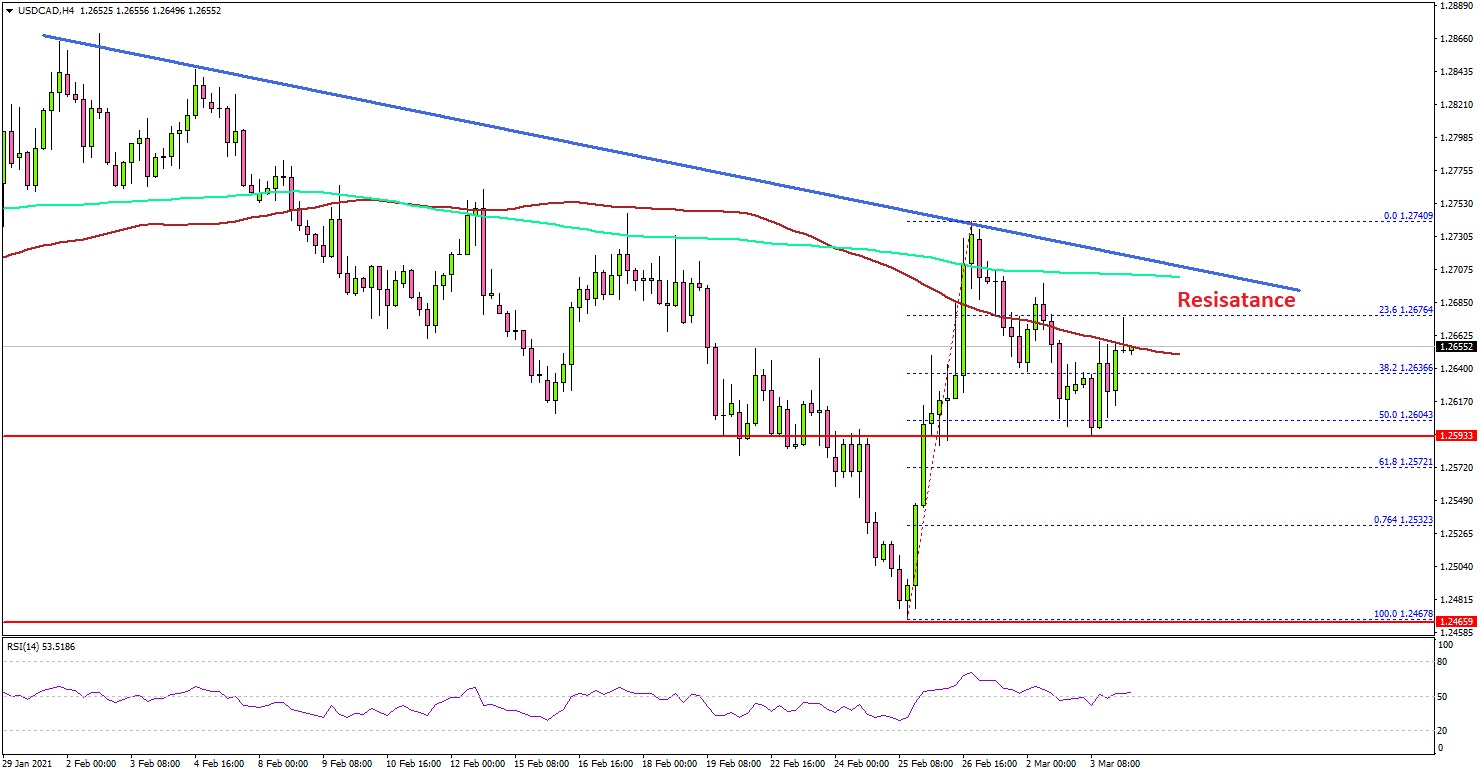

This past week, the US Dollar started a steady increase from 1.2465 against the Canadian Dollar. USD/CAD climbed above 1.2600, but it struggled to surpass 1.2750.

Looking at the 4-hours chart, the pair topped near 1.2740 and started a fresh decrease. There was a break below the 1.2700 support zone and the 200 simple moving average (green, 4-hours).

The pair even traded below the 1.2650 support level and the 100 simple moving average (red, 4-hours). It tested the 50% Fib retracement level of the upward move from the 1.2467 low to 1.2740 high.

An immediate support is near the 1.2580 zone, below which there is a risk of a sharp decline. In the stated case, the pair could decline towards the 1.2500 level. On the upside, the pair is likely to face hurdles near 1.2650.

There is also a major bearish trend line forming with resistance near 1.2700 on the same chart. A clear break above the trend line resistance could open the doors for a move towards the 1.2800 level.

Fundamentally, the US ADP Employment Change for Feb 2021 was released yesterday by the Automatic Data Processing, Inc. The market was looking for a rise of 177K jobs, close to the last reading of 174K.

The actual result was lower than the forecast, as the ADA employment increased 117K in Feb 2021. On the other hand, the last reading was revised up from 174K to 195K.

Overall, USD/CAD could move down further unless it clears the 1.2700 resistance. Looking at EUR/USD, the pair failed to recover above 1.2100 and declined again. GBP/USD also remained below 1.4000.

Economic Releases

- Euro Zone Retail Sales for Jan 2021 (YoY) - Forecast -1.2%, versus +0.6% previous.

- Euro Zone Retail Sales for Jan 2021 (MoM) - Forecast -1.1%, versus +2.0% previous.

- US Initial Jobless Claims - Forecast 750K, versus 730K previous.