Aayush Jindal

Key Highlights

- USD/JPY started a consolidation phase above the 134.50 level.

- A key bearish trend line is forming with resistance near 137.15 on the 4-hours chart.

- EUR/USD extended its increase above the 1.0680 resistance zone.

- The Bank of England raised interest rates from 3% to 3.5%.

USD/JPY Technical Analysis

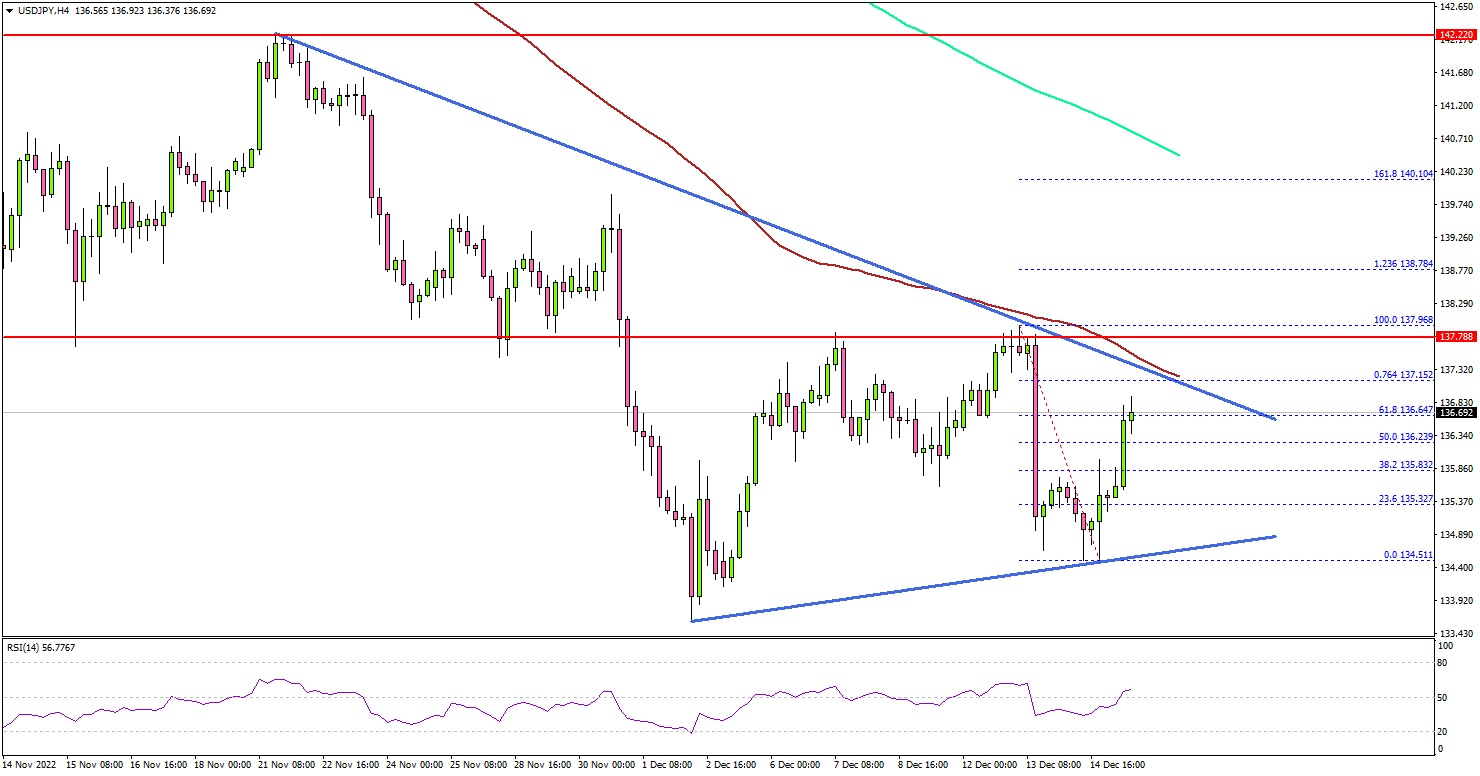

The US Dollar saw a bearish moves after it settled below the 142.00 level. USD/JPY even declined below the 140.00 support level to move into a bearish zone.

Looking at the 4-hours chart, the pair settled well below the 140.00 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

There was also a drop below the 136.50 support level. The recent low was formed near 134.51 before there was an upside correction. The pair corrected above the 135.80 resistance zone. However, the bears are active near the 137.20 zone.

There is also a key bearish trend line forming with resistance near 137.15 on the same chart. The next major resistance may perhaps be near 137.50. A clear move above the 137.50 resistance might start a steady increase.

In the stated case, USD/JPY may perhaps rise towards the 138.50 level. Any more gains could lead the pair towards the 140.00 resistance zone.

If not, there is a risk of a fresh decline below the 135.50 support. The next major support is near the 134.50 zone. Any more losses might send the pair towards the 133.80 support zone.

Looking at EUR/USD, the pair extended its increase above the 1.0680 resistance and there are chances of more upsides.

Economic Releases

- Germany’s Manufacturing PMI for Nov 2022 (Preliminary) - Forecast 48.2, versus 48.3 previous.

- Germany’s Services PMI for Nov 2022 (Preliminary) - Forecast 46.3, versus 46.1 previous.

- Euro Zone Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 47.1, versus 47.1 previous.

- Euro Zone Services PMI for Nov 2022 (Preliminary) – Forecast 48.5, versus 48.5 previous.

- UK Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 46.3, versus 46.5 previous.

- UK Services PMI for Nov 2022 (Preliminary) – Forecast 48.5, versus 48.8 previous.

- US Manufacturing PMI for Nov 2022 (Preliminary) – Forecast 47.7, versus 47.7 previous.

- US Services PMI for Nov 2022 (Preliminary) – Forecast 46.8, versus 46.2 previous.