Aayush Jindal

Key Highlights

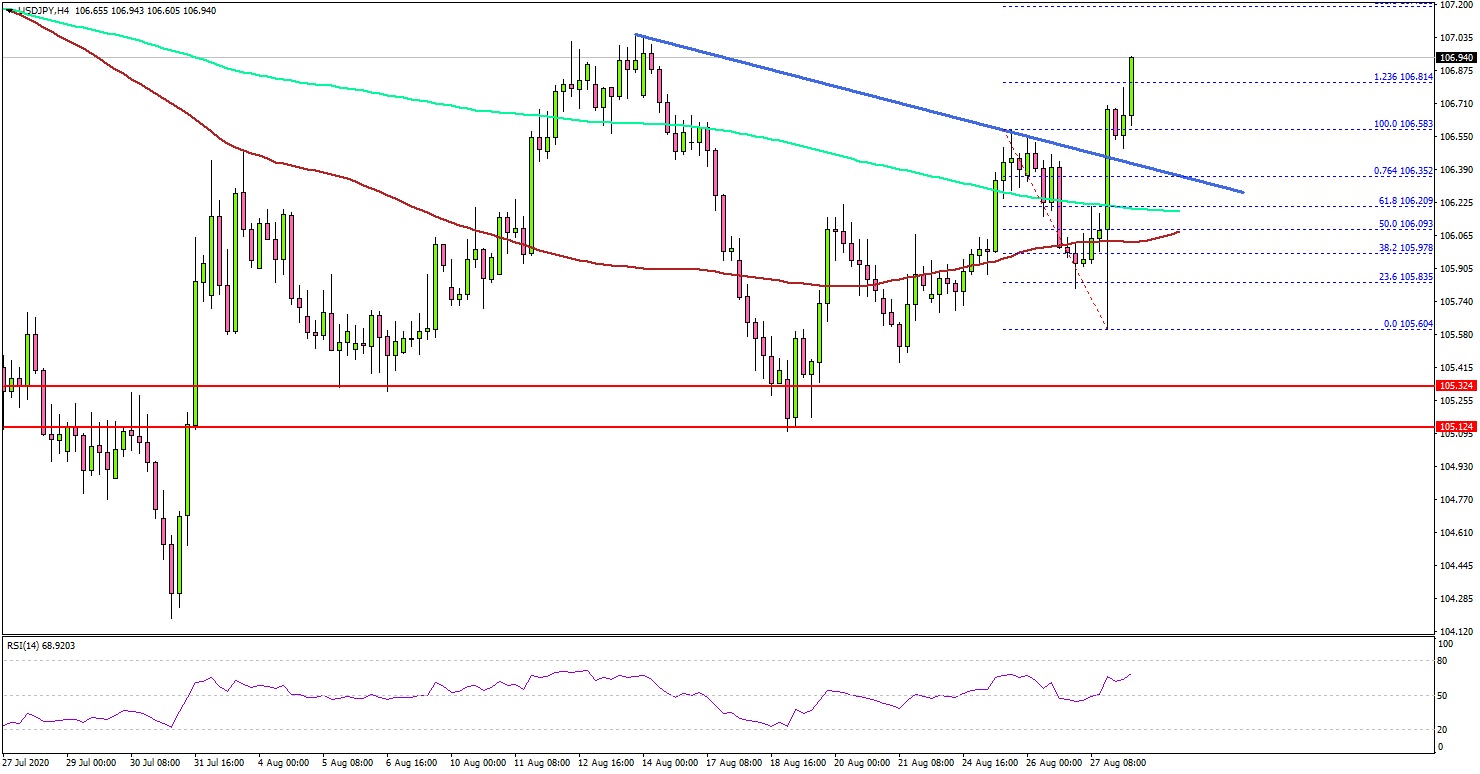

- USD/JPY surpassed a couple of key hurdles near 106.20 and 106.50.

- There was a break above a crucial bearish trend line with resistance near 106.40 on the 4-hours chart.

- The US Gross Domestic Product decreased 31.7% in Q2 2020 (Preliminary).

- The US Personal Income could decline 0.2% in July 2020 (MoM), less than the last -1.1%.

USD/JPY Technical Analysis

The US Dollar formed a decent support near 105.20 against the Japanese Yen. USD/JPY climbed higher above 106.00 and it gained bullish momentum to move into a positive zone.

Looking at the 4-hours chart, the pair traded as low as 105.60 before it started a strong increase. There was a break above the 106.00 resistance, the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

Moreover, there was a break above a crucial bearish trend line with resistance near 106.40 on the same chart. The pair even climbed above the 106.58 swing high and 1.236 Fib extension level of the downward move from the 106.58 high to 105.60 low.

It seems like the pair might continue to rise and it could even break the 107.00 resistance zone. The next resistance could be near 107.20 or the 1.618 Fib extension level of the downward move from the 106.58 high to 105.60 low.

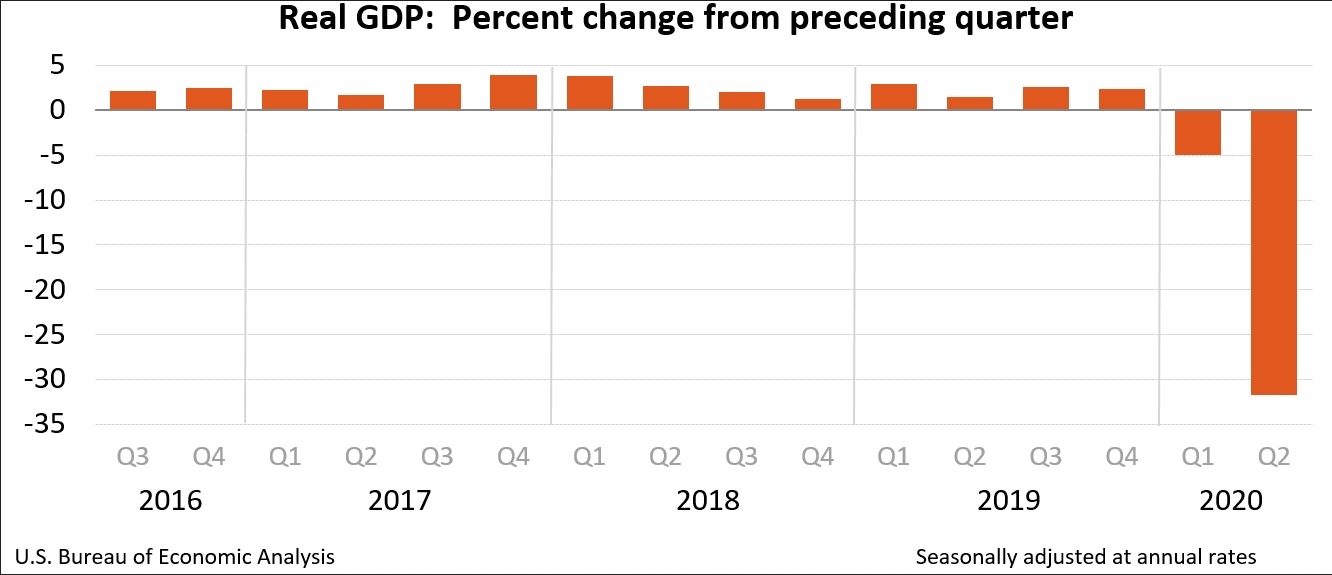

Fundamentally, the US Gross Domestic Product Annualized report for Q2 2020 (Prelim) was released by the US Bureau of Economic Analysis. The market was looking for a drop of 32.5% in Q2 2020.

The actual result was close to the market forecast, as the US Gross Domestic Product decreased 31.7% in Q2 2020 (according to the "second" estimate).

Overall, USD/JPY started a strong increase above 106.00 and 106.20. Looking at EUR/USD and GBP/USD, there were bullish spikes after the release, but both pairs failed to continue higher.

Upcoming Economic Releases

- Euro Zone Consumer Confidence August 2020 – Forecast -14.7, versus -14.7 previous.

- US Personal Income for July 2020 (MoM) - Forecast -0.2%, versus -1.1% previous.

- Canadian Gross Domestic Product for Q2 2020 (QoQ) – Forecast -39.6%, versus -8.2% previous.