Aayush Jindal

Key Highlights

- USD/JPY extended its decline below 103.50 and 103.20.

- A key bearish trend line is forming with resistance near 103.55 on the 4-hours chart.

- EUR/USD, GBP/USD, and AUD/USD extended gains above major hurdles.

- Gold price remains in a positive zone above the $1,850 support.

USD/JPY Technical Analysis

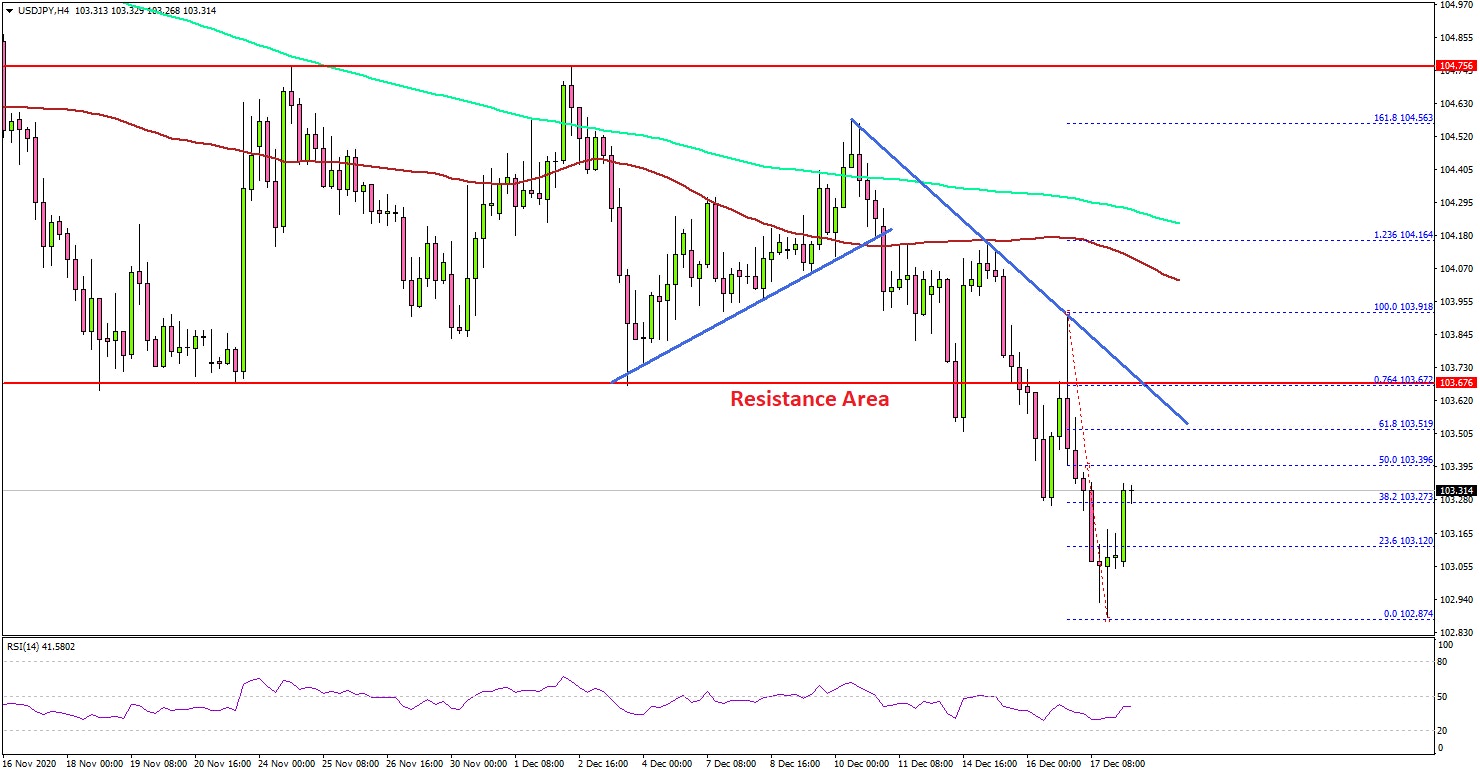

In the past few days, the US Dollar followed a bearish path from well above 104.40 against the Japanese Yen. USD/JPY traded below the key 103.50 support level to move into a bearish zone.

Looking at the 4-hours chart, the pair even broke the 103.20 support, and it settled well below the 200 simple moving average (green, 4-hours) and the 100 simple moving average (red, 4-hours).

It tested the 103.00 level and started consolidating losses. On the upside, an initial resistance is near the 103.40 and 103.50 levels. There is also a key bearish trend line forming with resistance near 103.55 on the same chart.

The main resistance is near the 103.70 level (the last breakdown zone). A close above 103.50 and 103.70 could open the doors for a decent increase.

If not, the pair might continue to move down below 103.00 and 102.80. The next major support is near the 102.50 level.

Fundamentally, the US Initial Jobless Claims report for the week ending Dec 12, 2020 was released by the US Department of Labor. The market was looking for a decline from 853K to 800K.

The actual result was disappointing, as the US Initial Jobless Claims increased to 885K. The last reading was also revised up from 853K to 862K.

The report added:

The 4-week moving average was 812,500, an increase of 34,250 from the previous week's revised average. The previous week's average was revised up by 2,250 from 776,000 to 778,250.

Looking and EUR/USD and GBP/USD, there were more upsides above 1.2220 and 1.3600 respectively. Moreover, AUD/USD and NZD/USD extended their rise and traded to new multi-month highs.

Upcoming Economic Releases

- UK Retail Sales Nov 2020 (YoY) - Forecast +2.8%, versus +5.8% previous.

- UK Retail Sales Nov 2020 (MoM) - Forecast -4.2%, versus +1.2% previous.

- Canadian Retail Sales Oct 2020 (MoM) – Forecast +0.2%, versus +1.1% previous.

- Canadian Retail Sales ex Autos Oct 2020 (MoM) – Forecast +0.2%, versus +1.0% previous.