Aayush Jindal

Key Highlights

- USD/JPY stayed above the crucial support at 107.00 and recovered recently.

- The pair seems to be facing a strong resistance near 108.00.

- Besides, a major bearish trend line is forming with resistance near 108.20 on the 4-hours chart.

- The US Initial Jobless Claims declined from 6615K to 5245K for the week ending April 11, 2020.

USD/JPY Technical Analysis

Earlier this week, the US Dollar extended its decline and traded below 107.50 against the Japanese Yen. USD/JPY traded as low as 106.92 before starting a decent recovery wave.

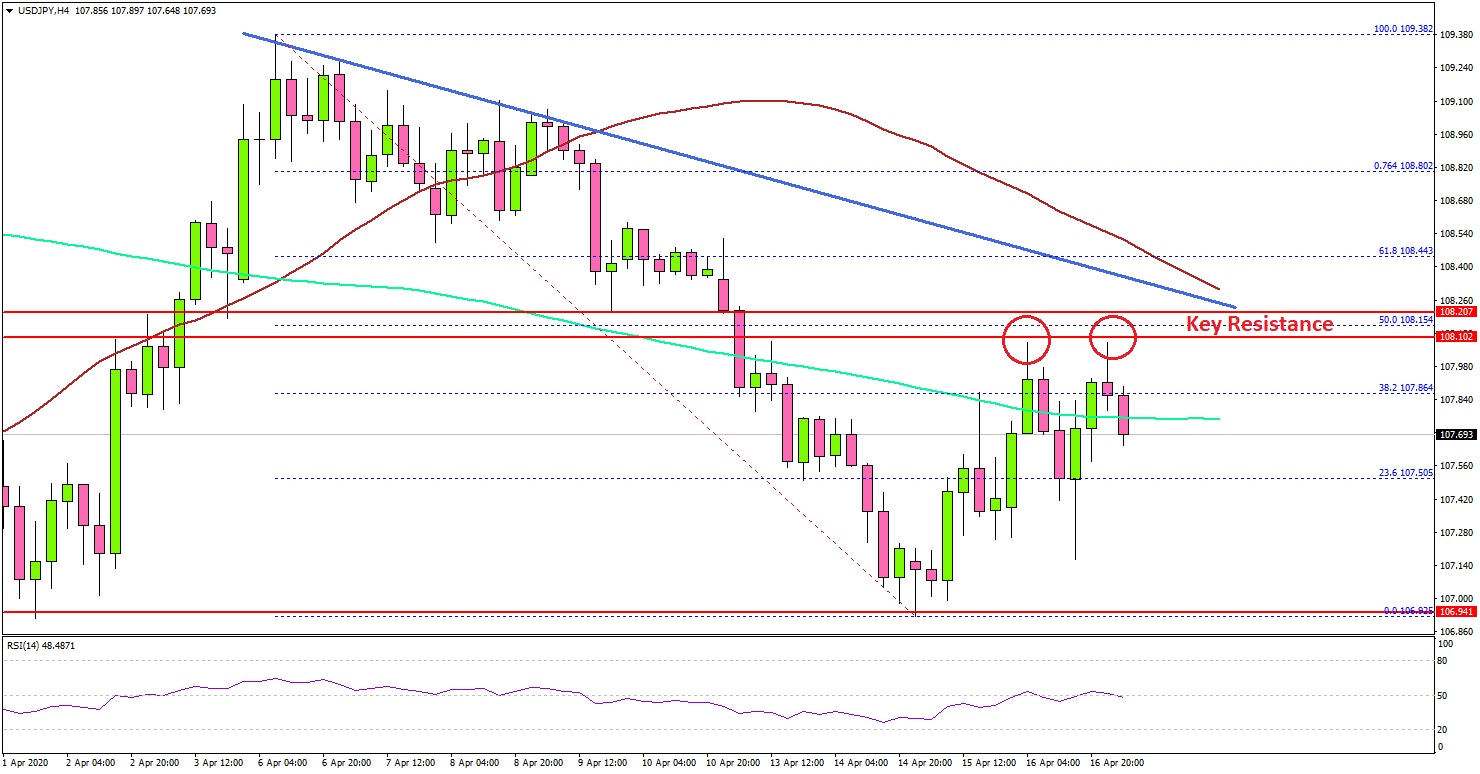

Looking at the 4-hours chart, the pair stayed above the crucial support at 107.00. It corrected above the 107.50 level, and the 23.6% Fib retracement level of the last key decline from the 109.38 high to 106.92 low.

However, the pair faced a strong resistance near the 108.00 area. It also failed to test the 50% Fib retracement level of the last key decline from the 109.38 high to 106.92 low.

More importantly, there is a major bearish trend line forming with resistance near 108.20. Above the trend line, the 100 simple moving average (red, 4-hours) is positioned near the 108.40 level.

Therefore, USD/JPY is likely to face a strong selling starting on the upside, starting with 108.00 and up to 108.50. A successful close above the 108.50 is needed for a push towards the 109.50 and 109.80 levels.

If not, the pair could revisit the main 106.90-107.00 support area. Any further losses may perhaps open the doors for a larger decline towards the 105.00 level in the coming days.

Fundamentally, the US Initial Jobless Claims figure for the week ending April 11, 2020 was released by the US Department of Labor. The market was looking for a decline from 6606K to 5105K.

The actual result was a bit disappointing, as the US Initial Jobless Claims only declined to 5245K. Besides, the last reading was revised up from 6606K to 6616K.

The report added:

The 4-week moving average was 5,508,500, an increase of 1,240,750 from the previous week's revised average. The previous week's average was revised up by 2,250 from 4,265,500 to 4,267,750.

Overall, USD/JPY remains at a risk of more losses below 107.00 unless it recovers steadily above 108.00. Looking at EUR/USD and GBP/USD, both are correcting lower from the 1.1000 and 1.2650 resistance levels respectively.

Upcoming Economic Releases

- Euro Zone CPI for March 2020 (YoY) - Forecast +0.7%, versus +0.7% previous.

- Euro Zone CPI for March 2020 (MoM) - Forecast +0.5%, versus +0.2% previous.