Aayush Jindal

Key Highlights

- USD/JPY failed to climb above 109.80 and corrected lower.

- A key bearish trend line is forming with resistance near 109.05 on the 4-hours chart.

- EUR/USD remains strong above 1.2180, GBP/USD eyes a fresh increase above 1.4200.

- The US Manufacturing PMI could remain stable at 50.4 in May 2021 (Preliminary).

USD/JPY Technical Analysis

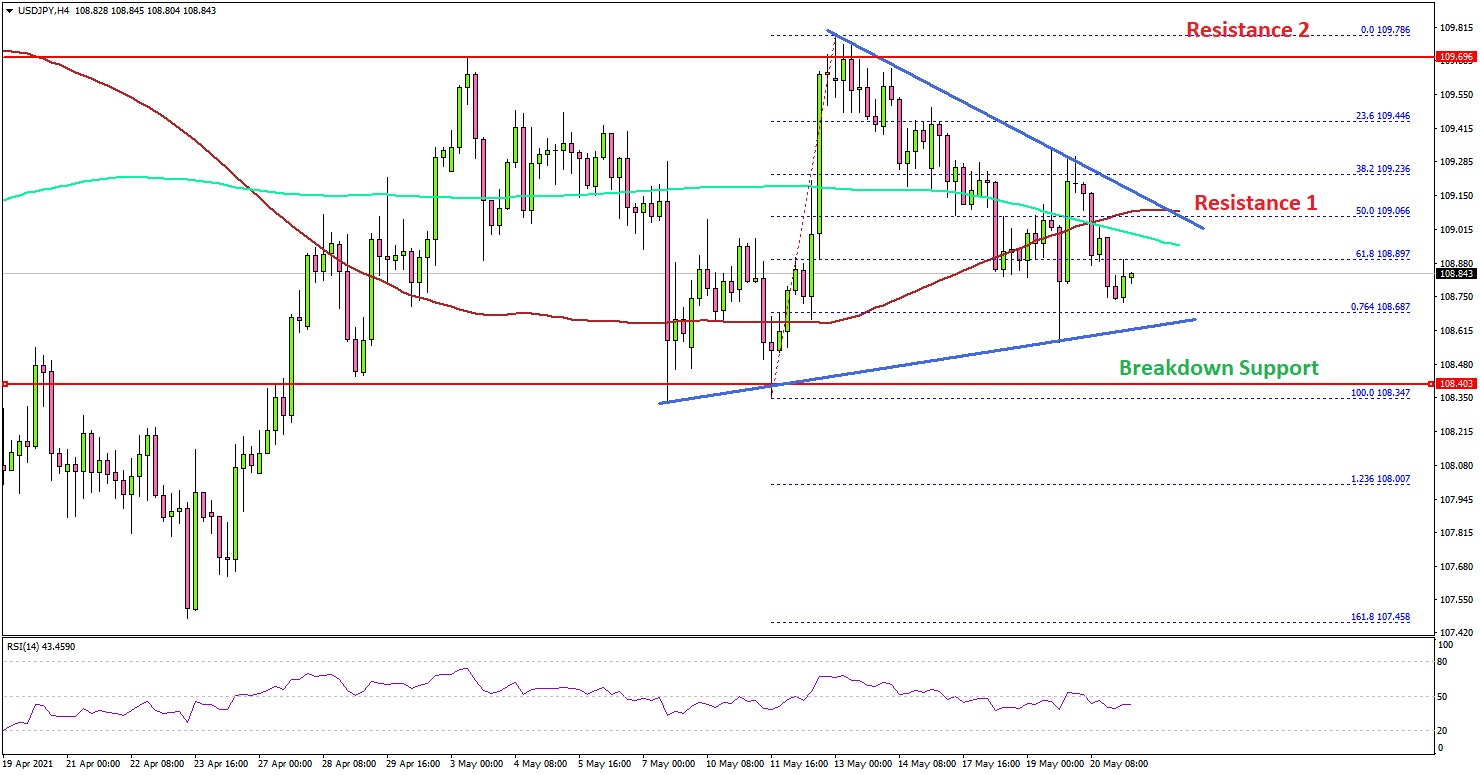

This past week, the US Dollar made an attempt to clear the 109.80 resistance against the Japanese Yen. USD/JPY failed to gain strength and reacted to the downside.

Looking at the 4-hours chart, the pair topped near the 109.78 level. Recently, there was a downside correction below the 109.50 support zone. There was also a break below 109.00, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

The bears even pushed the pair below the 50% Fib retracement level of the upward move from the 108.34 low to 109.78 high. The first major support on the downside is near the 108.40 level.

If there is a downside break below the 108.40 support, the pair could decline sharply towards the 107.50 level in the near term. On the upside, the pair is facing hurdles near 109.10. There is also a key bearish trend line forming with resistance near 109.05 on the same chart.

A clear break above the trend line could lead the pair towards the 109.80 level. The main resistance sits near the 110.0 level, above which the bulls are likely to gain strength.

Looking at EUR/USD, the pair is likely to accelerate higher above 1.2250. Similarly, GBP/USD might climb again above the 1.4200 level.

Economic Releases

- UK Retail Sales for April 2021 (YoY) - Forecast +36.8%, versus +7.2% previous.

- UK Retail Sales for April 2021 (MoM) - Forecast +4.5%, versus +5.4% previous.

- Germany’s Manufacturing PMI for May 2021 (Preliminary) - Forecast 65.9, versus 66.2 previous.

- Germany’s Services PMI for May 2021 (Preliminary) - Forecast 52.0, versus 49.9 previous.

- Euro Zone Manufacturing PMI May 2021 (Preliminary) – Forecast 62.5, versus 62.9 previous.

- Euro Zone Services PMI for May 2021 (Preliminary) – Forecast 52.3, versus 50.5 previous.

- UK Manufacturing PMI for May 2021 (Preliminary) – Forecast 60.7, versus 60.7 previous.

- UK Services PMI for May 2021 (Preliminary) – Forecast 60.1, versus 60.1 previous.

- US Manufacturing PMI for May 2021 (Preliminary) – Forecast 50.4, versus 50.5 previous.

- US Services PMI for May 2021 (Preliminary) – Forecast 64.5, versus 64.7 previous.