Aayush Jindal

Key Highlights

- USD/JPY started a fresh decline from the 134.50 zone.

- A major bearish trend line is forming with resistance near 134.50 on the 4-hours chart.

- EUR/USD could attempt a fresh increase above the 1.0650 and 1.0680 resistance levels.

- Gold price is still aiming a clear move above the $1,825 resistance zone.

USD/JPY Technical Analysis

The US Dollar attempted a recovery wave above the 133.50 resistance against the Japanese Yen. USD/JPY even climbed above the 134.00 resistance zone.

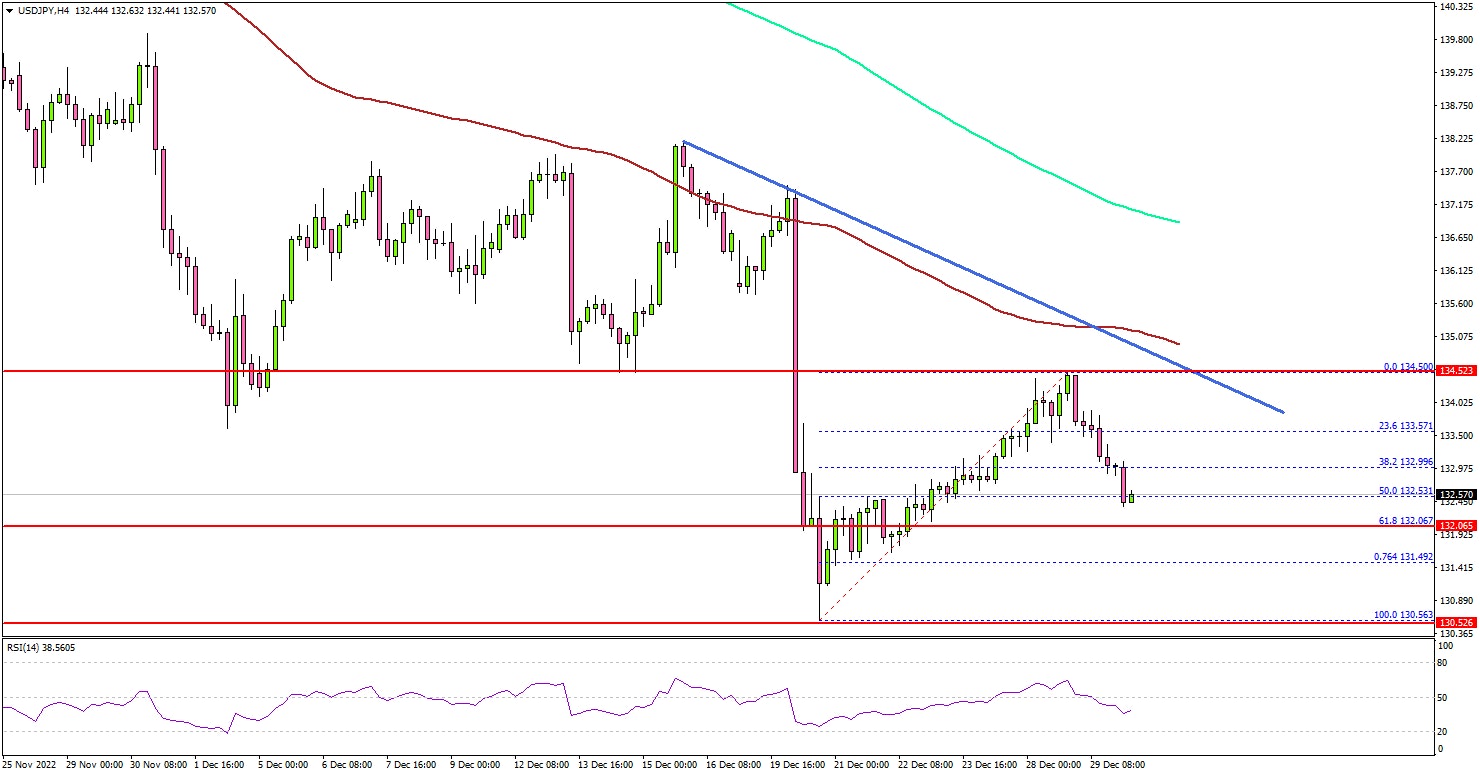

Looking at the 4-hours chart, the pair clearly struggled to clear a major resistance zone near the 134.50 level. The pair formed a high near the 134.50 and recently started a fresh decline.

There was a move below the 133.50 support zone. The pair even spiked below the 50% Fib retracement level of the upward move from the 130.56 swing low to 134.50 high. It is now trading well below 133.20 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

On the downside, there is a key support at 132.00. It is near the 61.8% Fib retracement level of the upward move from the 130.56 swing low to 134.50 high.

A downside break below the 132.00 zone might spark a major decline. The next major support sits near the 130.50 level. Any more losses might open the doors for a move towards the 130.00 support zone.

On the upside, an initial resistance is near the 133.80 level. The next major resistance may perhaps be near 134.50. There is also a major bearish trend line forming with resistance near 134.50 on the same chart.

A clear move above the 134.50 resistance might start a steady increase. In the stated case, USD/JPY may perhaps rise towards the 136.00 level.

Looking at gold price, the bulls may soon attempt another increase above the main resistance zone near the $1,825 level.

Economic Releases

- Chicago Purchasing Manager’s Index for Dec 2022 – Forecast 41.3, versus 37.2 previous.