Aayush Jindal

Key Highlights

- USD/JPY climbed higher steadily above 105.00 and 105.50.

- A major bullish trend line is in place with support near 105.00 on the 4-hours chart.

- EUR/USD tested 1.2025 before correcting higher, GBP/USD surged above 1.3950.

- The US Manufacturing PMI could decline from 59.2 to 58.5 in Feb 2021 (Preliminary).

USD/JPY Technical Analysis

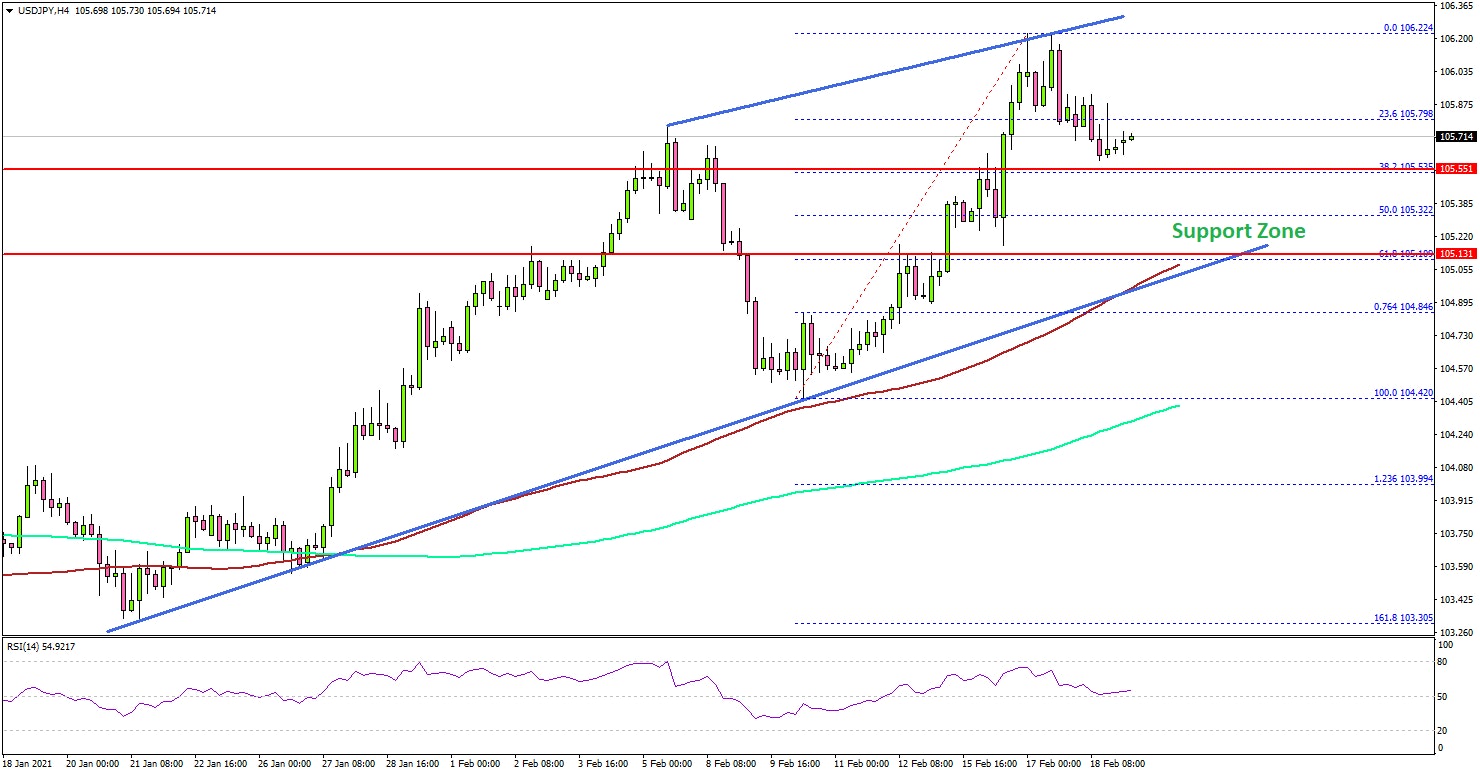

After forming a support base near 103.40, the US Dollar started a strong increase against the Japanese Yen. USD/JPY broke many major hurdles near 105.00 to move into a positive zone.

Looking at the 4-hours chart, the pair even traded above the 105.50 resistance. There was a strong close above 105.00, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The pair even climbed above the 106.00 level and traded to a new yearly high at 106.22. Recently, there was a downside correction below the 106.00 level.

USD/JPY declined below the 23.6% Fib retracement level of the upward move from the 104.40 swing low to 106.22 high. The first major support is near the 105.30 level.

The 50% Fib retracement level of the upward move from the 104.40 swing low to 106.22 high is also near 105.30. The next major support is near the 105.20 level (a multi-touch zone).

There is also a major bullish trend line in place with support near 105.00 on the same chart. Any more losses below 105.00 might call for a trend change in the near term. On the upside, the 106.20 level is a short-term resistance. A clear break above 106.20 might lead the price towards the 106.80 and 107.00 levels.

Overall, USD/JPY might correct further, but the 105.00 zone is likely to act as a strong support. Looking at EUR/USD, the pair dropped below 1.2050 before the bulls appeared near 1.2025. More importantly, GBP/USD extended its rally above 1.3950 and it traded to a new multi-month high.

Economic Releases

- Germany’s Manufacturing PMI Feb 2021 (Preliminary) - Forecast 56.5, versus 57.1 previous.

- Germany’s Services PMI Feb 2021 (Preliminary) - Forecast 46.5, versus 46.7 previous.

- Euro Zone Manufacturing PMI Feb 2021 (Preliminary) – Forecast 54.4, versus 54.8 previous.

- Euro Zone Services PMI Feb 2021 (Preliminary) – Forecast 45.9, versus 45.4 previous.

- UK Manufacturing PMI Feb 2021 (Preliminary) – Forecast 54.0, versus 54.1 previous.

- UK Services PMI Feb 2021 (Preliminary) – Forecast 40.7, versus 39.5 previous.

- US Manufacturing PMI Feb 2021 (Preliminary) – Forecast 58.5, versus 59.2 previous.

- US Services PMI Feb 2021 (Preliminary) – Forecast 57.5, versus 58.3 previous.