Aayush Jindal

Key Highlights

- USD/JPY is facing a crucial resistance near the 108.00 region.

- The main breakdown support is near the 107.00 level.

- The US Initial Jobless Claims for the week ending April 18, 2020 declined from 5237K to 4427K.

- The US Durable Goods Orders are likely to drop 11.9% in March 2020.

USD/JPY Technical Analysis

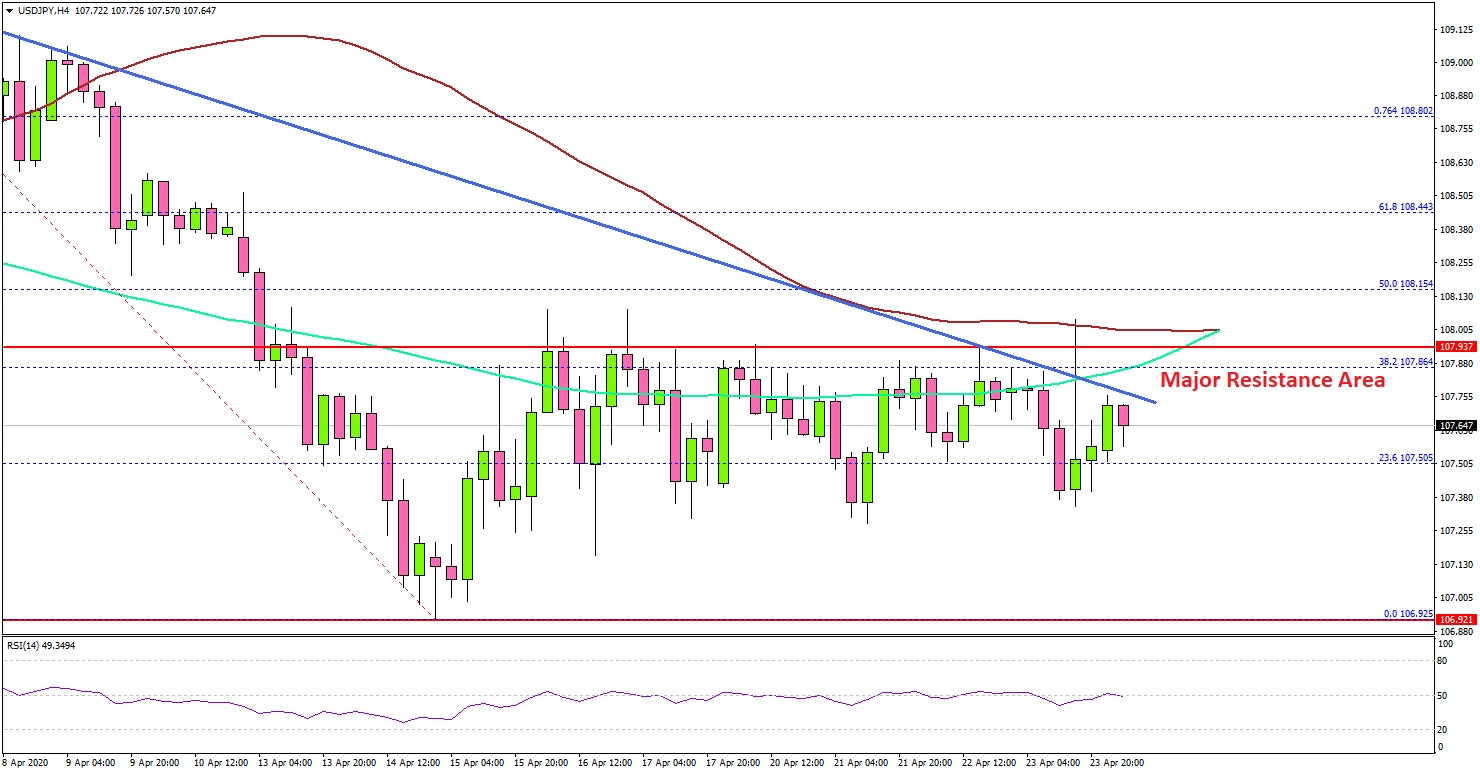

In the past few days, the US Dollar mostly traded in a range above the 107.00 support against the Japanese Yen. USD/JPY seems to be facing a crucial resistance near the 108.00 region.

Looking at the 4-hours chart, the pair recovered from the 106.92 low and climbed above the 107.50 resistance level. Besides, there was a break above the 23.6% Fib retracement level of the last key decline from the 109.38 high to 109.92 low.

However, the bulls seem to be struggling near the 108.00 and 108.05 levels. More importantly, both the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours) are also near 108.00.

Therefore, a successful break above the 108.00 resistance is needed for a sustained upward move. An immediate resistance is near 108.15 since it is close to the 50% Fib retracement level of the last key decline from the 109.38 high to 109.92 low.

A clear break above 108.05 and 108.15 could start a strong rally towards the 108.80 and 109.20 levels in the near term.

On the downside, the main support is near the 107.00 area. A daily close below 107.00 may perhaps start a strong decline towards the 106.20 and 106.00 levels.

Fundamentally, the US Initial Jobless Claims report for the week ending April 18, 2020 was released by the US Department of Labor. The market was looking for a decline in claims from 5245K to 4200K.

However, the result was slightly disappointing, as the US Initial Jobless Claims declined to 4427K. Besides, the last reading was revised up from 5245K to 5237K.

The report added:

The 4-week moving average was 5,786,500, an increase of 280,000 from the previous week's revised average. The previous week's average was revised down by 2,000 from 5,508,500 to 5,506,500.

Overall, USD/JPY is likely preparing for the next major move either towards 109.00 or below 106.50. Looking at EUR/USD and GBP/USD, both pairs are showing bearish signs below 1.0900 and 1.2400.

Upcoming Economic Releases

- UK Retail Sales for March 2020 (YoY) - Forecast -4.7%, versus 0% previous.

- UK Retail Sales for March 2020 (MoM) - Forecast -4.0%, versus -0.3% previous.

- German IFO Business Climate Index for April 2020 – Forecast 80.0, versus 86.1 previous.

- US Durable Goods Orders for March 2020 – Forecast -11.9% versus +1.2% previous.