Aayush Jindal

Key Highlights

- USD/JPY started a decent increase above the 111.50 resistance.

- It broke a key bearish trend line at 109.85 on the 4-hours chart.

- The US GDP grew 6.7% in Q2 2021 (market forecast was 6.6%).

- The US ISM Manufacturing Index could decline from 59.9 to 59.6 in Sep 2021.

USD/JPY Technical Analysis

The US Dollar formed a base above 109.00 and started a major increase against the Japanese Yen. USD/JPY broke many hurdles near 109.80 and 110.00 to enter a positive zone.

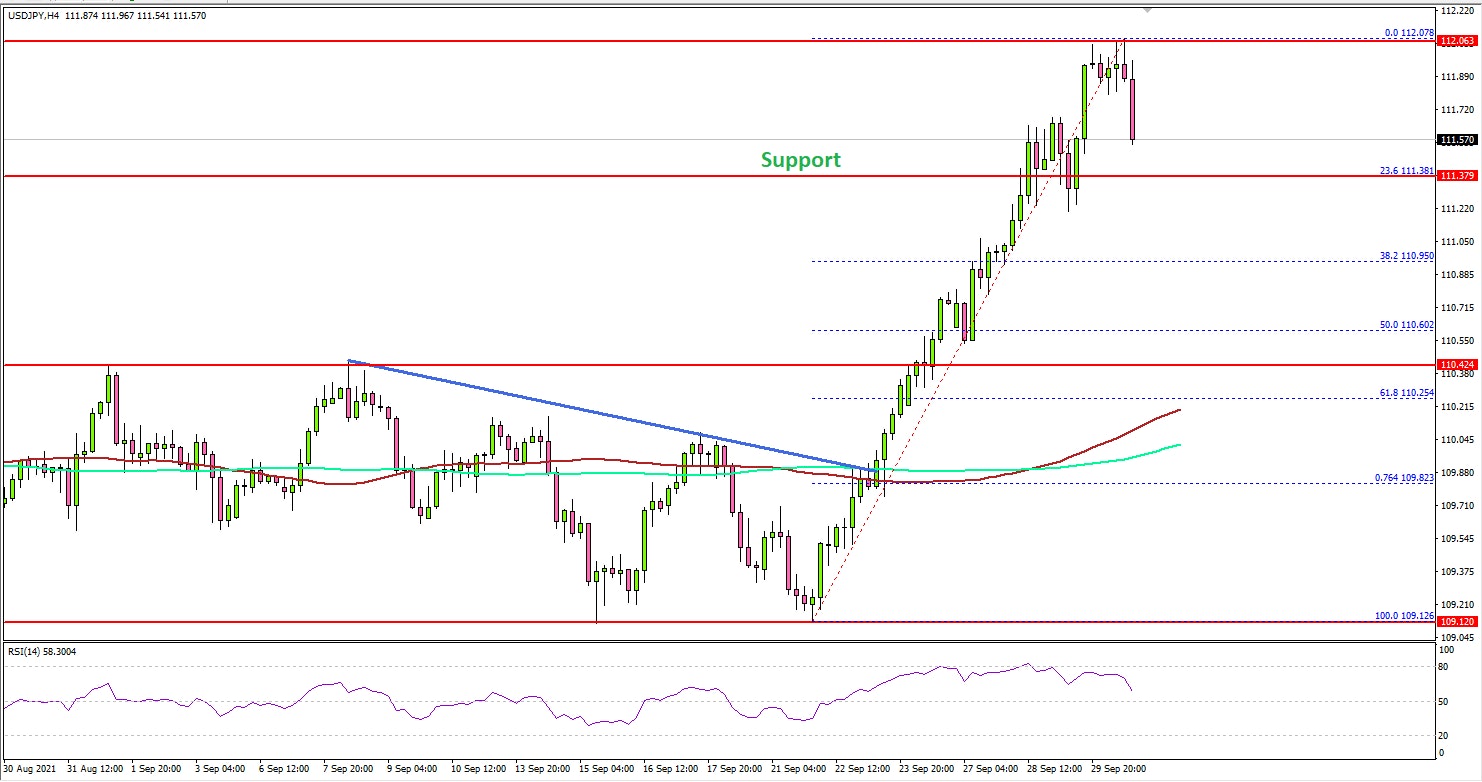

Looking at the 4-hours chart, there was a break above a key bearish trend line at 109.85. The pair gained pace above 111.00, and settled above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The pair even climbed above the 111.50 resistance and spiked above 112.00. A high was formed near 112.07 before it started consolidating gains.

An initial support on the downside is near the 111.50 and 111.40 levels. The 23.6% Fib retracement level of the upward move from the 109.12 swing low to 112.07 high is also near the 111.38 level.

The next key support is near 111.20, below which the pair may possibly dive towards 110.50. On the upside, an initial resistance is near the 112.00. The first major resistance is near 112.20, above which USD/JPY could continue higher towards 113.00.

The US Gross Domestic Product for Q2 2021 was released yesterday by the US Bureau of Economic Analysis. The market was looking for a rise of 6.6%.

The actual result was better than the forecast, as the US Gross Domestic Product grew 6.7%. Looking at the GDP index, there was a 6.2% rise, up from the last 6.2%.

Looking at EUR/USD, the pair extended its decline and traded below 1.1600. On the other hand, GBP/USD managed to recover a few points from 1.3410.

Economic Releases

- Germany’s Manufacturing PMI for Sep 2021 - Forecast 58.5, versus 58.5 previous.

- Euro Zone Manufacturing PMI for Sep 2021 – Forecast 58.7, versus 58.7 previous.

- UK Manufacturing PMI for Sep 2021 – Forecast 56.3, versus 56.3 previous.

- US Manufacturing PMI for Sep 2021 – Forecast 60.6, versus 60.5 previous.

- US ISM Manufacturing Index for Sep 2021 – Forecast 59.6, versus 59.9 previous.