Aayush Jindal

Key Highlights

- USD/JPY is still facing a strong resistance near the 104.75 zone.

- EUR/JPY remained in a bullish zone above 125.00, EUR/USD climbs above 1.2120.

- The US CPI increased 1.2% in Nov 2020 (YoY), better than the market forecast of 1.1%.

- The US Producer Price Index (to be released today) could rise 0.8% in Nov 2020 (YoY).

USD/JPY Technical Analysis

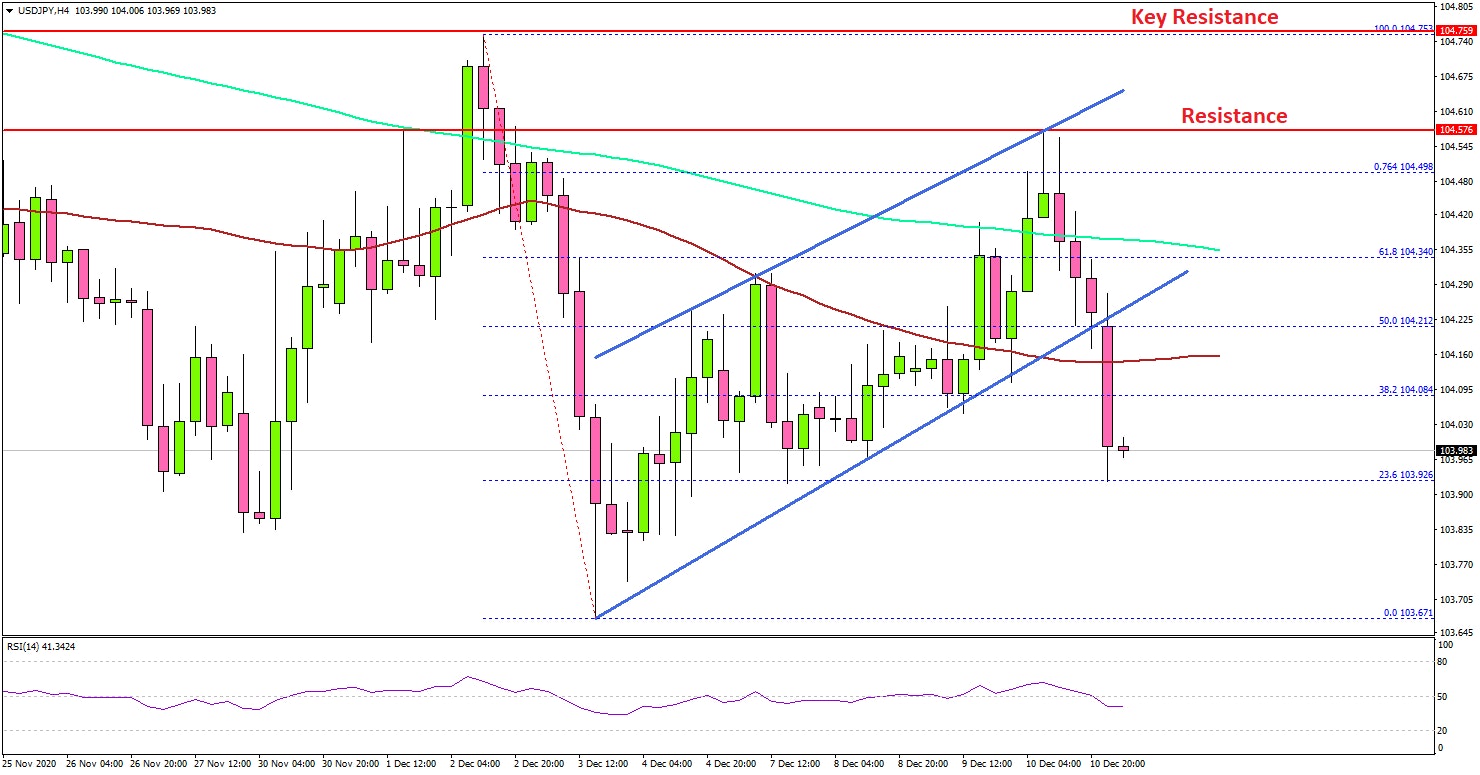

After a sharp decline from 104.75, the US Dollar found support near 103.65 against the Japanese Yen. USD/JPY started a fresh increase above 104.00, but it is still facing many hurdles.

Looking at the 4-hours chart, the pair climbed above the 104.20 resistance (earlier this week), the 200 simple moving average (green, 4-hours), and the 100 simple moving average (red, 4-hours).

There was also a break above the 50% Fib retracement level of the last key decline from the 104.75 high to 103.67 low. However, the pair struggled to clear the 104.65 resistance and the main 104.75 hurdle. A successful close above the 104.75 resistance could open the doors for a push above the 105.00 level.

There was a bearish reaction recently, and the pair traded below a key bullish trend line with support at 104.30 on the same chart. The next major support is near the 103.85 level, below which the pair could retest the 103.65 support zone. Any more losses might call for a test of 103.10.

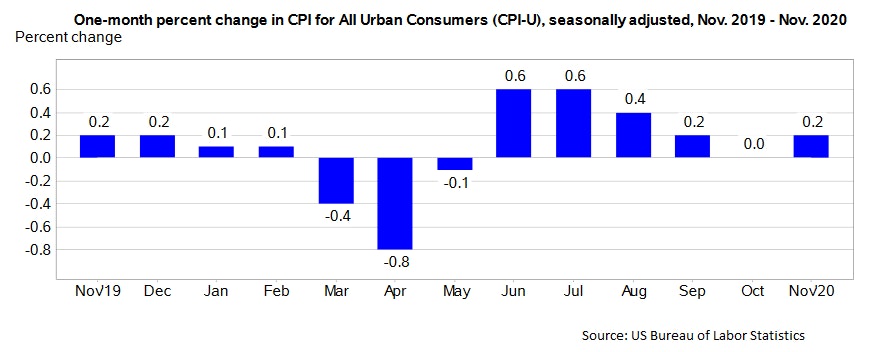

Fundamentally, the US Consumer Price Index for Nov 2020 was released yesterday by the US Bureau of Labor Statistics. The market was looking for an increase of 1.1% in Nov 2020, compared with the same month a year ago.

The actual result was better than the market forecast, the US Consumer Price Index increased 1.2% in Nov 2020 (YoY). The monthly change was 0.2%, similar to the market forecast.

The report added:

The index for all items less food and energy increased 0.2 percent in November after being unchanged the prior month.

Looking at EUR/USD, the pair remained well bid above 1.2050 and it climbed above 1.2120. Conversely, there was another drop in GBP/USD from the 1.3465 zone.

Upcoming Economic Releases

- German Consumer Price Index Nov 2020 (YoY) – Forecast -0.3%, versus -0.3% previous.

- German Consumer Price Index Nov 2020 (MoM) – Forecast -0.8%, versus -0.8% previous.

- US Producer Price Index Nov 2020 (MoM) – Forecast +0.2%, versus +0.3% previous.

- US Producer Price Index Nov 2020 (YoY) – Forecast +0.8%, versus +0.5% previous.