Aayush Jindal

Key Highlights

- USD/CHF started a fresh increase after testing the 0.8840 support.

- It is now facing a strong resistance near 0.8920 on the 4-hours chart.

- EUR/USD failed to surpass the 1.2200 resistance zone, GBP/USD is correcting gains.

- The US Gross Domestic Product is likely to grow 3.9% in Q4 2020 (Preliminary).

USD/CHF Technical Analysis

The US Dollar remained well bid above 0.8830 and 0.8840 against the Swiss Franc. USD/CHF started a fresh increase above 0.8865 and it is now facing a strong resistance.

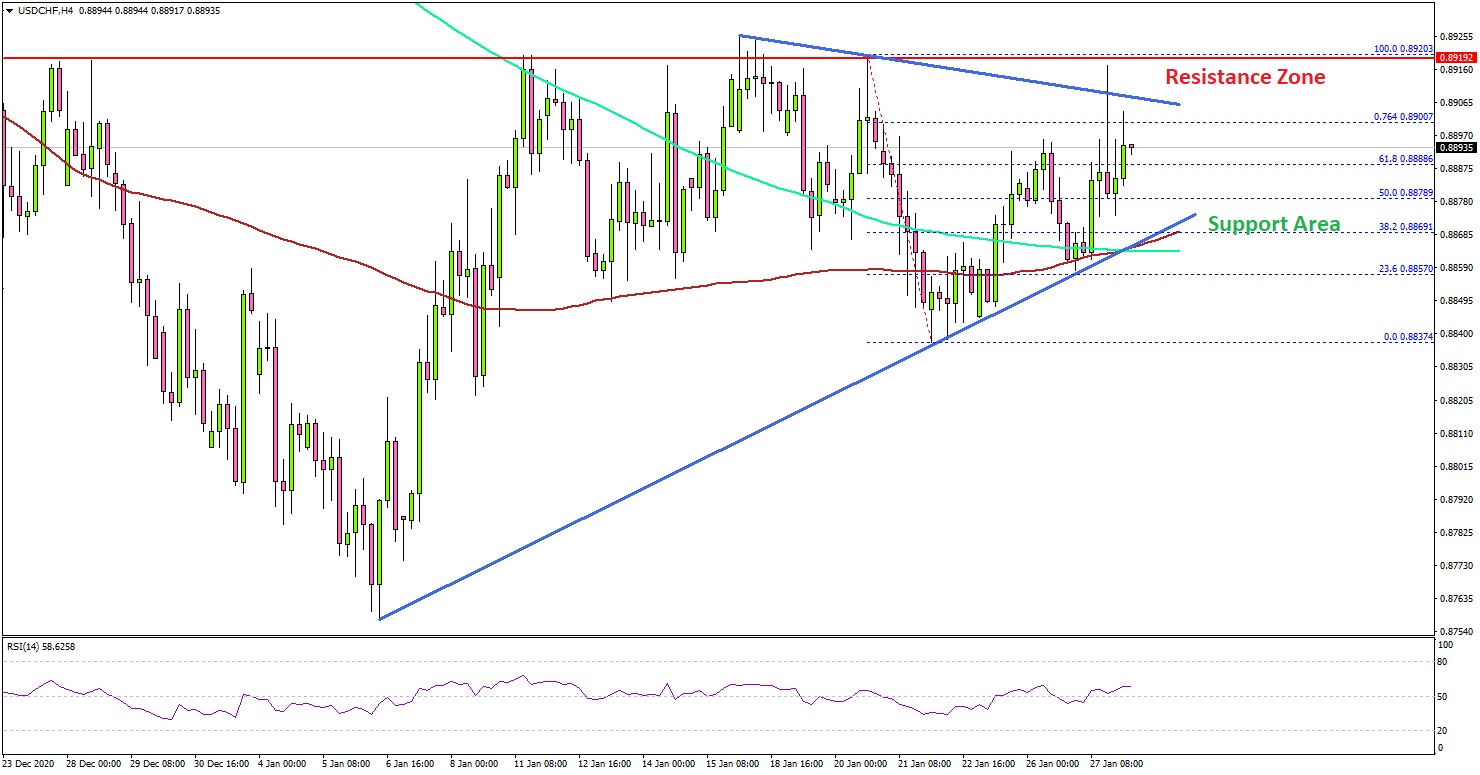

Looking at the 4-hours chart, the pair cleared the 0.8880 level and it settled nicely above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

There was also a break above the 50% Fib retracement level of the downward move from the 0.8920 high to 0.8837 swing low. However, the pair is still facing a significant resistance near the 0.8920 level (a multi-touch zone).

If there is a successful break above 0.8920, the pair could rise steadily towards the 0.8950 and 0.8965 resistance levels. On the downside, there are many major supports forming near 0.8865. There is also a major bullish trend line forming with support near 0.8865 on the same chart.

A clear break below the trend line and the 100 simple moving average (red, 4-hours) could open the doors for a larger decline. The next major support on the downside is near the 0.8840, followed by 0.8802.

Looking at EUR/USD, the pair failed to clear the 1.2200 resistance zone and started a fresh decline. Conversely, GBP/USD retested the 1.3750 resistance zone before correcting lower.

Economic Releases

- German CPI for Jan 2021 (YoY) (Preliminary) – Forecast 0.7%, versus -0.3% previous.

- German CPI for Jan 2021 (MoM) (Preliminary) – Forecast 0.4%, versus 0.5% previous.

- US Initial Jobless Claims - Forecast 875K, versus 900K previous.

- US Gross Domestic Product Q4 2020 (Preliminary) – Forecast 3.9%, versus previous 33.4%.