Aayush Jindal

Key Highlights

- USD/JPY is attempting a recovery wave above the 131.50 resistance zone.

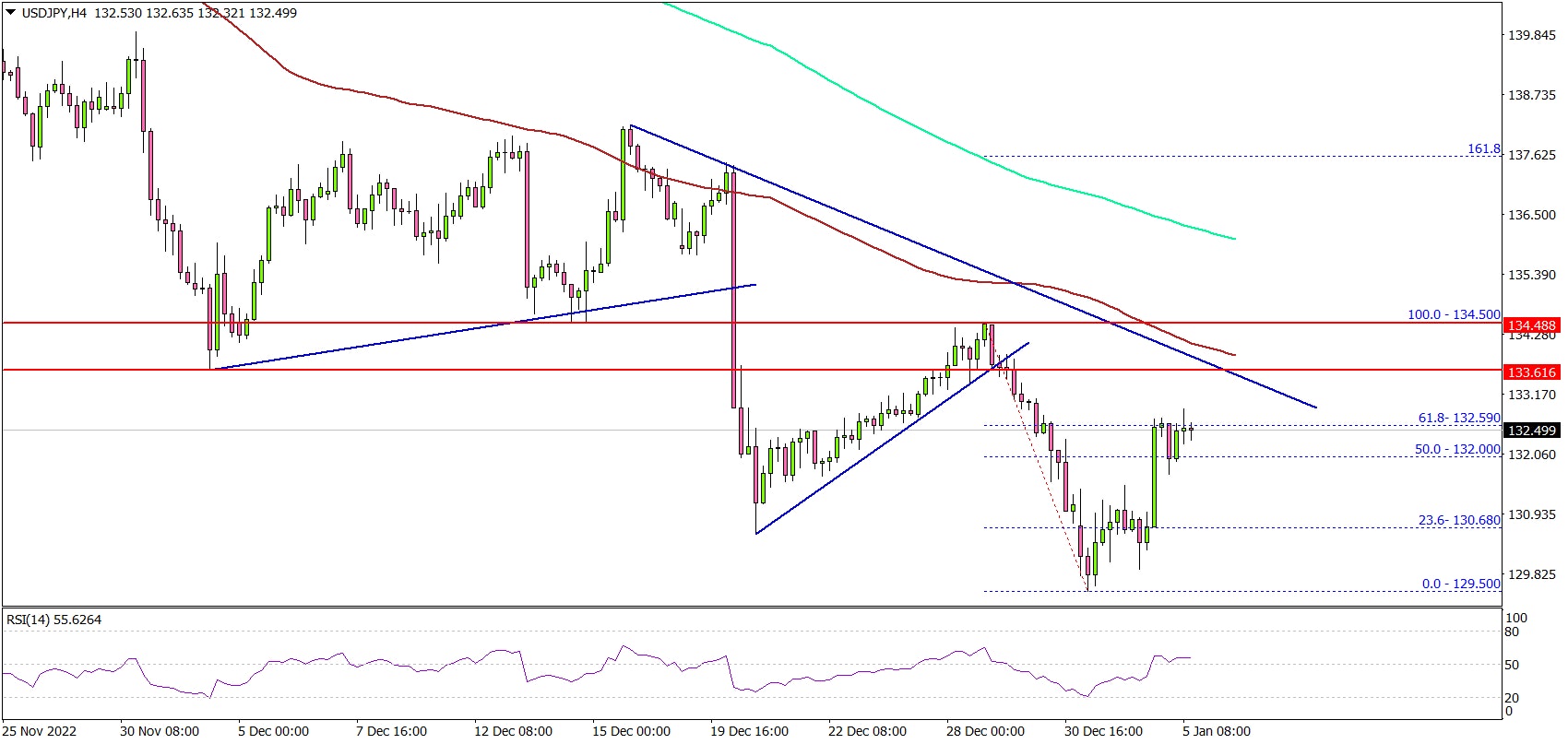

- A major bearish trend line is forming with resistance near 133.60 on the 4-hours chart.

- Gold remains well supported above the $1,820 pivot zone.

- The US nonfarm payrolls could decline from 263K to 200K in Dec 2022.

USD/JPY Technical Analysis

The US Dollar extended its decline below the 132.00 level against the Japanese Yen. USD/JPY found support near 129.50 and recently started a recovery wave.

Looking at the 4-hours chart, the pair traded as low as 129.50 and climbed higher. There was a move above the 130.00 and 130.50 resistance levels. The bulls were able to push the pair above the 50% Fib retracement level from the 134.50 swing high to 129.50 low.

However, the pair is trading below the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

On the upside, an initial resistance is near the 133.20 level. There is also a key bearish trend line forming with resistance near 133.50 on the same chart. The next major resistance may perhaps be near 134.00.

A clear move above the 134.00 resistance might start a steady increase. In the stated case, USD/JPY might start a steady increase. In the stated case, the pair could rise towards the 135.00 level.

On the downside, there is a key support at 131.00. The main support is now forming near the 130.00 level. A downside break below the 130.00 zone might push the pair lower. The next major support sits near the 129.50 level. Any more losses might open the doors for a move towards the 128.00 support zone.

Looking at gold price, the bulls are active above the $1,820 and $1,810. Moving ahead, the price might start another increase towards $1,880.

Economic Releases

- Euro Zone CPI for Dec 2022 (YoY) (Prelim) - Forecast +9.7%, versus +10.1% previous.

- Euro Zone CPI for Dec 2022 (MoM) - Forecast +0.8%, versus -0.1% previous.

- US nonfarm payrolls for Dec 2022 – Forecast 200K, versus 263K previous.

- US Unemployment Rate for Dec 2022 - Forecast 6.7%, versus 6.7% previous.

- Canada’s employment Change payrolls for Dec 2022 – Forecast 8K, versus 10.1K previous.

- Canada’s Unemployment Rate for Dec 2022 - Forecast 5.2%, versus 5.1% previous.