Aayush Jindal

Key Highlights

- USD/JPY is facing resistance near 148.50 and 149.00.

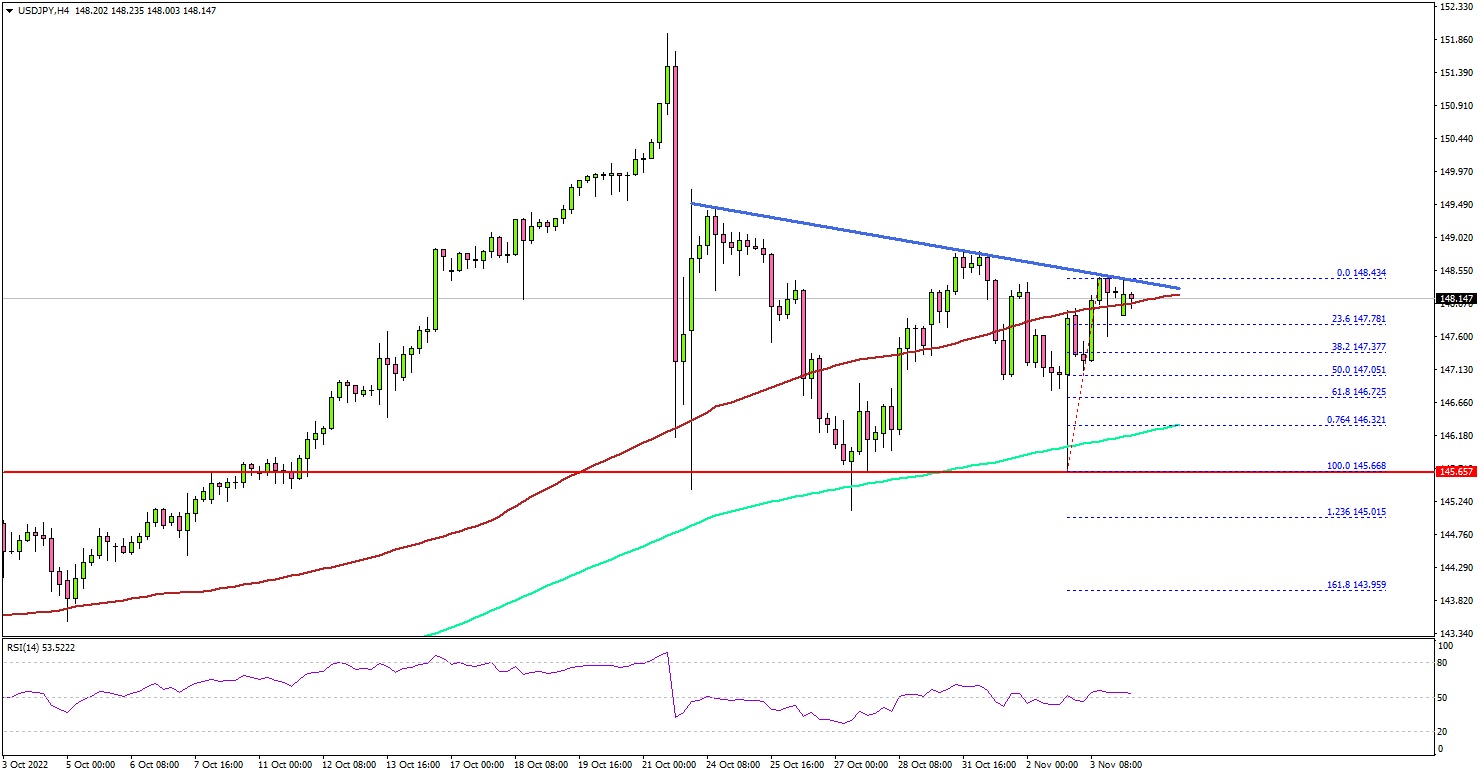

- A major bearish trend line is forming with resistance near 148.40 on the 4-hours chart.

- EUR/USD and GBP/USD gained bearish momentum below 0.9850 and 1.1320 respectively.

- The US nonfarm payrolls could increase 200K in Oct 2022, down from 263K.

USD/JPY Technical Analysis

The US Dollar attempted a fresh increase from the 145.50 support zone against the Japanese Yen. USD/JPY climbed above 146.50, but it faced a lot of hurdles.

Looking at the 4-hours chart, the pair climbed above the 147.00 level, the 100 simple moving average (red, 4-hours) plus the 200 simple moving average (green, 4-hours).

However, the bears were active near the 148.50 zone. There is also a major bearish trend line forming with resistance near 148.40 on the same chart. A clear move above the trend line resistance could open the doors for more upsides.

The next major resistance may perhaps be near 149.50. Any more gains could set the pace for a move towards the 151.20 level, above which it could even test 152.00.

An initial support is near the 147.00 level. The next major support is near the 146.50 zone. The main support sits at 145.50 zone or the 200 simple moving average (green, 4-hours).

The stated 145.50 support acted as a strong barrier and prevented downsides on three occasions. Therefore, a close below the 145.50 level and the 200 simple moving average (green, 4-hours) could increase selling pressure. In the stated case, it could decline towards the 142.00 support.

Looking at EUR/USD, the pair gained bearish momentum below the 0.9850 support. Similarly, GBP/USD declined below the 1.1320 support.

Economic Releases

- US nonfarm payrolls for Oct 2022 – Forecast 200K, versus 263K previous.

- US Unemployment Rate for Oct 2022 - Forecast 3.6%, versus 3.5% previous.

- Canada’s employment Change payrolls for Oct 2022 – Forecast 10K, versus 21.1K previous.

- Canada’s Unemployment Rate for Oct 2022 - Forecast 5.3%, versus 5.2% previous.