Aayush Jindal

Key Highlights

- USD/JPY declined heavily and traded below the 145.50 support.

- A major bearish trend line is forming with resistance near 147.80 on the 4-hours chart.

- Gold price extended gains above the $1,715 and $1,720 resistance levels.

- The US CPI increased 7.7% in Oct 2022 (YoY), down from 8.2%.

USD/JPY Technical Analysis

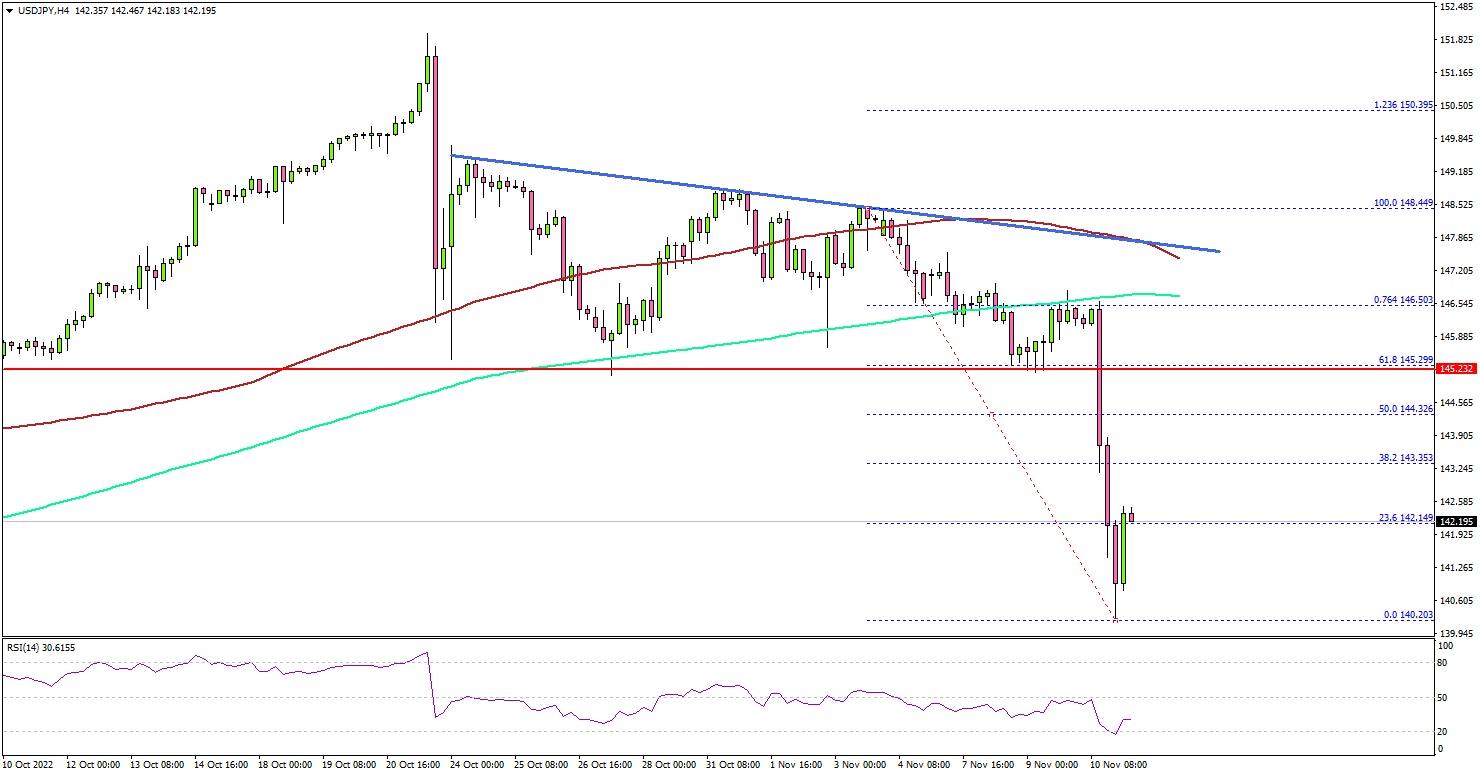

The US Dollar started a fresh decline from the 148.50 resistance against the Japanese Yen. USD/JPY traded below the 146.50 support to start a short-term downtrend.

Looking at the 4-hours chart, the pair gained bearish momentum after the US CPI numbers were released. The US CPI increased 7.7% in Oct 2022 (YoY), down from 8.2%.

It triggered a sharp decline in USD/JPY below the 145.50 support zone. The pair settled well below the 145.50 support, the 100 simple moving average (red, 4-hours) plus the 200 simple moving average (green, 4-hours).

The bears were able to push the pair below the 143.20 support. The pair spiked below the 142.00 level before the bulls took a stand. On the upside, the pair could face hurdles near 142.80 level.

The next major resistance may perhaps be near 143.20. Any more gains could set the pace for a move towards the 144.50 level, above which it could even test 145.50.

An initial support is near the 141.50 level. The next major support is near the 140.40 zone. The main support sits at 140.00. A close below the 140.00 level might start another strong decline. In the stated case, USD/JPY could decline towards the 138.00 support.

Looking at gold price, there was a strong upward move above the $1,720 level and it seems like the price might even climb above the $1,750 level.

Economic Releases

- UK GDP for Q3 2022 (QoQ) (Prelim) - Forecast -0.5%, versus +0.2% previous.

- German Consumer Price Index for Oct 2022 (YoY) – Forecast +10.4%, versus +10.4% previous.

- German Consumer Price Index for Oct 2022 (MoM) – Forecast +0.9%, versus +0.9% previous.