Aayush Jindal

Key Highlights

- USD/JPY started a recovery wave above the 129.50 resistance.

- A key bullish trend line is forming with support near 128.70 on the 4-hours chart.

- EUR/USD and GBP/USD traded in a range after the US GDP release.

- The US GDP grew 2.9% in for Q4 2022 (Preliminary), more than the market forecast of 2.6%.

USD/JPY Technical Analysis

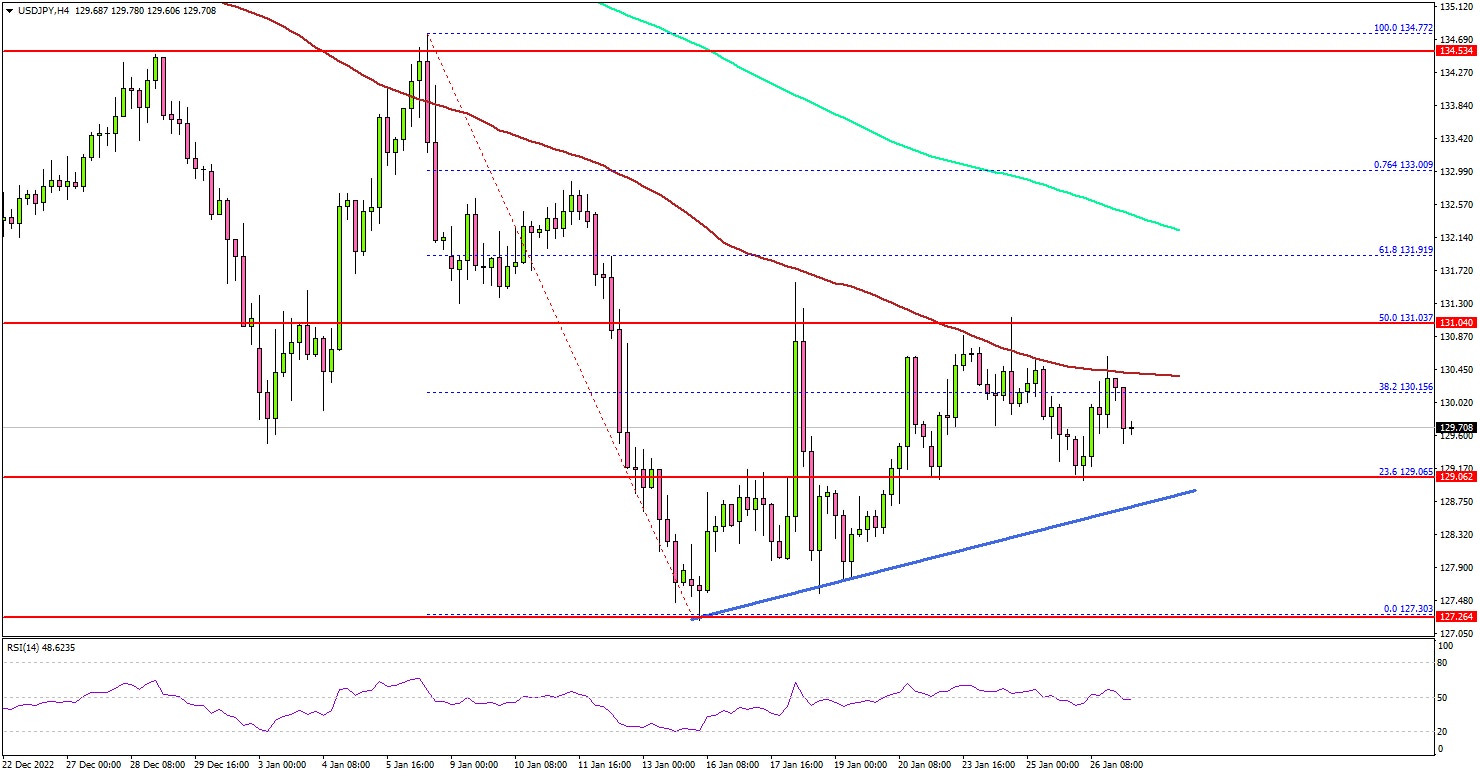

The US Dollar found support near the 127.30 zone against the Japanese Yen. USD/JPY started a recovery wave above the 128.00 and 128.40 resistance levels.

Looking at the 4-hours chart, the pair was able to clear the 129.50 resistance zone. There was also a move above the 38.2% Fib retracement level of the key decline from the 134.77 swing high to 127.30 low.

Recently, it faced resistance near the 100 simple moving average (red, 4-hours). The first major resistance is near the 131.00 level.

The 50% Fib retracement level of the key decline from the 134.77 swing high to 127.30 low is also near the 131.00 zone. A clear move above the 131.00 resistance might start a steady increase towards the 132.50 resistance zone.

Any more gains could open the doors for a move towards the 133.50 level. The next key hurdle is near 134.00, above which the pair could climb towards the 135.00 resistance zone.

On the downside, there is a major support at 129.60. There is also a key bullish trend line forming with support near 128.70 on the same chart. A downside break below the 128.70 zone might push the pair lower.

The next major support sits near the 128.00 level. Any more losses might open the doors for a move towards the 127.30 support zone.

Looking at EUR/USD, the pair is consolidating above the 1.0800 zone and might attempt a fresh increase above the 1.0900 resistance.

Economic Releases

- US Personal Income for Dec 2022 (MoM) - Forecast +0.2%, versus +0.4% previous.

- US Pending Home Sales for Dec 2022 (YoY) - Forecast -0.9%, versus -4.0% previous.