Aayush Jindal

Key Highlights

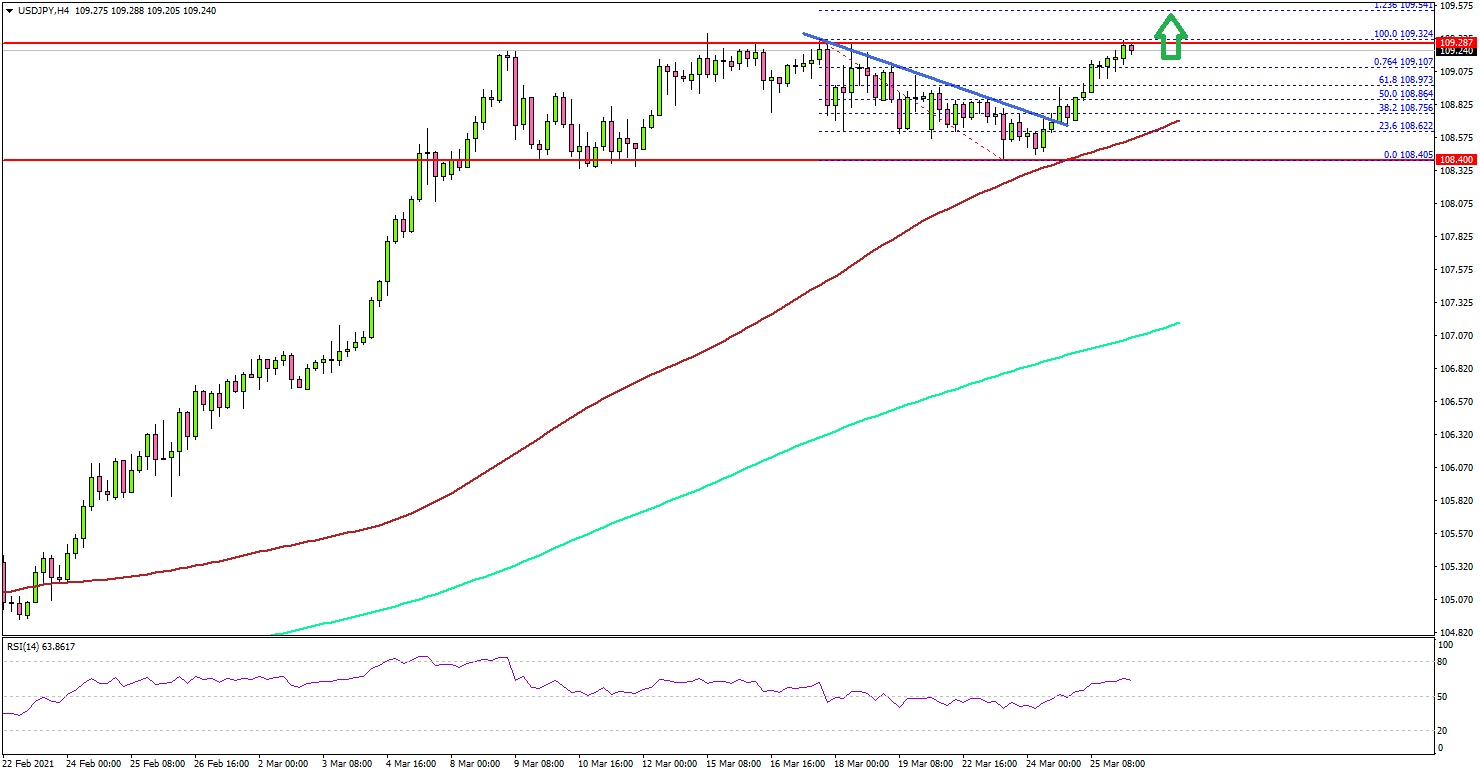

- USD/JPY is trading in a positive zone above the 108.40 and 108.50 support levels.

- There was a break above a key bearish trend line at 108.70 on the 4-hours chart.

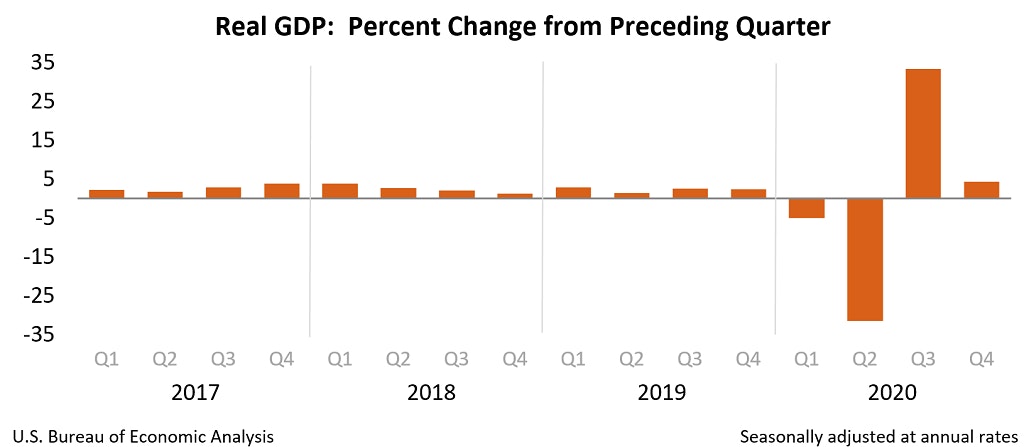

- The US Gross Domestic Product grew 4.3% in Q4 2020.

- The US Personal Income could decline 7.3% in Feb 2021 (MoM), versus the last +10.0%.

USD/JPY Technical Analysis

In the past few days, the US Dollar remained in a strong uptrend above 108.00 against the Japanese Yen. USD/JPY is slowly rising and it seems like there could a break above 109.50 or even 110.00.

Looking at the 4-hours chart, the pair traded as low as 108.38 before starting a fresh increase. It broke the 108.50 and 108.80 resistance levels. There was also a break above a key bearish trend line at 108.70.

The pair is now trading well above 108.500, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). An immediate resistance is near the 109.35 level. It seems like the pair is likely to accelerate higher above the 109.50 level.

The next major resistance sits near the 110.00 level. If there is a fresh decline, the 108.50 level is likely to act as a support. The main support is now forming near the 108.35 zone. Any more losses might call for a drop towards the 108.00 level.

Fundamentally, the US Gross Domestic Product for Q4 2020 was released yesterday by the US Bureau of Economic Analysis. The market was looking for a growth of 4.1%.

The actual result was better than the forecast, as the US GDP grew 4.3% in Q4 2020. Besides, the GDP Price Index increased 1.9%, down from the last 2%.

The report added:

The "third" estimate of GDP released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 4.1 percent.

Overall, the US Dollar is showing positive signs and it seems like USD/JPY may soon break to a new multi-week high above 109.50 in the near term. Besides, EUR/USD and GBP/USD continue to struggle below 1.1880 and 1.3850 respectively.

Economic Releases

- UK Retail Sales for Feb 2021 (YoY) - Forecast +1.7%, versus +4% previous.

- UK Retail Sales for Feb 2021 (MoM) - Forecast -0.8%, versus +2.3% previous.

- US Personal Income for Feb 2021 (MoM) - Forecast -7.3%, versus +10.0% previous.